Bitcoin’s Sudden Price Dip: Over 75,000 Traders Liquidated

In a shocking turn of events, Bitcoin’s (BTC) price plunge has sent ripples through the cryptocurrency market, resulting in over 75,000 liquidated positions in a matter of hours. The leading cryptocurrency, which had its sights set on breaking the elusive $70,000 barrier, faced a severe pullback that saw it drop by more than $2,000 in just a few minutes.

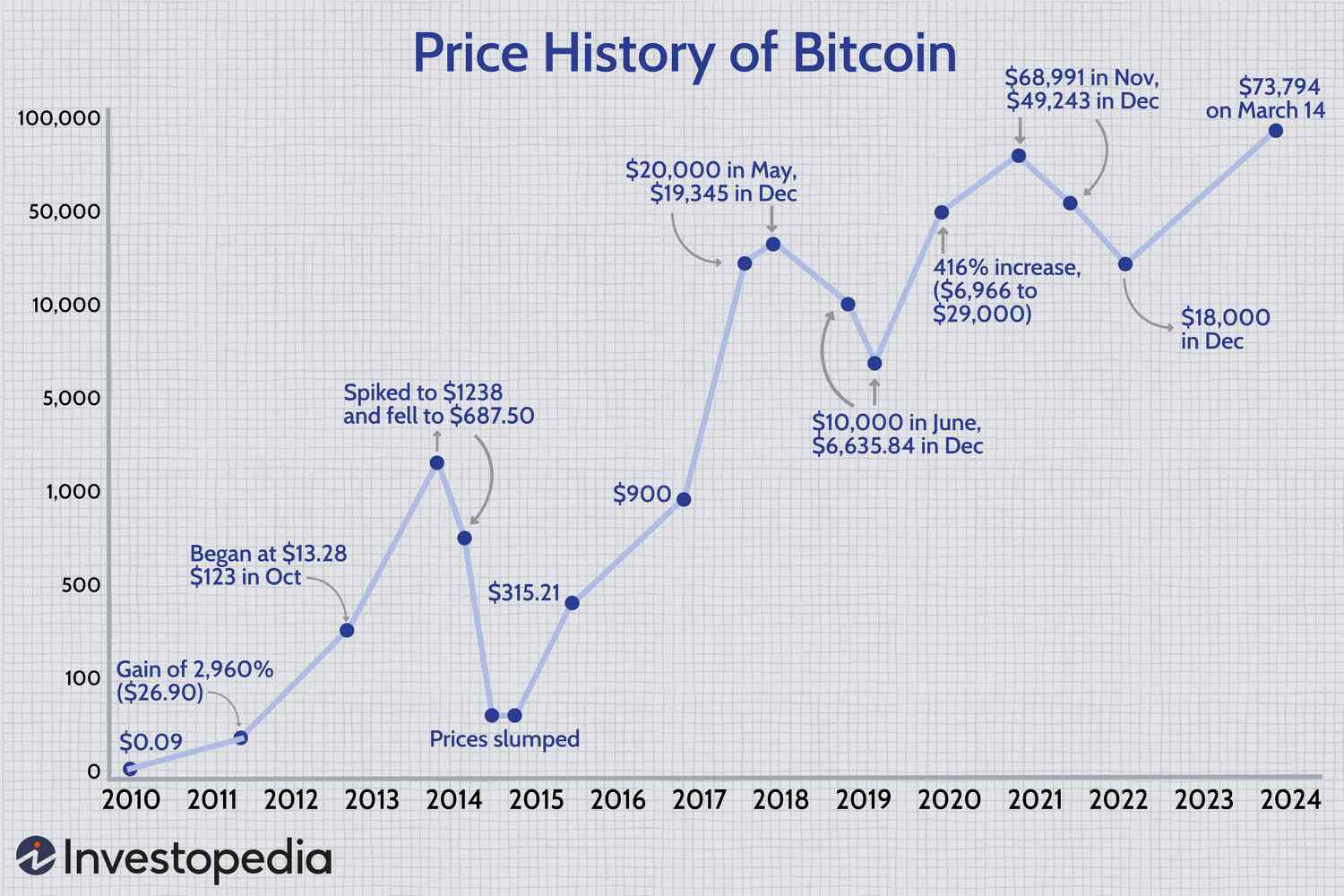

Bitcoin price chart showing recent volatility

The Surge and Fall

Following a rather stagnant weekend, Bitcoin’s price rose to a daily high, briefly touching the $70,000 mark. The bullish momentum seemed promising, particularly as traders anticipated a breakthrough. However, the enthusiasm was short-lived as bears quickly reasserted control, leading to a swift decline that saw BTC’s value tumble to $67,500, its lowest level since June 3. The market capitalization concurrently plummeted to approximately $1.335 trillion according to CoinGecko.

The fallout wasn’t limited to Bitcoin alone; the broader cryptocurrency market suffered a staggering $80 billion loss in total market cap. This drop underscored the fragility of the current market environment, as traders scrambled to understand the shifting tides.

Altcoins in Turmoil

Moreover, the altcoin space experienced considerable turmoil, with Ethereum (ETH) witnessing a 3.5% decline that dropped its value to around $3,560. Other cryptocurrencies, including SOL, DOGE, and LINK, mirrored this downward trend, painting a grim picture for traders and investors alike. Binance Coin (BNB), once the standout performer, has also taken a hit, falling over 7% in the last 24 hours and settling below $620.

Recent trends in the cryptocurrency market showcasing volatility across various assets

Worse losses were reported by newer tokens, such as NOT and W, which plummeted by 19% and 15% respectively. These drastic drops reveal the heightened volatility in the market, particularly for less established cryptocurrencies.

Liquidation Cascade

Reports reveal that the total value of liquidated positions reached about $170 million over the past day, with a staggering $120 million recorded in just the last 12 hours. This situation has left many traders facing significant financial losses, with the recent chaos attributed largely to the rapid price fluctuations in BTC. Most notably, Ethereum accounted for the largest liquidated position, which alone was worth over $6.5 million on Binance.

Looking Ahead: What’s Next for Crypto?

As the dust settles from this price correction, the question on every trader’s mind is, what’s next for Bitcoin and the broader cryptocurrency market? The sudden volatility could serve as a wake-up call for investors to reassess their strategies in this unpredictable environment. Analysts recommend that traders exercise caution and remain vigilant in their tradings and decisions.

“The cryptocurrency market is notorious for its rapid shifts. Staying informed and agile is crucial,” said a leading crypto analyst.

The world of digital currencies is in constant flux—while the recent downturn is disheartening, it also represents an opportunity for astute investors to capitalize on potential rebounds in the future. Understanding resilience and market dynamics will be key as traders navigate this rapidly changing landscape.

With upcoming regulatory developments and technological advancements on the horizon, the cryptocurrency scene is primed for major shifts, making it essential to stay proactive in monitoring market trends and news.

In conclusion, the latest episode of market turbulence has served as a stark reminder of the inherent risks and volatility within the cryptocurrency ecosystem. As we look forward, it remains to be seen how Bitcoin and its altcoin counterparts will respond in the following days and weeks.