Bitcoin and Ethereum: A New Era in Cryptocurrency

The cryptocurrency market is witnessing notable shifts, particularly between Bitcoin and Ethereum, as market dynamics evolve in 2024. With Bitcoin nearing the $70,000 mark while Ethereum falls further behind, it’s crucial to dissect the factors driving this change and what it means for investors.

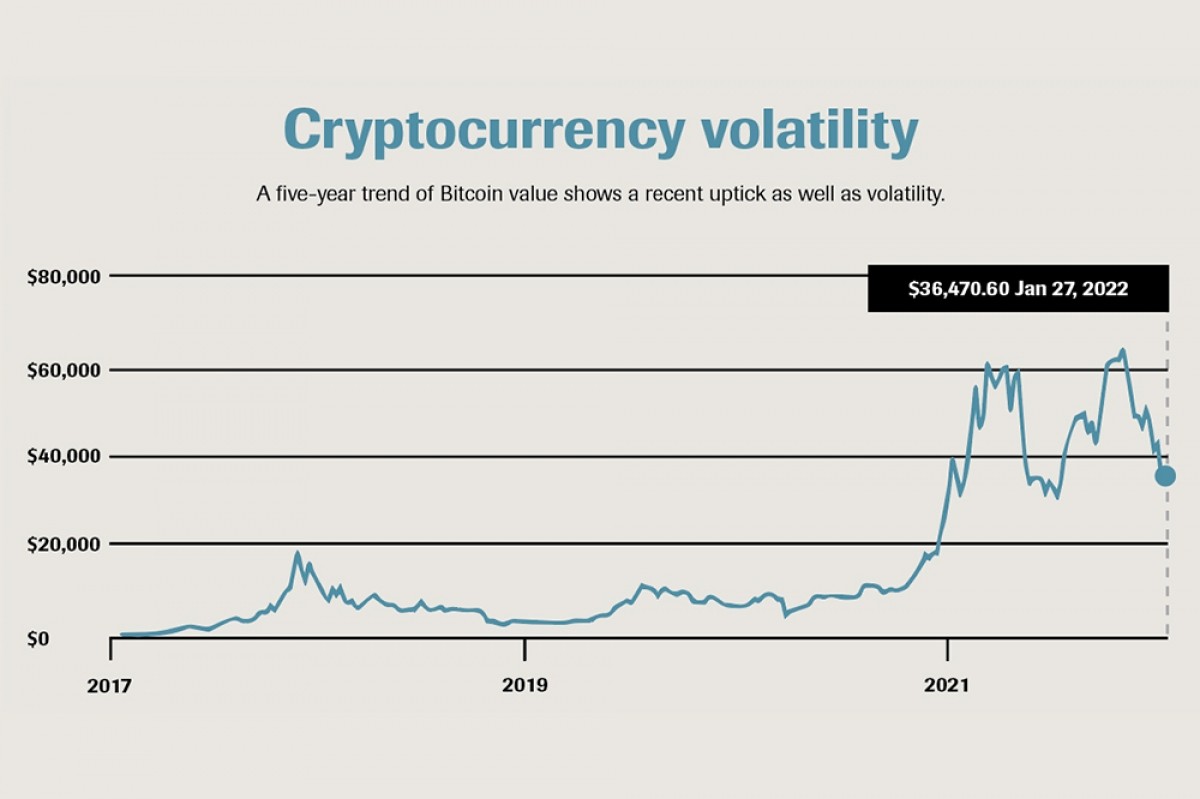

A representation of Bitcoin’s surge nearing $70,000

Bitcoin’s Resurgence

Leading the charge is Bitcoin, which recently showed signs of aggressive growth propelled by optimistic inflows into exchange-traded funds (ETFs). As of October, Bitcoin’s price soared to $68,252, reflecting a remarkable 10% increase over the past week, its strongest performance in over a month. This bullish momentum has been significantly influenced by the upcoming U.S. presidential elections, with a growing belief that favorable regulatory changes could be on the horizon.

According to Bloomberg, the U.S. spot-Bitcoin ETFs attracted nearly $2.4 billion in net inflows over just six days leading up to October 18. The anticipation surrounding regulatory clarity is palpable, especially with prominent political figures hinting at more supportive policies for cryptocurrencies. Republican candidate Donald Trump’s vocal advocacy for digital assets has garnered attention, prompting many investors to view Bitcoin as a strategic ‘Trump trade.’ On the contrary, discussions around potential regulations from Vice President Kamala Harris suggest a more structured approach may emerge regardless of election outcomes.

“The two key market trends are the elections and the global macroeconomic environment,” noted David Lawant of FalconX, highlighting that market volatility is anticipated to peak around election day, indicating a possible surge in trading activity.

Ethereum’s Struggles

In stark contrast, Ethereum’s performance has been disappointing. As of October 21, its market cap had fallen a staggering $1 trillion behind Bitcoin, a reflection of a broader decline in investor confidence. Ethereum opened at $2,647 but has failed to maintain momentum, and key bearish catalysts have emerged that might explain this downturn:

1. Whale Activity Dwindles

The drop in transactions by large holders, or ‘whales,’ is alarming. Over the last four years, Ethereum’s whale transactions have plummeted by 70%, demonstrating a significant withdrawal from the market just when the ecosystem needs robust backing to maintain its price levels.

2. Selling Pressure from the Ethereum Foundation

Moreover, the Ethereum Foundation has reportedly sold off around 336,000 ETH, valued at approximately $906.3 million, contributing to the selling pressure that has clouded the perception of ETH as a long-term investment. The actions of those at the helm of Ethereum could project an image of instability to potential investors.

3. ETF Adoption Lagging

Lastly, despite Ethereum’s ETF being approved in late July 2024, its adoption rates have lagged considerably behind those for Bitcoin ETFs, which have garnered immense popularity since their approval in January. This slow uptake raises concerns about Ethereum’s competitive position in the market.

An analytical view of Ethereum’s market cap struggles

The Macro Perspective

Broader economic factors are also playing a role in market sentiment. Analysts suggest that a unified Republican government could create a conducive environment for the passage of key legislation pertaining to digital assets, paving the way for a more structured market landscape in 2025.

Additionally, macroeconomic conditions, including subdued inflation in Japan and recent rate cuts in China, add to a ‘risk-on’ sentiment amongst traders. As highlighted by QCP Capital, these global economic factors are enhancing speculative interest in assets like Bitcoin, particularly as October historically trends bullish for cryptocurrencies.

Stripe’s Strategic Move

As the landscape shifts, established companies are making their moves as well. Fintech giant Stripe, having re-entered the crypto space after several years of absence, is reportedly in talks to acquire Bridge for a significant $1 billion. This acquisition would mark Stripe’s largest deal and will bolster its attempts to establish a more formidable presence in the stablecoin market. With stablecoins’ collective market cap exceeding $170 billion, this could strategically position Stripe to leverage growing global interest in these digital assets, essential for businesses conducting seamless transactions beyond borders.

Emerging tech leaders in the crypto space

Conclusion

The current dichotomy between Bitcoin and Ethereum reflects broader market sentiments, heightened by regulatory predictions and macroeconomic influences. As Bitcoin nears $70,000, Ethereum’s struggles highlight the necessity for strategic re-evaluation among its stakeholders. The prudent investor might begin to position themselves for continued volatility in these markets, while also keeping a keen eye on developments within the political landscape that could either stymie or boost market confidence in the realm of cryptocurrencies.

In navigating these changes, investors should consider the narratives shaping both Bitcoin and Ethereum, understanding that in this rapidly evolving landscape, adaptability is key. As October progresses, one can only speculate about the outcomes of the upcoming U.S. elections and their potential impact on the crypto market.

Envisioning the next chapter in the crypto journey