Bitcoin Soars: A New Dawn for Crypto Following Trump’s Victory

In an unprecedented surge, Bitcoin has reached an all-time high of $75,369 just hours after Donald Trump’s win in the U.S. elections. With the crypto market’s capitalization soaring to approximately $2.5 trillion, many enthusiasts are optimistic about the potential for a friendlier regulatory environment under the new Trump administration. This article dives into the implications of this political shift and how companies like Palantir and emerging technologies are poised to benefit.

Bitcoin’s historic rise mirrors the political changes in the U.S.

Bitcoin’s historic rise mirrors the political changes in the U.S.

The Political Landscape and its Impact on Cryptocurrency

The recent elections have opened doors for cryptocurrencies, with Trump actively courting the crypto community. His promises of transforming the U.S. into a crypto hub resonate well with investors and stakeholders. Trump’s previous engagements, including a keynote at a major Bitcoin conference, showcased his commitment to integrating cryptocurrency into the American financial system. As influential investors express their optimism, the market sentiment leans towards a period of growth for digital assets.

“Trump’s win could signal a new era for crypto. We’re looking at a much more favorable regulatory environment for investors and innovators alike,” said Matthew Hougan, Chief Investment Officer at Bitwise Asset Management.

Rising Tides for Tech Stocks: Palantir’s Prominence

Alongside cryptocurrencies, tech stocks like Palantir have emerged as frontrunners in this new political climate. Joe Lonsdale, co-founder of Palantir Technologies, has publicly lauded Trump’s economic vision. He envisions a “golden age” for the American economy with the potential to double the nation’s wealth.

“The future is gonna be fantastic,” shared Elon Musk, reflecting a similar optimism. The interplay between technology and crypto signals significant opportunities ahead.

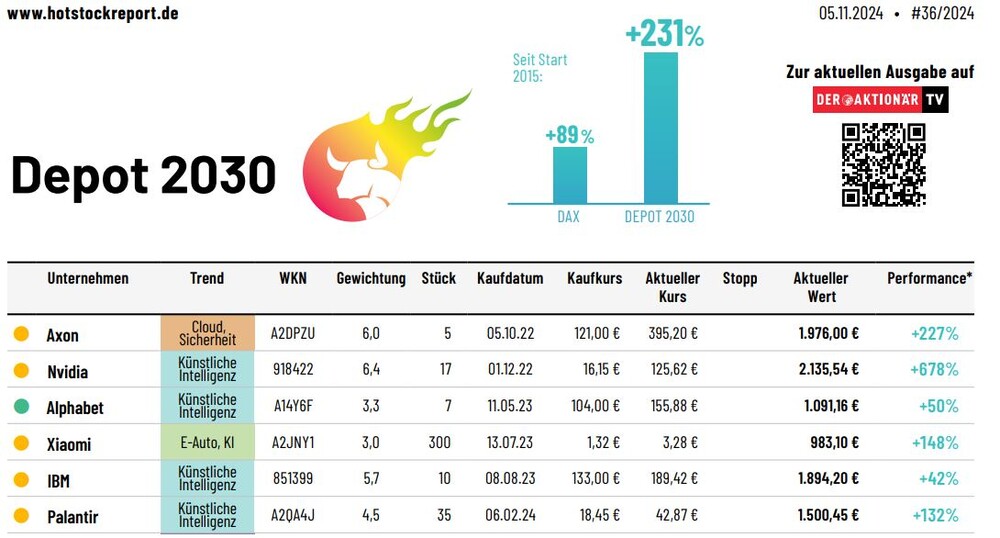

As Palantir’s stock price experiences remarkable gains, its valuation begins to rival that of established giants like Nvidia. With a current price-to-earnings ratio that exceeds 100, the investment community is watching closely to see if Palantir can maintain this momentum.

A Shift Towards Economic Freedom

The crux of Lonsdale’s excitement—and that of many Trump supporters—lies in the desire for a leaner government and reduced bureaucratic hurdles. Lonsdale plans to advocate for reduced regulation that stifles innovation, proclaiming that “we need to get rid of millions of bureaucrats who are hindering our progress." His comments resonate with a libertarian ethos that champions free enterprise and minimal government intervention.

As we look towards Europe, Lonsdale emphasizes a broader understanding of America’s commitment to exceptional liberty and freedom. This principle aligns closely with the burgeoning Bitcoin market, providing a fertile ground for growth and acceptance in a more liberated economic system.

Bitcoin and the Promise of Reform

Bitcoin’s recent price spike isn’t merely a reflection of speculative trading; it indicates a growing confidence in the future of crypto in a post-Trump world. With calls for less regulatory intrusion and clearer policies, enthusiasts are expecting long-term stability and growth in the cryptocurrency sector.

Lonsdale’s and Musk’s positive rhetoric for Bitcoin is echoed by figures like Tyler Winklevoss, who stated, “This is the most important election of our lifetime. If you care about the future of crypto, vote Trump." Such strong sentiments underline the intertwined fates of politics and cryptocurrency.

The political winds play a crucial role in cryptocurrency’s future trajectory.

The political winds play a crucial role in cryptocurrency’s future trajectory.

What Lies Ahead for Investors and Tech Enthusiasts

As the market adjusts to the new political landscape, investors should remain vigilant. While the immediate outlook shows promise, analysts caution that rising U.S. treasury yields may pose challenges. As Marcel Heinrichsmeier noted, “There’s a silver lining to this dark cloud, as an increase in yields might dampen crypto momentum.”

Nevertheless, the bullish outlook extends beyond immediate market reactions; it encourages sustained investments in both technology and cryptocurrencies. The combination of favorable regulatory shifts and an inclination towards innovation is likely to sustain interest in Bitcoin and associated technologies.

In conclusion, the intersection of cryptocurrency and politics marks a vital chapter in the ongoing narrative of digital finance. Investors would do well to keep their eyes peeled as this story unfolds, capturing the dual horsepower of political foresight and technological progress.

For further insights, subscribe to our updates and stay engaged with the rapid changes in the cryptocurrency space!

Photo by

Photo by