Bitcoin’s $1 Million Future: Why Jack Dorsey’s Prediction Isn’t So Far-Fetched

The cryptocurrency market has been abuzz with the prediction that Bitcoin could reach $1 million by 2030. This bold claim comes from none other than Jack Dorsey, co-founder and former CEO of Twitter. But what makes this forecast so interesting is that it’s not coming from a Wall Street investment firm, but from a technologist with an intimate knowledge of how Bitcoin works.

Is Bitcoin an Asset or a Technology?

There are two classic ways that investors think about Bitcoin. The first approach is to think about Bitcoin as a commodity, a digital gold and a store of value, and should be hoarded much like physical gold. The second approach is to think about Bitcoin as a digital currency, a means of exchange and a payment mechanism. But there’s a third way of thinking about Bitcoin – as a technology. That’s how Dorsey is thinking about Bitcoin. He sees it as a blockchain-based technology that is capable of disrupting the modern financial system.

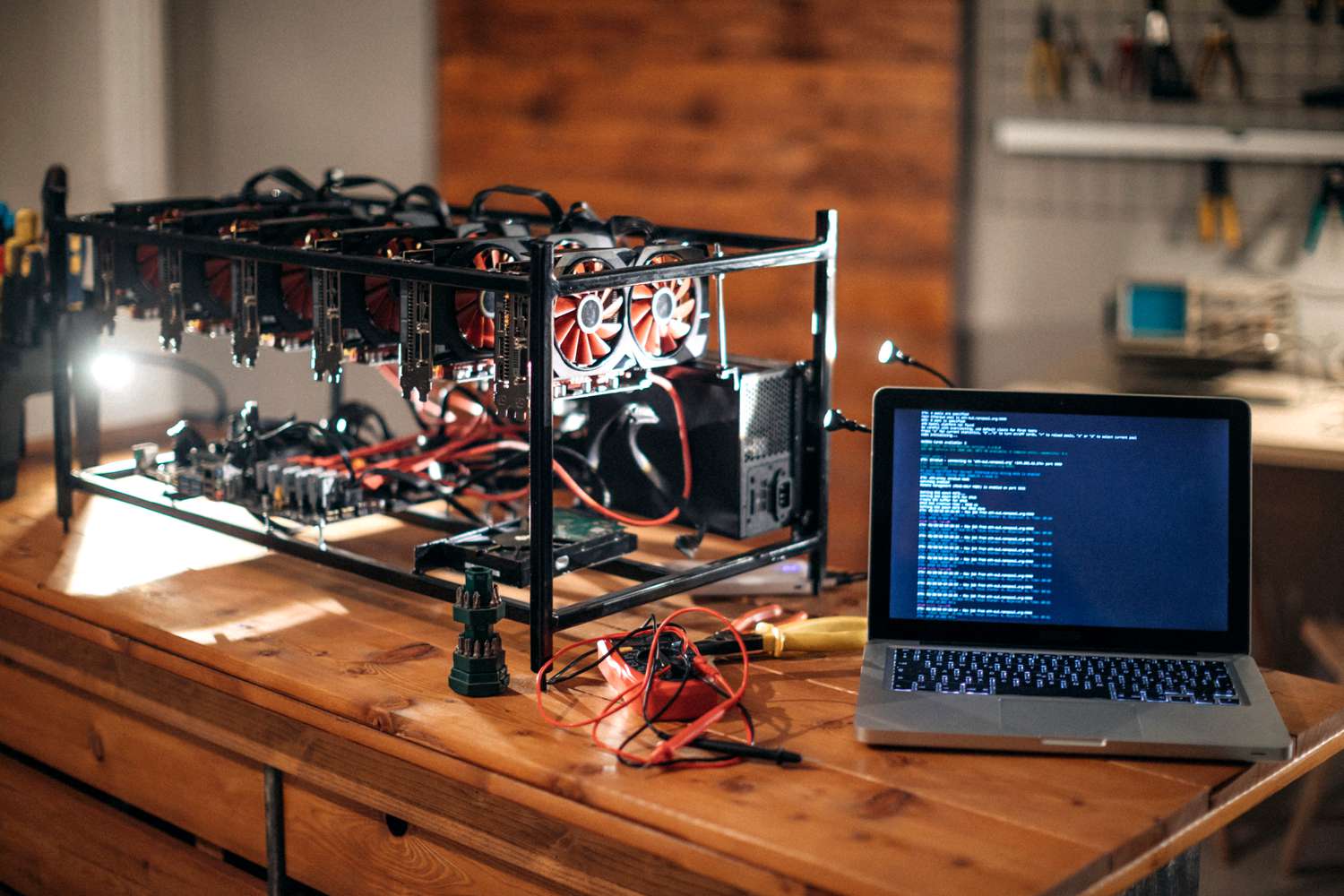

Bitcoin mining is a crucial part of the Bitcoin ecosystem.

The Bitcoin Ecosystem

According to Dorsey, every single person who touches Bitcoin in a significant way helps to make it better. He should know: Over the past few years, Dorsey has famously collaborated on a number of Bitcoin-related projects. His latest project is Ocean, a new Bitcoin mining initiative. But what’s the value of the Bitcoin ecosystem? That’s a great question, but I’m not sure if anyone has really answered it in a satisfactory way.

The Lightning Network is a key component of the Bitcoin ecosystem.

The Lightning Network is a key component of the Bitcoin ecosystem.

The Value of the Bitcoin Ecosystem

Cathie Wood of Ark Invest has perhaps come closest, with her focus on the primary use cases of Bitcoin. For example, in Ark Invest’s 2023 “Big Ideas” report, she highlighted various roles that Bitcoin can play, including as a remittance asset. So, for example, investors could plausibly attach a greater valuation to Bitcoin if they see its role in the cross-border remittances market increasing over time.

Another approach is to focus on the new products and services that members of this Bitcoin ecosystem are bringing to market. For example, Lightning Labs, already well known for its Lightning Network, is now working on bringing stablecoins and tokenized assets to the Bitcoin blockchain. And Strike continues to bring new Bitcoin payment options to global users. All these products and services are helping to make Bitcoin more valuable by boosting its adoption on a worldwide basis.

Bitcoin adoption is key to its long-term success.

Is Bitcoin Really Going to $1 Million?

When it comes to valuing Bitcoin, the focus should be on mainstream Bitcoin adoption. In other words, what are members of the ecosystem doing to make Bitcoin more useful in everyday life? In this case, “utility” means more than just a lot of people buying spot Bitcoin ETFs. It means people using Bitcoin as part of a decentralized financial system that empowers individuals, reduces fees, and lowers barriers to entry.

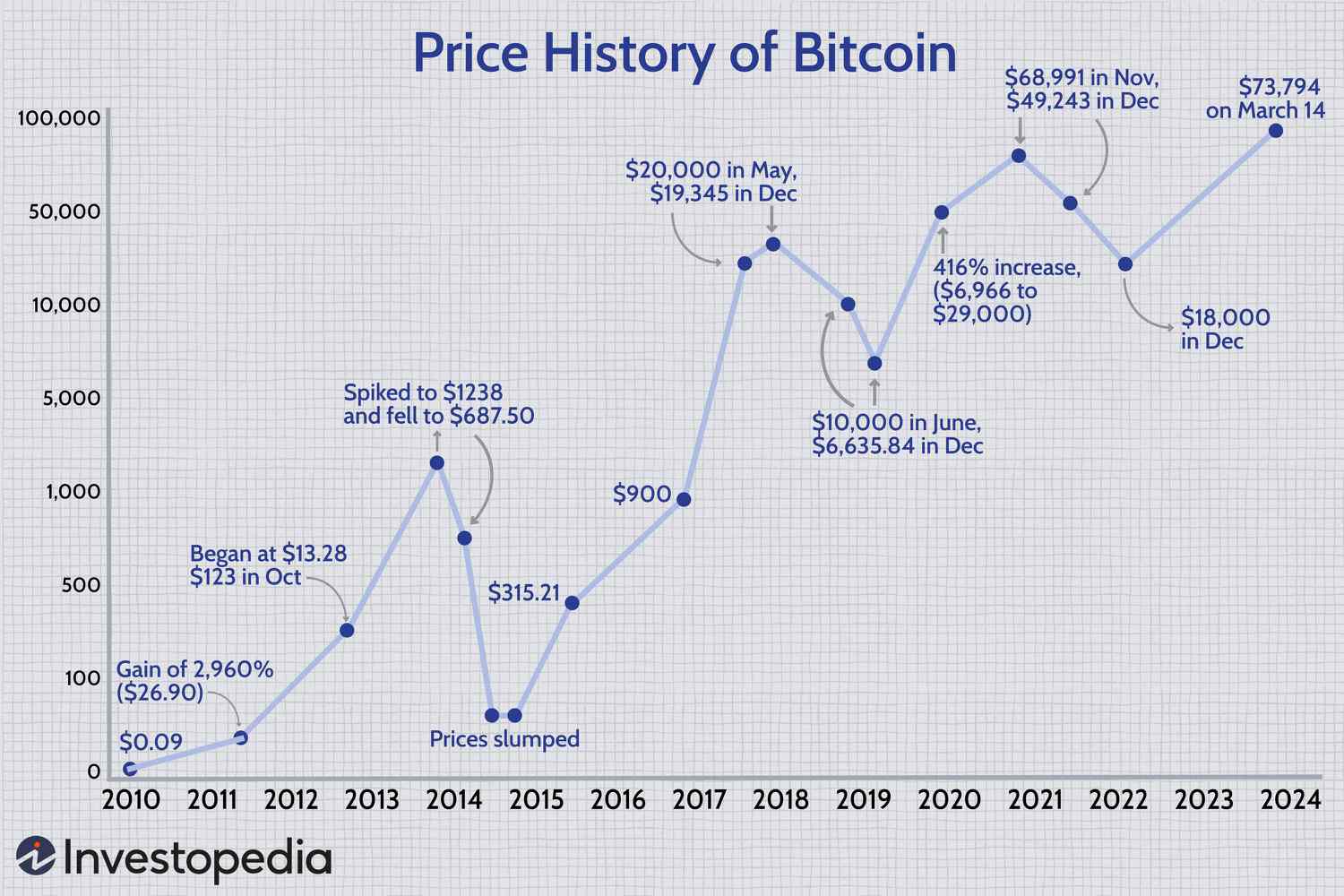

While I’m still unconvinced that Bitcoin will hit the mythical price of $1 million by 2030, I am convinced that Bitcoin is currently undervalued at its current price of $63,000. That’s because too many investors are focused on Bitcoin as a financial asset, and not as a digital technology capable of disrupting the modern financial system. With that in mind, I’m bullish on Bitcoin’s long-term outlook.