Bitcoin Price Poised for a Leap to $80,000: Here’s Why

A Renewed Optimism in the Crypto Market

Recent weeks have proven transformative for the cryptocurrency landscape. Just two weeks ago, fears of an impending recession in the U.S. loomed large, casting a shadow over Bitcoin and other cryptocurrencies. Disappointing earnings reports from major companies, a sluggish job market, and high-interest rates contributed to a prevailing pessimism. However, following the Federal Reserve’s significant decision to cut rates, a robust recovery seems underway. The Bitcoin price has surged back to approximately $64,000, signaling that this could merely be the beginning of an exciting chapter for the crypto market.

An inspiring rebound for Bitcoin as monetary policy shifts.

An inspiring rebound for Bitcoin as monetary policy shifts.

Interest Rate Cuts Ignite a Rally

The Federal Reserve’s latest interest rate cut—its first in over four years—came as a surprise to many, particularly as it was implemented at a bold 50 basis points. The market enthusiasm has been palpable, with investors reacting positively to the easing of financial conditions. Looking beyond U.S. borders, the People’s Bank of China is also indicating a willingness to reduce its benchmark rate, which has historically triggered a bullish wave within Bitcoin markets. Interestingly, such monetary easing measures typically correlate with peaks in Bitcoin pricing, suggesting a significant surge could be on the horizon.

Whales Are Back in the Game

Yet another factor contributing to the likelihood of Bitcoin’s ascent is the natural cycle of halving that occurs approximately every four years. The last halving took place over five months ago, and history paints a clear picture: this event has invariably preceded substantial price hikes. With financial whales—an informal term for individuals or entities holding large quantities of Bitcoin—re-entering the market, the stage is set for a potential explosion in valuations. The overall sentiment is brewing with optimism, hinting that Bitcoin could soon breach the coveted $80,000 mark and establish a new all-time high.

Altcoins Riding the Bitcoin Wave

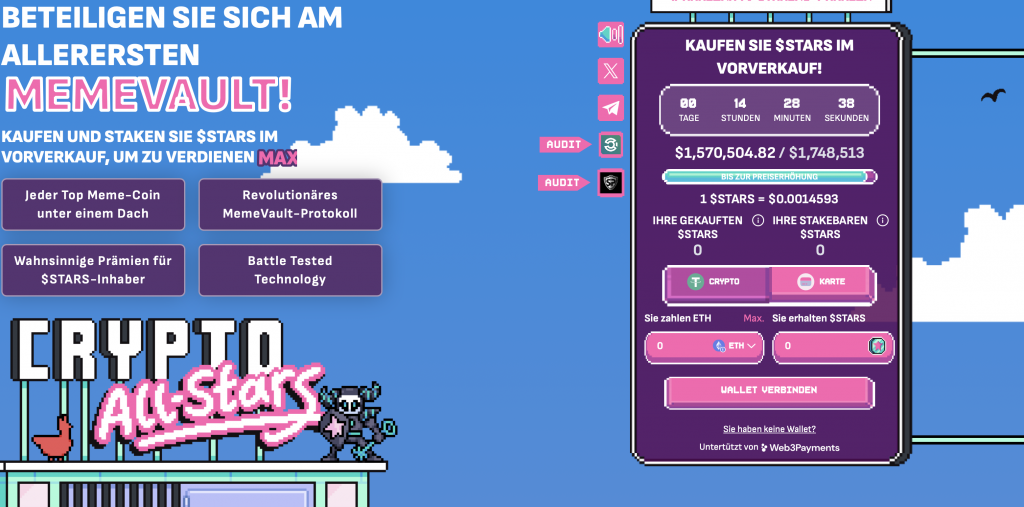

Historically, a bullish Bitcoin price often leads to altcoins benefiting significantly. Such is the expected scenario going forward, as many investors will likely look towards lesser-known altcoins in anticipation of their own rallies. One particular project, Crypto Allstars ($STARS), stands out as a potential candidate for this upcoming surge. Given the current bullish sentiment surrounding Bitcoin, it wouldn’t be surprising for alternatives like $STARS to enjoy a similar trend.

Could Crypto Allstars benefit from Bitcoin’s bullish momentum?

Could Crypto Allstars benefit from Bitcoin’s bullish momentum?

A Personal Perspective: The Future Looks Bright

As someone immersed in the world of cryptocurrency, the recent market movements fill me with a cautious optimism. I have been actively trading Bitcoin and I cannot deny how profoundly the fluctuation in interest rates impacts market dynamics. Remember a few years back when we saw a similar rate cut that propelled Bitcoin past previous all-time highs? It feels like déjà vu. My analytical instinct tells me we are potentially repeating history.

Moreover, it’s fascinating seeing how community sentiment shifts. Social media platforms and forums have become vibrant with discussions about Bitcoin’s trajectory, and every new report of institutional investment loads another round of confidence into the market.

Conclusion: The Calm Before the Surge?

While the global economic landscape remains challenging, the indicators for Bitcoin are increasingly favorable. The fusion of central banks’ easing policies, the cyclical nature of cryptocurrency, and revitalized investor confidence are all contributing to a promising horizon for Bitcoin prices. Fasten your seatbelts, because if history teaches us anything, the anticipated jump to $80,000 might just be around the corner.

Are you ready to ride the wave?

Speculations on Bitcoin’s upward trajectory continue to grow.