Bitcoin: The Digital Gold Rush of Our Era

By Teddy Hale

The allure of digital gold

The allure of digital gold

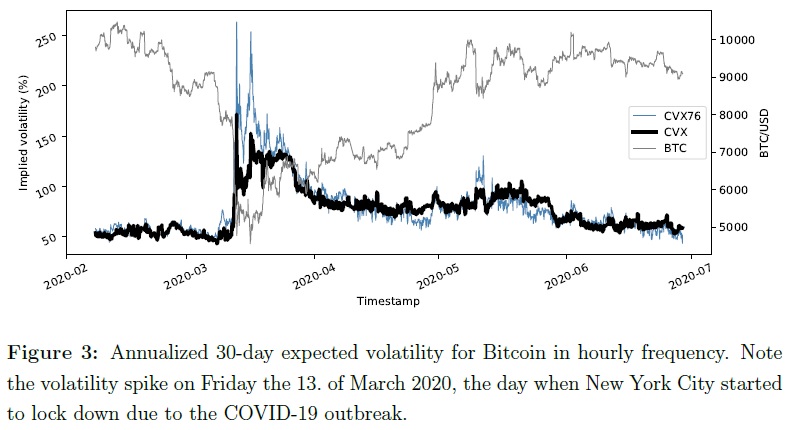

In a world where financial landscapes are rapidly evolving, Bitcoin has emerged as a beacon for investors seeking both high returns and a hedge against economic uncertainty. With its recent surge to a new all-time high of $73,750, Bitcoin has once again captured the imagination of the investment community. However, amidst this excitement, questions about its volatility and the timing of investments abound.

Mainstream Adoption and ETFs

The introduction of spot Bitcoin exchange-traded funds (ETFs) in January marked a pivotal moment in cryptocurrency’s journey towards mainstream acceptance. These ETFs have opened the floodgates for both retail and institutional investors, allowing them to gain exposure to Bitcoin without the complexities of direct investment. This development is not merely a blip on the radar but a long-term shift that is expected to funnel a significant amount of new money into Bitcoin, further propelling its price upward.

The Future is Bright

Predictions of exponential growth

Predictions of exponential growth

Reflecting on Bitcoin’s journey from 2011 to 2021, its status as the best-performing asset globally, with annualized returns of 230%, is nothing short of remarkable. While expecting similar performance in the future might be optimistic, leading analysts and investment firms like Ark Invest and Standard Chartered project that Bitcoin’s value could soar to $100,000 by the end of 2024 and even reach $250,000 by 2025. Cathie Wood of Ark Invest goes further, envisioning Bitcoin surpassing the $1 million mark before 2030. For investors contemplating a $1,000 investment today, these projections suggest a potential 10x to 15x return within a mere five years.

Bitcoin as ‘Digital Gold’

In times of economic turmoil, such as the regional banking crisis of 2023, investors have increasingly turned to Bitcoin as a safe haven, much like physical gold. Its unique risk-reward profile positions Bitcoin as the ultimate cryptocurrency investment in the current climate.

In conclusion, while the path of Bitcoin is undoubtedly marked by volatility, its potential for substantial returns, coupled with its role as a hedge against economic uncertainty, makes it an investment worth considering. As the digital gold of our era, Bitcoin offers a unique opportunity for those looking to diversify their portfolios and invest in the future of finance.