Bitcoin Set for Highest Monthly Close in History, Up 13% on 2021

Bitcoin is on course to break two historic records within the next few hours as it trades around $70,800. Bitcoin, which uses universal standard time, is hours away from closing its highest monthly candle ever, up 13% on 2021’s record.

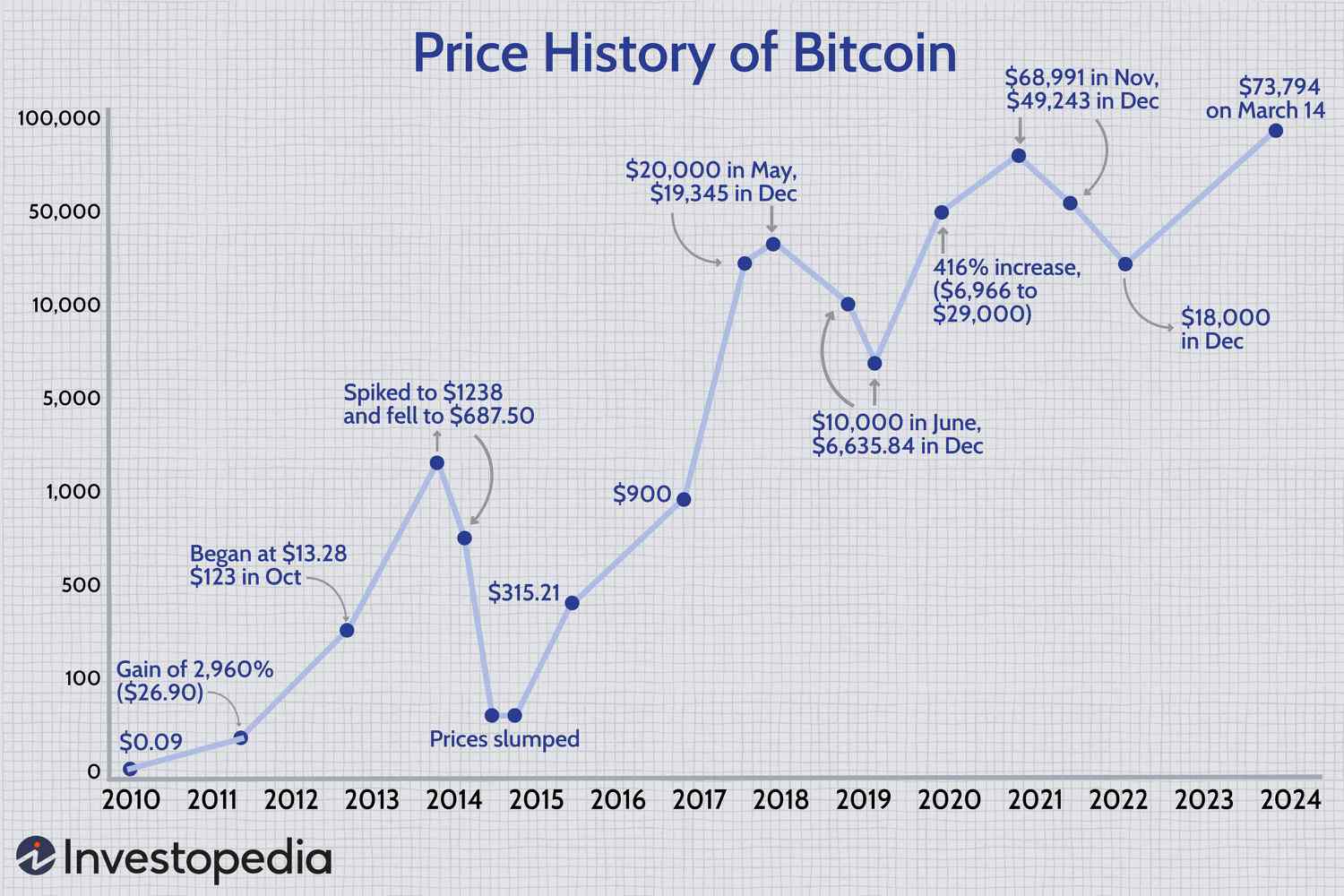

Chart showing Bitcoin’s monthly candles since 2017

While bitcoin hit an all-time high of $68,900 in 2021, it never closed a monthly candle above $61,400. Twice it broke the $60,000 psychological resistance, once between March and April and again between October and November. However, on neither occasion was the top digital asset able to hold above this critical level.

In March 2021, bitcoin closed at $58,800 after a monthly high of $61,700, then in April, it closed $100 lower, around $58,700, even though it reached a new all-time high of $64,700 earlier in the month.

Following a 55% drawdown to $29,000, bitcoin recovered by the year’s end to again break new all-time highs in October and November. However, bitcoin closed well below the new record peak in both months, down 8.5% and 17%, respectively.

In 2024, bitcoin has smashed through all previous highs and this month reached $73,640, almost 7% beyond the 2021 peak. Last month bitcoin closed around the 2021 level at $61,100, so at current prices and any monthly close above $61,400 will be a new monthly record.

As bitcoin looks prime to lock in a monthly close above $70,000, it will also achieve seven monthly green candles in a row for the first time in over 12 years. In 2012, bitcoin had seven green months, rising 152% over the period. Yet, during its current run, which started in September 2023, bitcoin has soared over 170%, marking its strongest seven-months ever.

Bitcoin monthly candles 2009 to 2024

Past months also saw bitcoin making a new all-time high before a halving event for the first time. Previous cycle highs have occurred mid-way through a halving cycle, never this deep in. The influx of capital from bitcoin ETFs and the resulting strain on its fixed supply has had a definitive impact on the price.

Historically, bitcoin has started its bull season after a halving event, but the past seven months suggest it has come early. Whether the upcoming cycle will reveal a new pattern in a post-ETF bitcoin world is yet to be seen. However, two bitcoin records in one month less than 30 days from the halving is unprecedented, setting up a bullish path to the start of the next four-year cycle.

It is prudent to remember that past performance never indicates future returns, as with all investments. Bitcoin has a unique makeup, but price discovery relies on market forces like any other asset.

3 Reasons Why The U.S. Needs To Embrace Bitcoin (And Other Crypto)

It is no secret that the topic of bitcoin and the broader cryptoasset space has continuously been a topic of controversy and debate in the United States. From being derided by most every TradFi institution in the United States to having 11 spot bitcoin ETFs attracting billions of dollars rapidly since inception it has become readily apparent that the U.S. private sector has embraced bitcoin and tokenized payments. These institutions include Blackrock, the largest asset manager in the world, and J.P. Morgan, the largest and most influential bank in the U.S. At the same time investment in bitcoin continues to hit all-time highs other indicators continue to point to greater interest in the space such as stablecoin capitalization and the resurrection of the NFT sector.

Despite these positive private sector trends, news, and indicators the pushback from U.S. policymakers has been fierce. The SEC continues to push to classify virtually every cryptoasset as a security, has open lawsuits against Coinbase (an exchange that is registered with the SEC), and has launched new investigations against organizations that are conducting business with the Ethereum Foundation. In addition, politicians continue to spar despite the obvious success of bitcoin and other tokenized assets.

Such a divergence cannot remain and is entirely counterproductive to level-headed conversations around what are technologies that are well positioned to reshape currency and business moving forward.

The Dollar Is Already Digital

According to a study by the Federal Reserve Bank of San Francisco, only 19% of total, and 6% by value, of dollar transactions were conducted using cash. No matter what metric is used to measure the pivot of dollar-based transactions the reality is clear; the dollar has already gone digital. This is not to dismiss the arguments being made both for and against a central bank digital currency (CBDC); both sides have valid concerns that need to be addressed in a productive manner.

The debate around CBDCs, however, potentially overshadows the reality that transactions for both business and individuals, are already increasingly digital/virtual in nature. Framed in that context it seems logical to conclude that as tokenized payments and blockchain-based transactions continue to increase in frequency and value that these technologies will become part of dollar transactions.

Money Is Technology

Building on that first point is it increasingly clear that money is less a currency (not to mention the obsolescence of physical units), and more a technology. As digitization accelerates in every aspect of the global economy, be it driven by blockchain or some other technology, money is transitioning to yet another technology application. With digital and virtual transactions forming an increasing percentage of total transaction volume and value, and the tokenization of TradFi assets well underway (and led by TradFi institutions) the line between money and technology is almost invisible.

These trends do not even touch on the important role that digital and tokenized transactions will have to play as e-gaming, streaming content, and augmented reality continue ascents into the mainstream. The metaverse may have been over-hyped at the beginning, but augmented reality and virtual reality continue to improve, and represent an almost ideal use case for tokenized/technological money.

The U.S. has long been a hotbed of technological innovation, and ignoring the evolution of money would harm both consumers and companies moving forward.

Reserve Status Is Not A Right

The United States enjoys one of the most exorbitant privileges that any nation can ever experience via the dollar’s role as the global reserve currency. With the U.S. dollar serving as the backbone for financial transactions and global markets for almost 70 years it is almost inconceivable to think of a world where this is not the reality. Difficult, but a mindset that ignores historic precedent; multiple nations and empires have held the global reserve currency in the past, and the U.S. is simply one in a long line whose currency has held this position.

As challenges to U.S. economic and geo-political strategies continue to emerge and rise, combined with the digitization of U.S. dollar transactions and the increasing technological nation, the reserve currency status of the dollar should not be taken for granted. Rather, policymakers should build on private market efforts to incorporate tokenization, embrace the digitization of the dollar, and invest proactively into the technological future of money.

Instead of fighting against the tide, U.S. policymakers should follow the private sector example embracing bitcoin and other cryptoassets.

Even after 15 years of history, there are discussions around the nature of Bitcoin. Despite being presented as “a peer-to-peer electronic cash system” by its pseudonymous creator, Satoshi Nakamoto, understanding this technology beyond the payments realm and competing with commodities like gold or real estate is gaining more and more advocates. One of the most prominent proponents of this view on Bitcoin is MicroStrategy Chairman Michael Saylor.

Saylor is one of the most well-known bitcoin holders and advocates worldwide. In 2020, his company made Bitcoin the main asset of its treasury and has been systematically acquiring BTC since then. According to bitcointreasuries.net, Saylor’s MicroStrategy holds 214,246 BTC, worth around 15 billion dollars, making it one of the largest global holders.

For Saylor, there needs to be a better understanding of Bitcoin’s nature and main purpose. “People refer to it as currency or digital currency, and that’s an unfortunate historical artifact. It’s not a digital currency. It’s digital property”, Saylor explained in a CNBC interview in early March.

With this in mind, Saylor argued the compelling use case of this technology is “capital preservation,” so using it for payments doesn’t make that much sense for him. He compared owning bitcoin with owning real estate and argued that nobody complains about being unable to spend a fraction of their buildings.

“Medium of exchange is worth only one trillion dollars, store of value is worth a hundred trillion dollars (…) medium of exchange is a distraction (…) Bitcoin is competing with gold”, he underscored.

But being presented as an electronic cash system in its origin and elevated through the years as a borderless and global payments network declared legal tender in El Salvador and used for digital and real-life commerce, it’s expected that this new interpretation presented by Saylor received a negative response from the Bitcoin community in social media channels like X.

For example, Canadian exchange BullBitcoin CEO Francis Pouliot posted a long-format answer arguing that Bitcoin is “the best medium of exchange the world has ever seen.” Pouliot explained how many people use it for payments worldwide on a daily basis and how his company has been helping them. “Wall Street games and fiat shenanigans are the distraction,” he said, referring to Saylor’s comments.

“Nearly every transaction will be performed using Bitcoin as the medium of exchange and unit of account. These payments will be executed using various methods of payment, which have varying degrees of trust and permission involved. Large payments will probably always happen on-chain, while smaller payments will be performed either via non-custodial “Layer 2” payment protocols such as the Lightning Network, custodial bearers asset protocols such as the Liquid Network or Fedimint, or using simple custodial ‘bitcoin bank accounts,’” he further detailed to me about the future of bitcoin payments via X direct messages.

Saylor’s comments triggered a debate around the nature of Bitcoin. But they also showed how this narrative shift is part of the new kind of holders that are part of the bitcoin market.

In the early days, it was mainly cypherpunks, technologists, and geeks and their interest was to have digital cash. The new wave of investors is more like Saylor: established businessmen finding their own use case for BTC, in this case, capital preservation. This won’t necessarily fit the known narratives around Bitcoin and why it exists.