Bitcoin Sees Profit-Taking Around $70K Amid ‘Stubbornly Bullish’ Sentiment

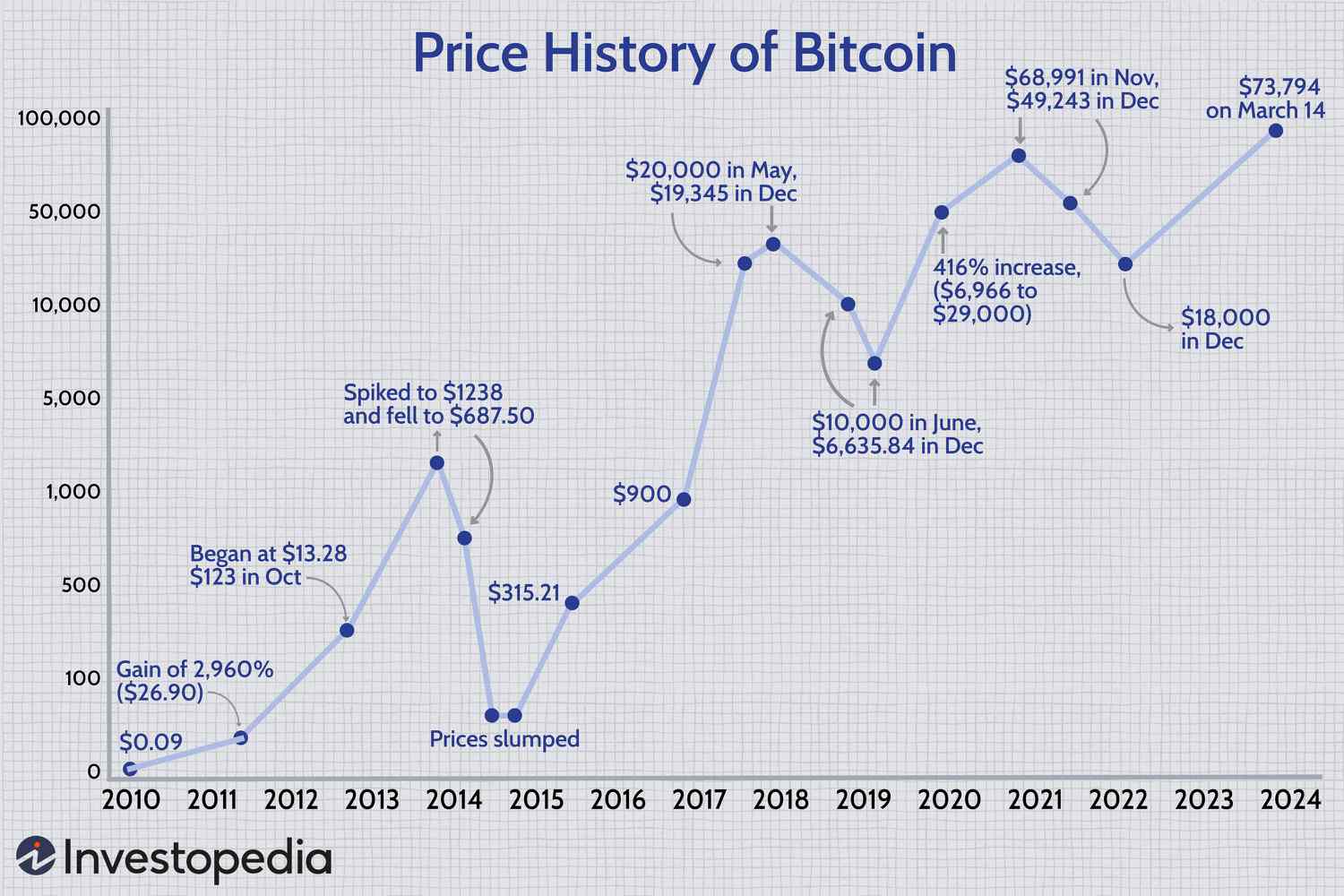

Bitcoin price dipped to $69,200 amidst profit-taking and broader U.S. stock market movements. Despite negative news, sentiment remains bullish due to long-term holder conviction and anticipation of further spot ETF approvals.

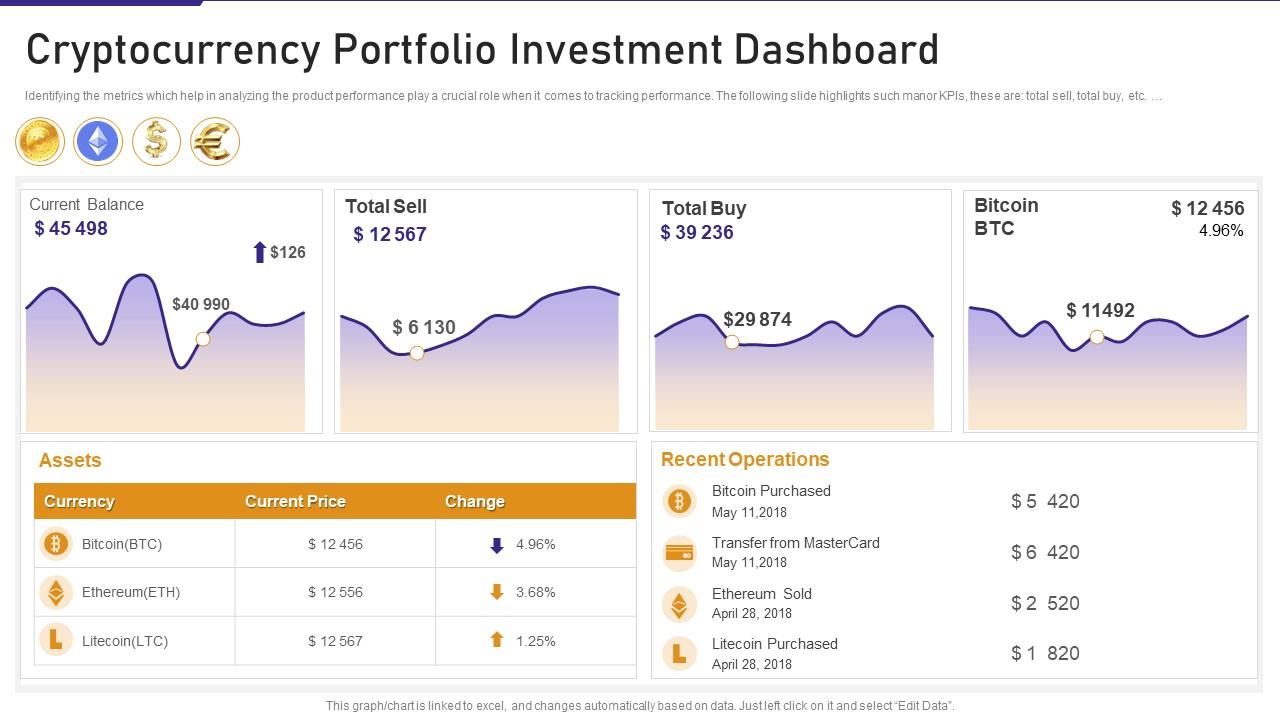

Bitcoin price chart

On-chain data shows over 50% of Bitcoin supply remains inactive, a sign of strong long-term conviction in the asset. This is considered a sign of strong long-term conviction, which may indicate further price gains.

The market remains stubbornly bullish in spite of negative headlines about Mt. Gox and the DMM hack last week, BTC rallied confidently above $69,000 in Asia.

As such, the sentiment around bitcoin’s continued growth remains ‘stubbornly bullish’, with Singapore-based QCP Capital seeing an increase in trading activity.

Long-term holders accumulating BTC

Long-term holders accumulating BTC

Another reason for persistent bullishness is speculators increasing long positions in other crypto majors in anticipation of additional spot ETF approvals in the near future.

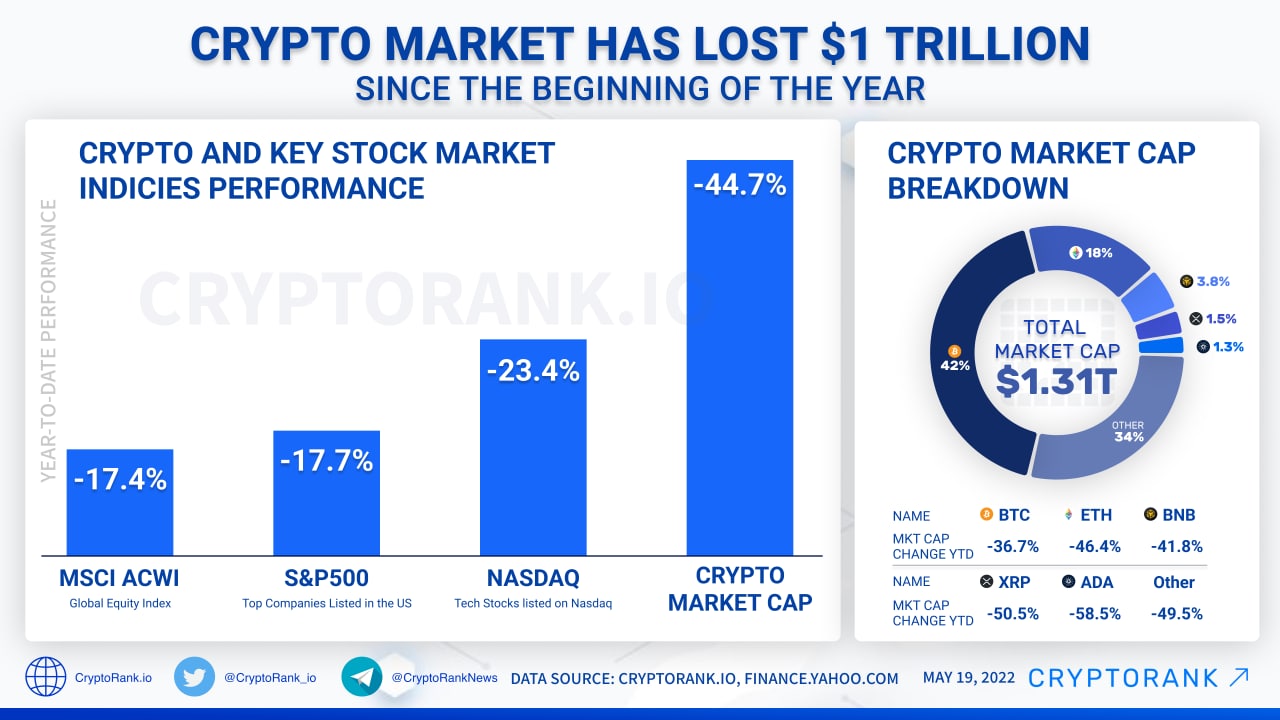

Elsewhere, ether (ETH) and dogecoin (DOGE) showed slight losses, while Cardano’s ADA and Solana’s SOL rose as much as 3%. The CoinDesk 20 (CD20), a broad-based index of the largest tokens minus stablecoins, is up 0.41% in the past 24 hours.

Crypto market performance

Crypto market performance

Among other larger tokens with a market capitalization above $1 billion, dog-themed floki (FLOKI) and synthetic dollar project Ethena’s ENA tokens rose more than 10%.

Crypto market trends

Crypto market trends