Trump Triumphs and Bitcoin Soars: The New Economic Landscape

The cryptocurrency market has entered a thrilling chapter, triggered by the return of a polarizing figure: Donald Trump. Following his recent victory in the 2024 presidential election, Bitcoin surged to an all-time high of over $76,000, with traders buoyed by hopes of a favorable environment for digital currencies. Trump’s campaign presented him as the champion of crypto enthusiasts, promising a series of policies that could reshape the landscape of digital currencies in the United States.

An analysis of Bitcoin’s price trajectory following the elections.

A Promising Landscape for Cryptocurrency

Investors had already begun rallying around Bitcoin days before the election, anticipating a shift in regulatory landscapes should Trump reclaim the presidency. Following the announcement of his victory, the reactions were explosive—not only for Bitcoin but also for associated stocks like Coinbase and Tesla. Bank stocks experienced a marked rise as the financial world adapted to the energetic climate Trump’s policies are forecasted to introduce.

The Pro-Crypto Promises

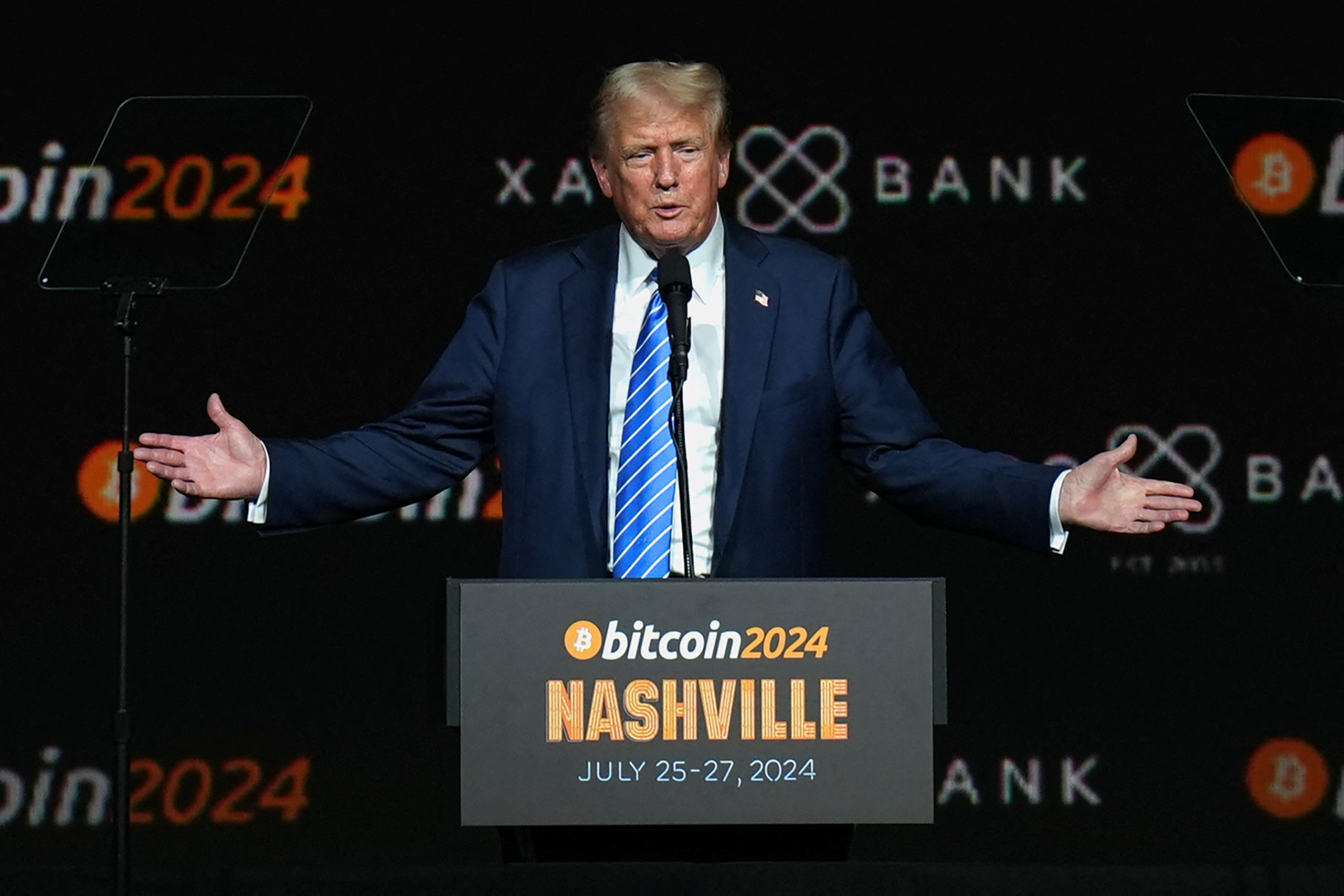

Trump’s promises were unveiled during a keynote at the Bitcoin 2024 convention, where he declared an ambition to transform the U.S. into the “cryptocurrency capital of the world.” Such aspirations echo throughout the crypto community, which hopes for diminished regulations and increased government backing. His ambitious plan included the establishment of a national Bitcoin stockpile, potentially valuing around $14 billion.

“To those who think crypto is a fad, you’re in for a surprise. America will embrace Bitcoin and cryptocurrency as fundamental assets in our financial makeup,” touted Trump during his address.

However, these promises do not come without their complexities. While the promise of fewer regulations might excite investors, it raises alarms over potential abuses reminiscent of the FTX debacle, where millions lost their assets to fraudulent schemes. Hence, a balance will need to be struck between innovation and regulatory prudence.

Trump rallies support at the Bitcoin convention.

Trump rallies support at the Bitcoin convention.

The Market Reacts: Stocks on the Rise

Following Trump’s victory, not just Bitcoin but an array of stocks also reacted favorably. Coinbase, Tesla, and various financial institutions like Wells Fargo and Discover saw notable upticks. Trump’s administration vows to mine more cryptocurrencies, which could mean increased energy consumption, contradicting the sustainability narratives pushed by previous administrations. The financial institutions’ optimism suggests that market participants are betting on the resurgence of the economy through tech-savvy initiatives during Trump’s potential second term.

A Divided Opinion

While the positive effects on the market are evident, analysts express concerns regarding the long-term implications of Trump’s policies. The outright dominance of fossil fuels to fuel the energy needed for cryptocurrency mining could jeopardize climate goals set across the globe. The trade-off between economic growth and environmental sustainability poses a challenging question for policymakers as the administration charts its course.

The intersection of market growth and sustainability concerns.

The intersection of market growth and sustainability concerns.

Conclusion: The Future Awaits

As Bitcoin and crypto-related stocks continue to flourish, the industry stands on a precipice of change. Investors and enthusiasts alike are cautiously optimistic, but the ramifications of political promises will play out over time. The cryptocurrency sector has always thrived in uncertainty, and as new policies emerge under Trump’s administration, only time will tell how these changes will reshape the future of digital assets in America. Will we see a true renaissance in the crypto landscape, or merely a flash in the pan?

In a world where Bitcoin is increasingly viewed not just as a currency, but a store of value and a hedge against traditional economic fluctuations, the stakes are undeniably high. Understanding these dynamics will be crucial for investors navigating this newly energized market landscape.