Bitcoin Surges: The Revival of Cryptocurrency in the US

Bitcoin has achieved a remarkable milestone, crossing the $71,000 mark on June 5, 2024, following a significant surge in spot bitcoin exchange-traded fund (ETF) inflows. In just 24 hours, Bitcoin experienced an increase of approximately 3%, while the broader CoinDesk 20 Index, which tracks a selection of digital assets, rose by 2.8%. With Bitcoin reaching a peak of $71,341 early Wednesday, the cryptocurrency is on a five-day streak of price increases—the longest in months.

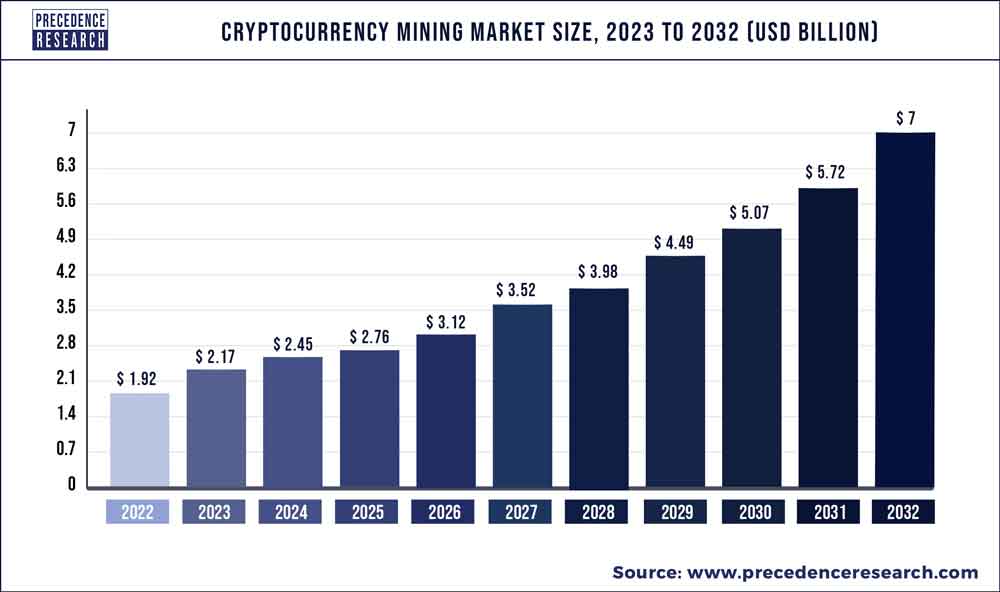

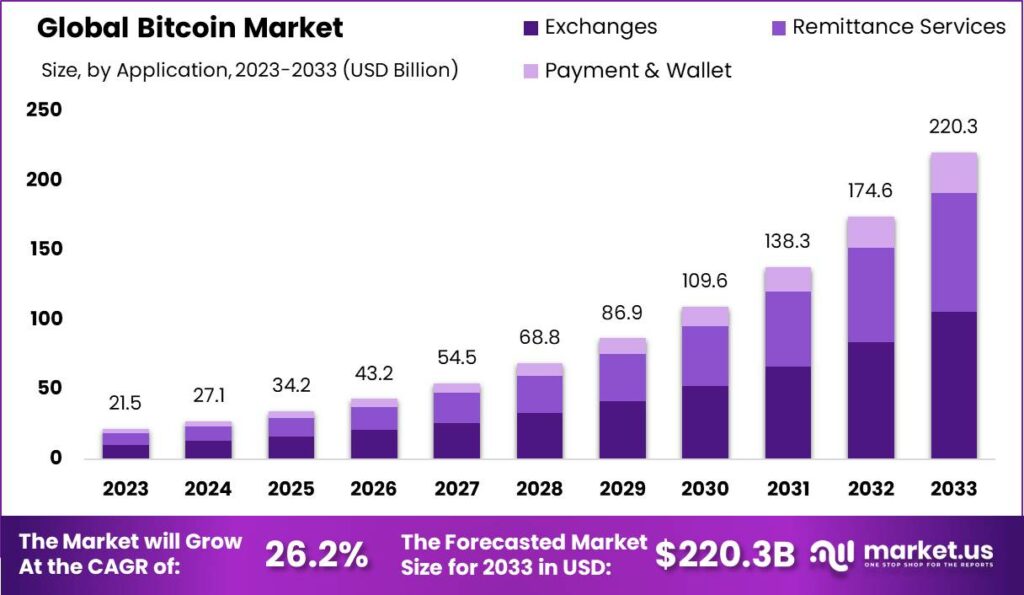

Recent trends in the Bitcoin market show robust growth in ETF inflows.

Recent trends in the Bitcoin market show robust growth in ETF inflows.

The recent resurgence in bitcoin’s price has been strongly influenced by the latest inflows into spot bitcoin ETFs. On June 4, these fund products saw an influx of over $880 million, marking the most substantial single-day total since March and the second-highest since their introduction in January. Key players in this surge include Fidelity’s FBTC and BlackRock’s IBIT, attracting $378 million and $270 million, respectively. This uptick in ETF activity has coincided with an overall positive sentiment towards cryptocurrencies, bolstered by developments in the U.S. presidential election cycle.

A Promising Political Landscape for Crypto

The political scenery in the United States appears increasingly favorable for cryptocurrency enthusiasts. The dollar has reclaimed its position as the dominant currency in crypto trading, accounting for over 50% of global volumes, reversing a trend that saw trading gravitate toward Asian markets last year. As U.S. regulators shift their stance towards cryptocurrencies, exemplified by recent approvals of spot ether ETF filings, the market has reacted positively.

Prominent figures in the financial sector are optimistic about bitcoin’s trajectory, with Galaxy Digital’s CEO Mike Novogratz predicting that prices could soar above $100,000 by the year’s end. As the political landscape becomes more crypto-friendly, coupled with the recent surge in ETF flows, the interest in cryptocurrencies is reigniting among institutional investors.

DMM Bitcoin Aims to Compensate Hack Victims

Amidst the positive movement in the cryptocurrency market, not all news is uplifting. Japanese crypto exchange DMM Bitcoin announced plans to raise $320 million to reimburse victims of a hacking incident that recently stole over $305 million. To facilitate this repayment, DMM Bitcoin will utilize loans and capital increases to secure the necessary bitcoin needed for reimbursement.

The exchange has promised users that their bitcoin holdings will be safeguarded through support from its parent group, DMM Group, which has a combined revenue of around $2.2 billion in 2023. As DMM Bitcoin works to stabilize its operations post-hack, the incident underscores the critical need for enhanced security measures within the ever-evolving crypto landscape.

A strong focus on security is vital for the future of cryptocurrency exchanges.

Rising Open Interest and Market Volatility

Further evidence of increasing market engagement is illustrated by the spike in open interest surrounding Bitcoin futures, which surged over $2 billion in a matter of days. This increase signals an influx of fresh capital into the markets, often an indicator of impending volatility. With nearly $37 billion in open interest, Bitcoin futures are experiencing the largest growth since early April, showcasing a reinvigorated interest from traders and investors alike.

Over $11 billion in futures contracts are currently active on the Chicago Mercantile Exchange (CME), a focal point for institutional trading, further solidifying the U.S. position in the global crypto marketplace. The convergence of market dynamics, regulatory developments, and investor sentiment sets a favorable stage for Bitcoin and the broader cryptocurrency ecosystem as we move forward.

Conclusion: A New Era for Bitcoin and Cryptocurrency

As Bitcoin reaches new heights, the intersection of strong ETF performance, political backing, and renewing investor confidence seems to signal the dawn of a new era for cryptocurrency. Analysts are watching closely as Bitcoin’s price movements coincide with larger market trends, including the US dollar’s resurgence and legislative momentum aligning for favorable crypto regulations. The recent developments embody a multifaceted narrative where regulatory clarity and technological advancements merge to sculpt the future of finance as we know it.

In a landscape constantly shaped by innovation and emerging challenges, one thing remains clear: the evolution of cryptocurrency is an ongoing saga, unfolding with each passing day.

The horizon looks promising for the future of cryptocurrency amid evolving market conditions.