Bitcoin on the Rise: How Experts Are Eyeing New Heights

The cryptocurrency market is buzzing with excitement as Bitcoin surged to new heights, rekindling the optimistic outlook among analysts and investors alike. While many brace for corrections after drastic downturns, bullish projections seem to be overflowing this season, particularly from noted figures like Willy Woo, a popular analyst renowned for his data-driven predictions.

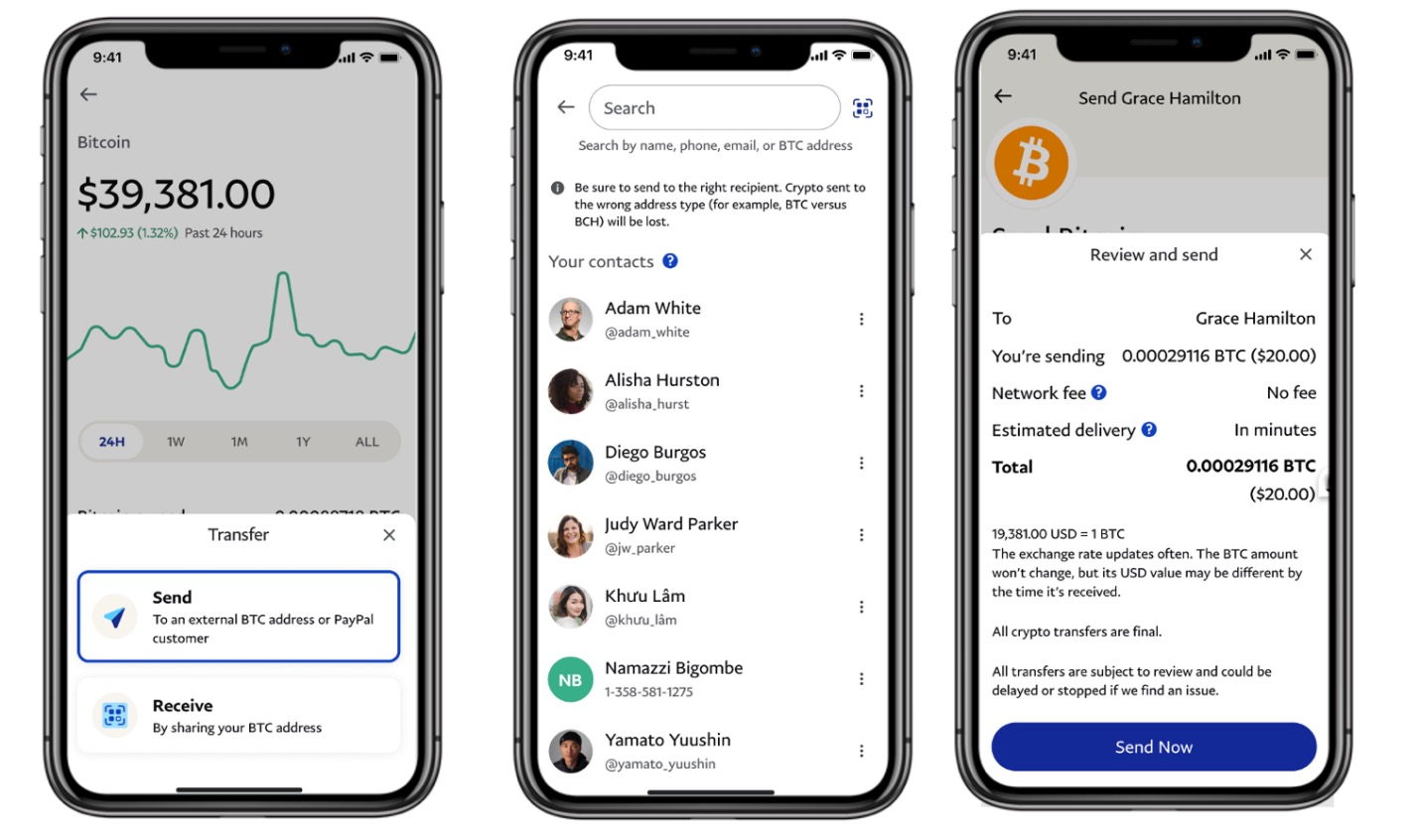

Bitcoin’s resurgence captures the attention of the crypto community.

Bitcoin’s resurgence captures the attention of the crypto community.

Willy Woo’s Bold Predictions

Willy Woo, with his knack for simplifying complex blockchain analyses, has recently made headlines with his audacious forecasts. He posits that one Satoshi could be valued at $0.05 in the future, translating to a staggering $5 million per Bitcoin. This viewpoint aligns with his history: Woo is well-regarded for backing his theories with solid on-chain data. He reminds investors, however, to focus on Bitcoin as a long-term asset and not to get distracted by short-term fluctuations.

“Bitcoin’s long-term price target is 5 cents per sat in today’s value. Stack sats. Don’t even look at the price or the path it weaves to get there. It’ll only distract you. Stay humble.” — Willy Woo (@woonomic)

Woo’s sentiments resonate particularly well in the wake of recent monetary policy changes, with the Federal Reserve cutting interest rates, paving the way for potential upticks in risk assets like cryptocurrency.

Market Conditions Shaping Prices

Recently, the crypto market value climbed significantly, nearing a one-month high of around $64.7K for Bitcoin. The atmosphere is ripe for new buyers as the market shows signs of breaking out of a prolonged downtrend, which many have been anxiously monitoring.

In less than a month, Bitcoin overcame numerous hurdles, and as the sentiment index signals a recovery — rising to 59 — the optimism around the market’s potential becomes clearer. Unlike previous peaks that ended in panic selling, today’s environment depicts a more tempered anticipation of potential gains.

Market trends suggest an optimistic phase for Bitcoin recovery.

Market trends suggest an optimistic phase for Bitcoin recovery.

Broader Optimism and Predictions

Moreover, experts like Michael Saylor, CEO of MicroStrategy, echo similar views. Saylor firmly believes in Bitcoin’s capability to hit well over a million dollars, asserting that the cryptocurrency currently represents merely 0.1% of global capital, which he anticipates will escalate to 7%. His long-term forecast even sees prices reaching as high as $13 million over the next 21 years.

The underlying argument centers on the transformative potential of Bitcoin and other cryptocurrencies—many see this period as a pivotal point where the market, having somewhat established itself, is ripe for growth. Speculative profits are expected, particularly among smaller altcoins that often experience dramatic gains in conjunction with Bitcoin rallies — a phenomena analysts eagerly watch for.

All Eyes on Crypto Allstars

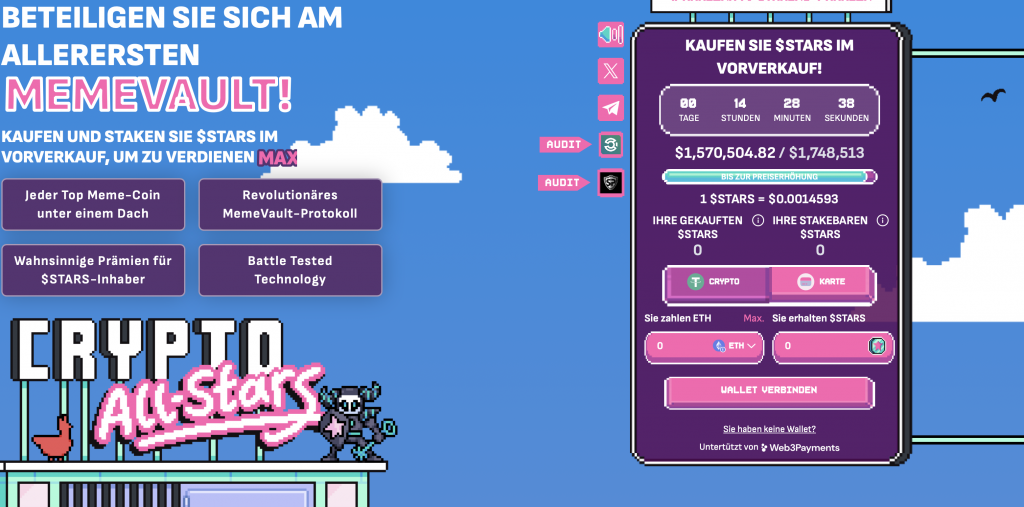

In the realm of altcoins, Crypto Allstars ($STARS) is drawing considerable interest as its innovative MemeVault ecosystem garners attention. Still in its presale phase, this unique project allows staking of various meme coins from different blockchains, hinting at explosive potential for both the platform and its early investors.

With nearly $1.6 million already invested even prior to exchange listings, the anticipation for $STARS is palpable. Analysts believe this could lead to an impressive surge upon official launch, potentially amplifying investor profits substantially.

Investors are keenly watching the rise of

Investors are keenly watching the rise of $STARS in the crypto arena.

Conclusion: A Strong Future Ahead

The interplay of monetary policy, market enthusiasm, and the unique offerings of emerging projects like Crypto Allstars set the stage for what could be a significant period of growth for Bitcoin and the broader cryptocurrency market.

With the historical precedents of previous cycles and the current investment patterns of notable whales, the optimism feels grounded in more than mere speculation. As the market adjusts to Fed rate cuts and Chinese economic stimulus, the overarching sentiment anticipates that new highs could be on the horizon for Bitcoin, with many believing that we’re on the verge of a historic breakout. Keeping an eye on the dynamics of these shifts will be essential for both seasoned investors and newcomers alike.

For those eager to dive into the world of crypto or increase their holdings in established coins, the next few months will likely prove pivotal. As always, however, prospective investors should conduct thorough due diligence before entering this remarkably volatile market.