Bitcoin Rebounds Above $70,000: What’s Next for Crypto Markets?

The cryptocurrency market has been on a rollercoaster ride in recent weeks, with Bitcoin (BTC) prices plummeting to below $60,000 before rebounding above $70,000. This volatility has left many investors wondering what’s next for the crypto market.

Inflation and Interest Rate Expectations Impact Crypto Markets

According to Steven Lubka, managing director of Swan Private Client Services, the recent price fluctuations can be attributed to inflation and interest rate expectations. In an interview on CNBC Crypto World, Lubka discussed the impact of these macroeconomic factors on the crypto market.

“The current inflation environment and interest rate expectations are having a significant impact on crypto markets,” Lubka explained. “As investors become more risk-averse, they’re seeking safer havens, which is affecting crypto prices.”

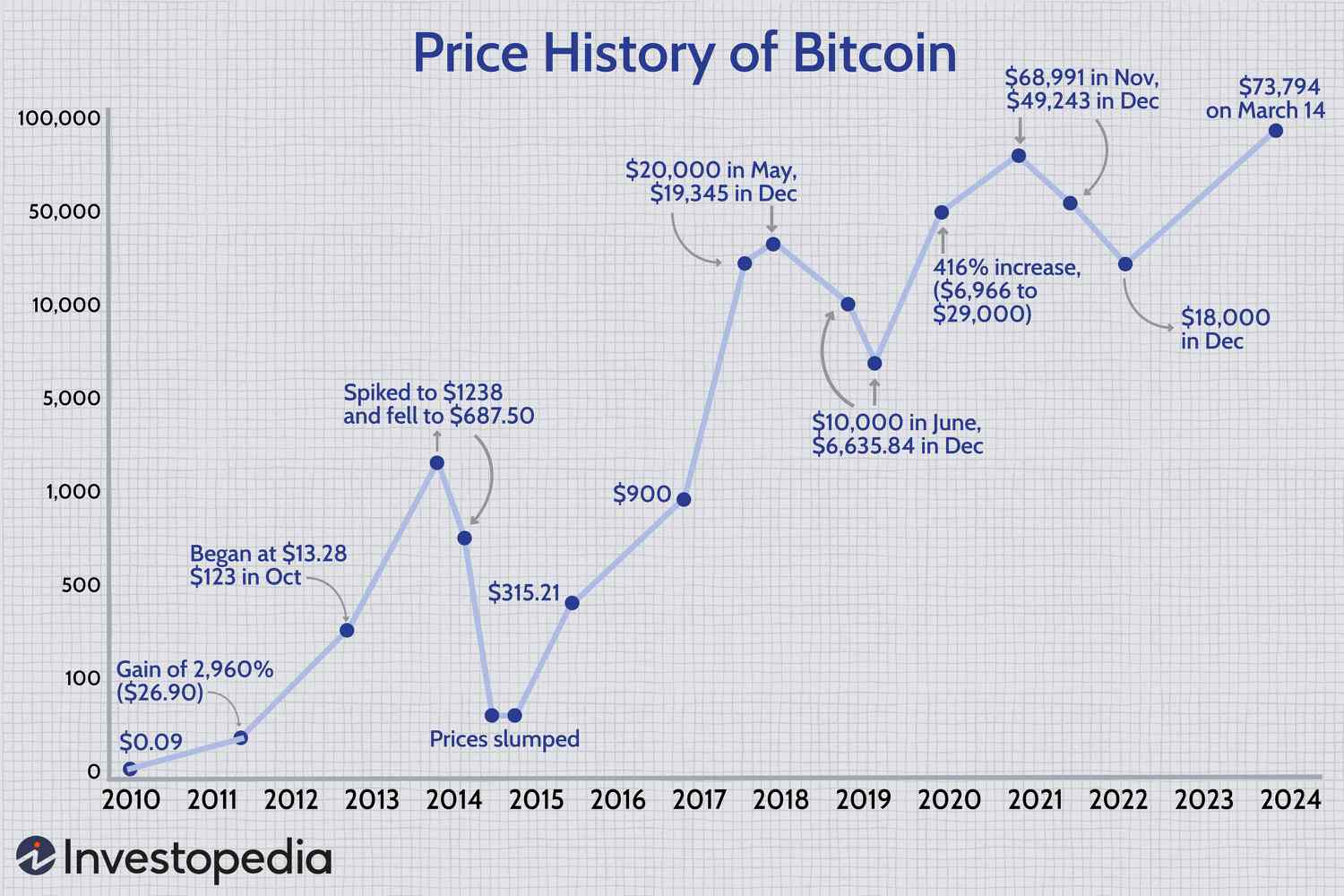

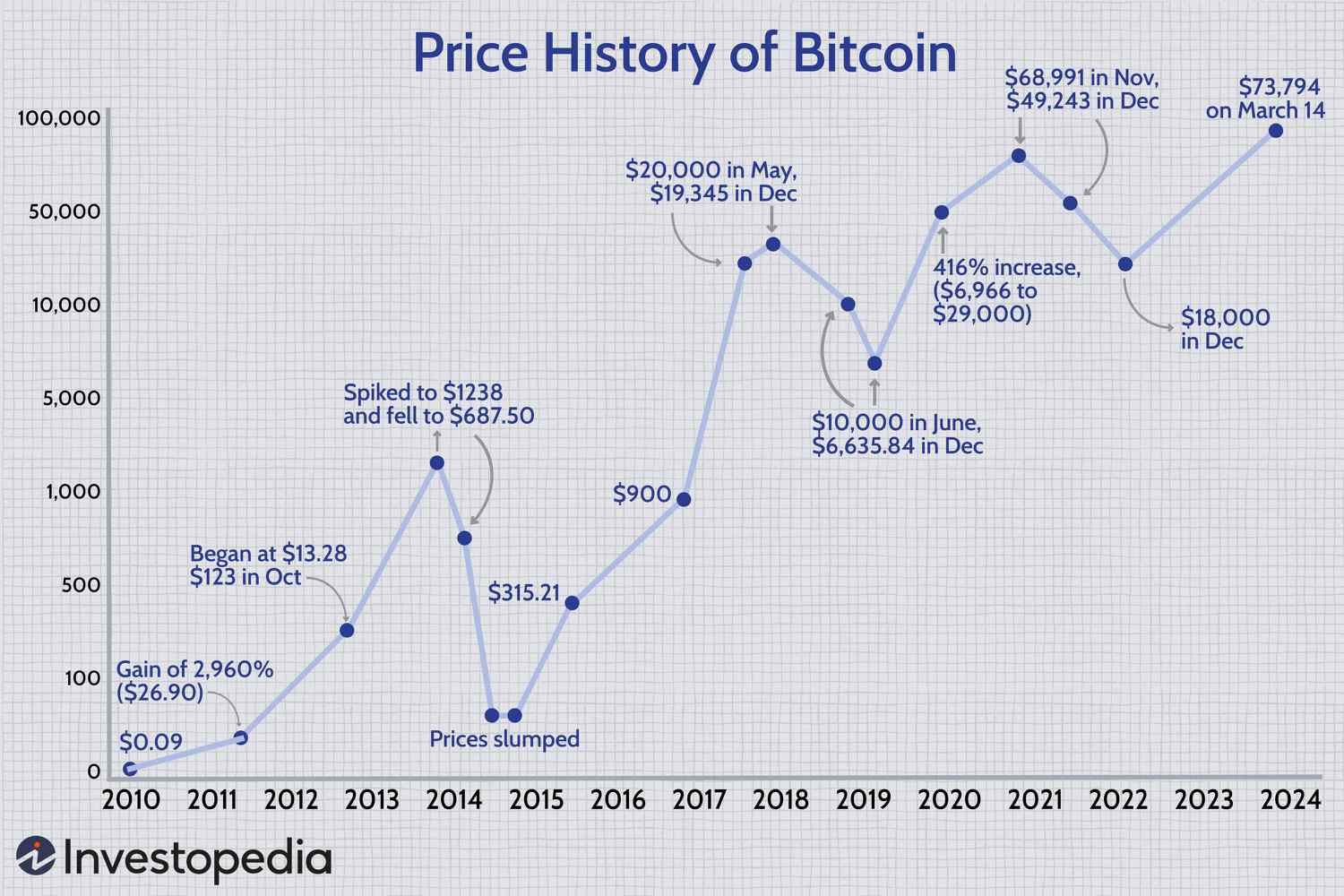

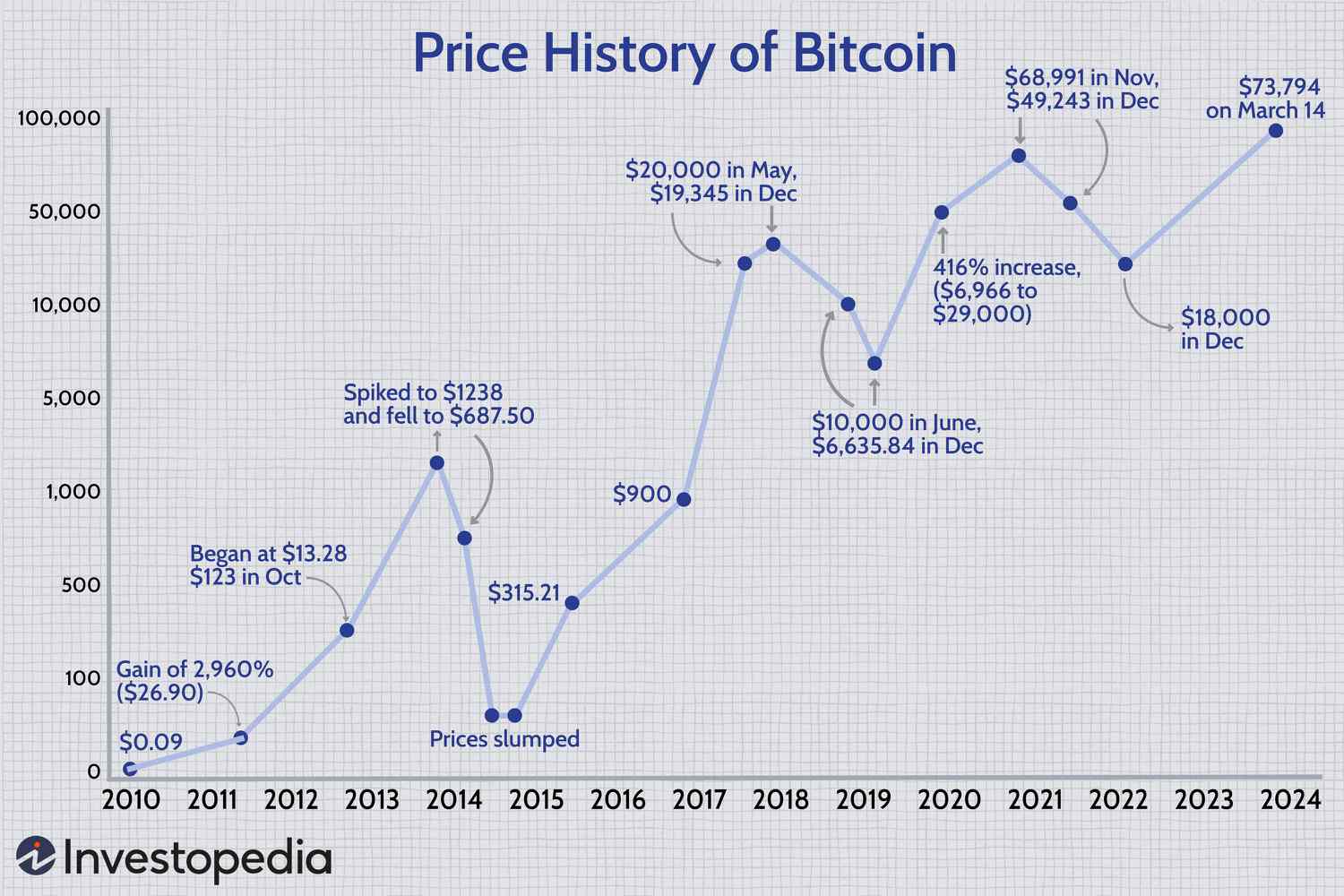

Bitcoin price chart showing recent fluctuations

Bitcoin price chart showing recent fluctuations

Spot Bitcoin ETF Adoption on the Horizon?

Lubka also discussed the potential for spot Bitcoin ETF adoption, which could be a game-changer for the crypto market. A spot Bitcoin ETF would allow investors to gain exposure to Bitcoin prices without actually holding the cryptocurrency, making it more accessible to a wider range of investors.

“A spot Bitcoin ETF would be a significant development for the crypto market,” Lubka said. “It would provide more investment options for institutions and retail investors alike, which could lead to increased adoption and higher prices.”

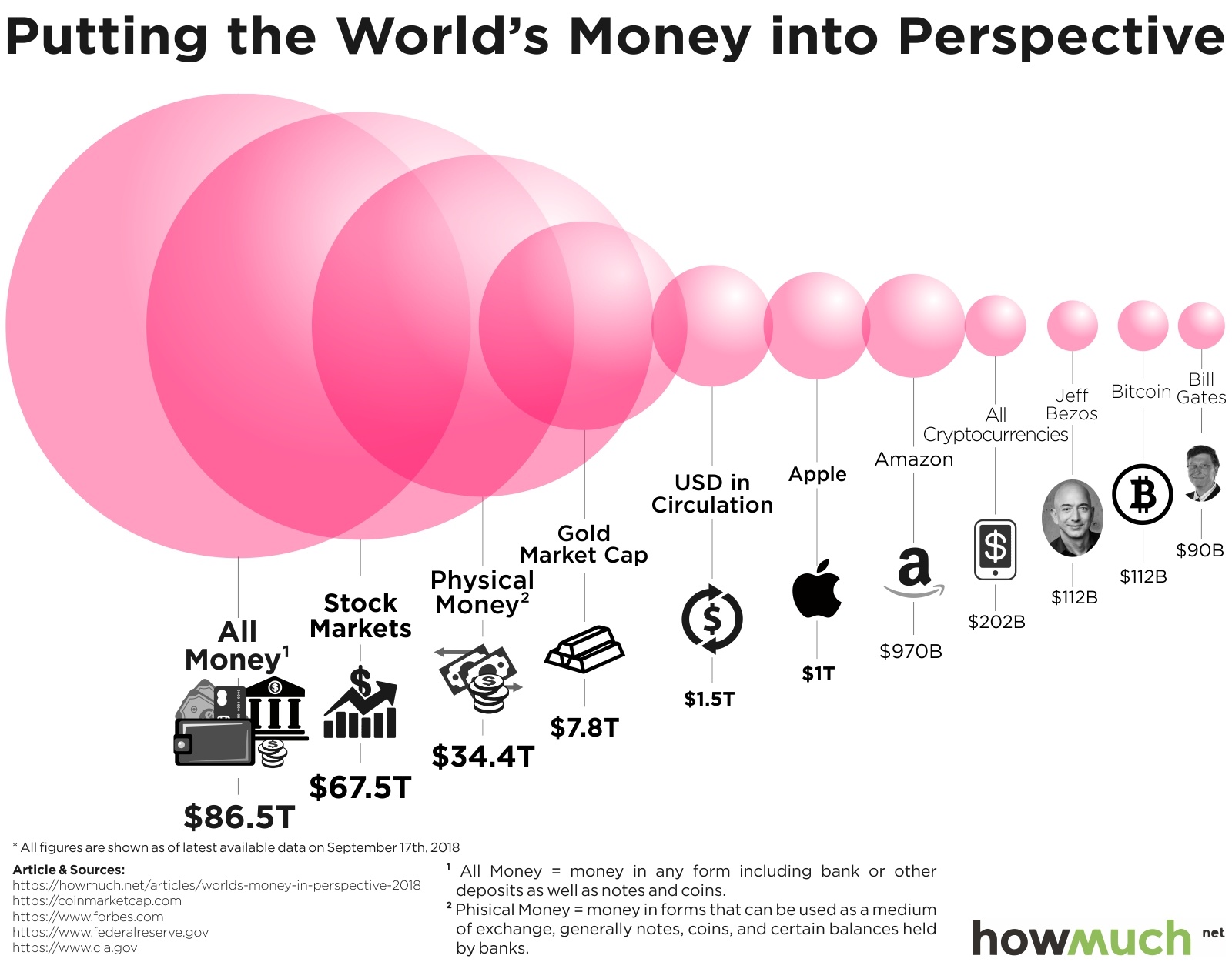

Crypto market graph showing recent trends

Crypto market graph showing recent trends

What’s Ahead for Crypto Markets?

As the crypto market continues to evolve, investors are eagerly awaiting the next big development. With inflation and interest rate expectations continuing to impact prices, it’s essential to stay informed about the latest trends and news.

Stay tuned for more updates from the world of cryptocurrency and blockchain technology.