Bitcoin Price Alert: BlackRock Insider Reveals Shock Sovereign Wealth Fund Interest After ETF Boom

The bitcoin price has bounced back following a ‘perfect storm’ this week, helped by a shock BlackRock bombshell that could trigger bitcoin price chaos.

Bitcoin price chaos

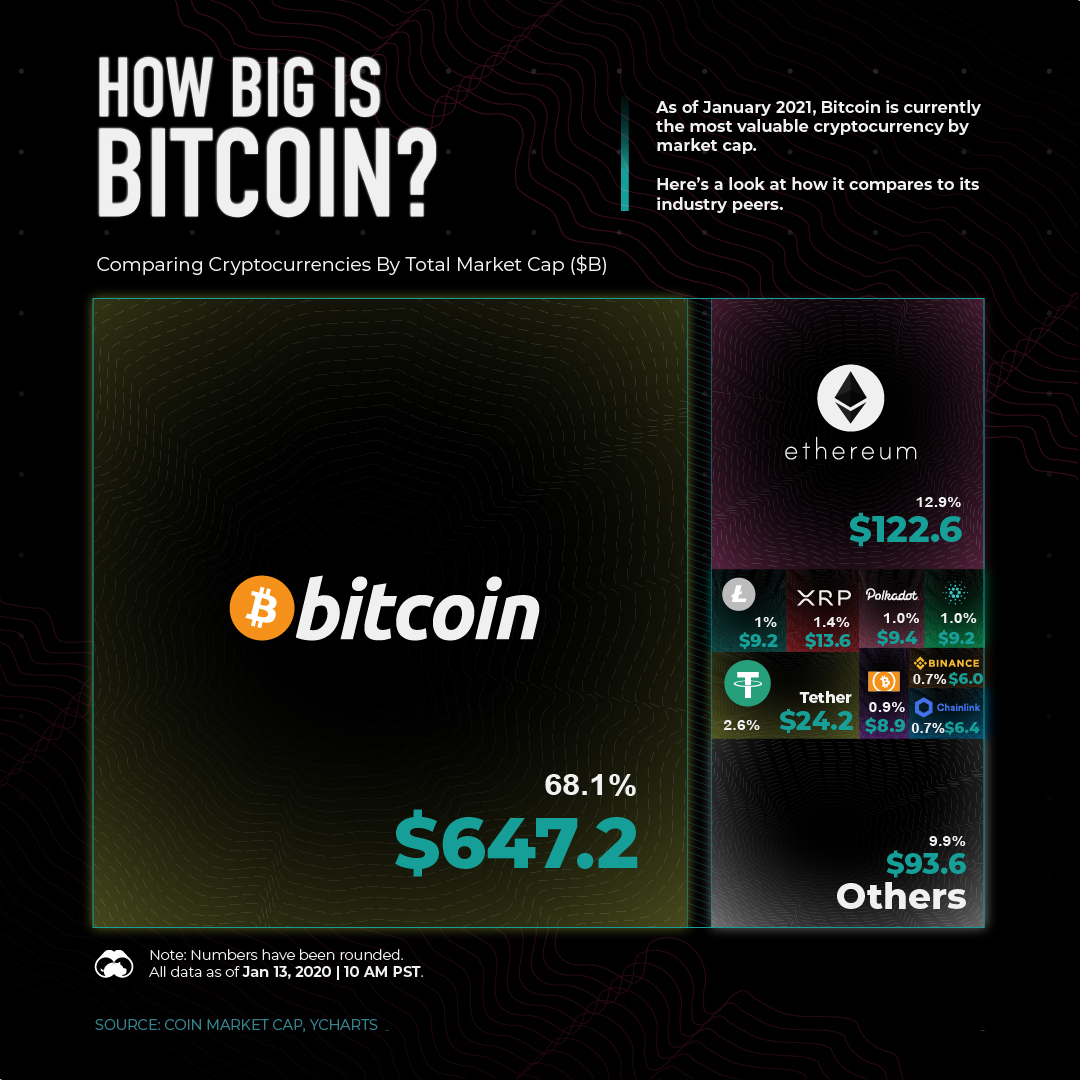

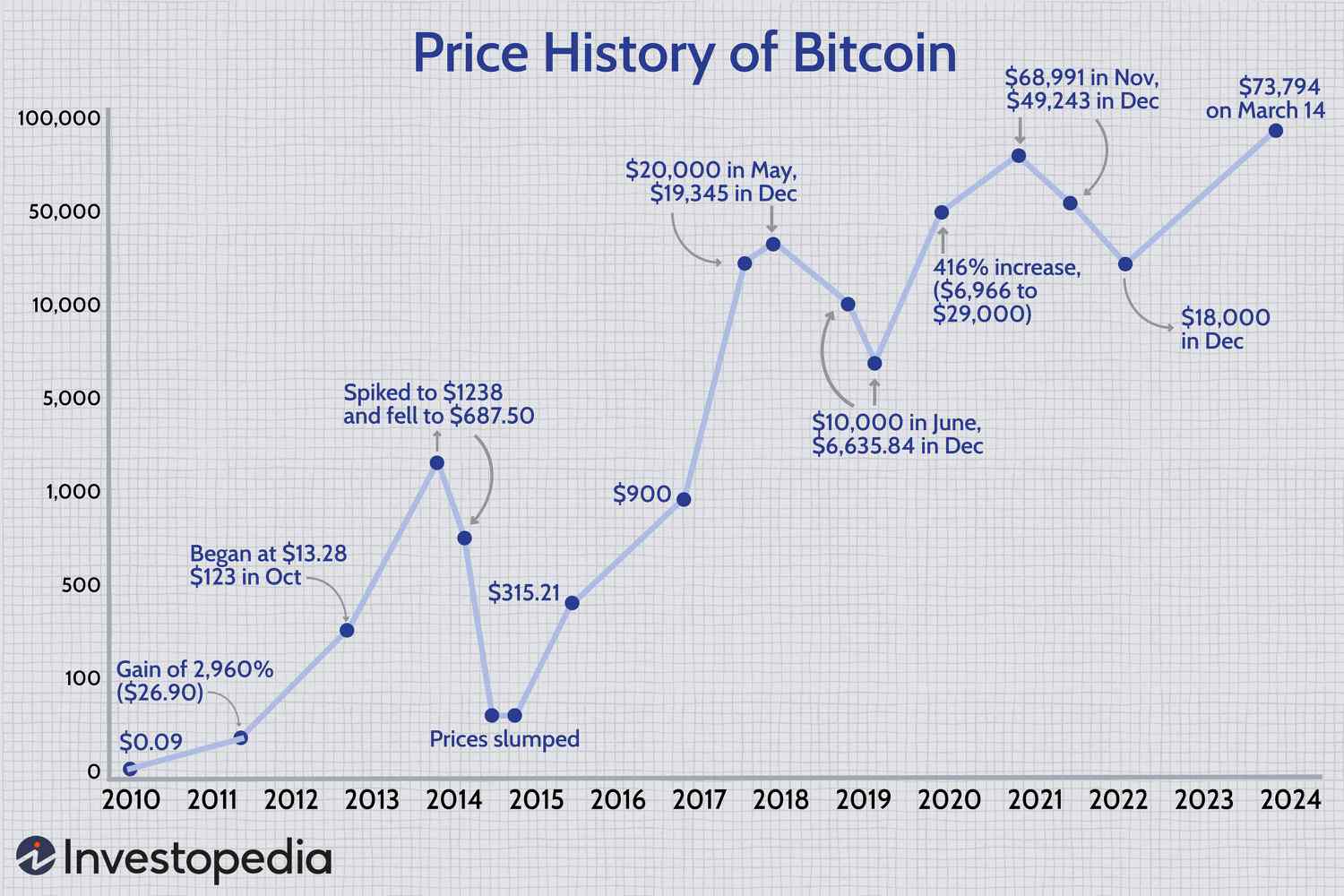

The bitcoin price has rocketed higher over the last year, fueled by a fleet of new Wall Street spot bitcoin exchange-traded funds (ETFs), though a Congress crypto bill could be about to cause a ‘huge disaster’ for bitcoin, ethereum, XRP and the wider crypto market.

Now, after an executive at Tesla billionaire Elon Musk’s social media company X revealed the platforms payments ’end goal,’ Musk has warned the U.S. dollar will soon be worth ’nothing’ as ‘stealth money printing’ pushes the price of bitcoin, ethereum, XRP and crypto higher.

‘We need to do something about our national debt or the dollar will be worth nothing,’ Musk posted to X in response to a post by an X influencer that included a quote by former U.S. president national security advisor H.R. McMaster calling for defense spending to be doubled to 4% of GDP in anticipation of ‘another world war.’

Musk’s U.S. dollar collapse warning follows similar warnings from others. Last month, legendary bitcoin billionaire Tim Draper has issued a ‘cataclysmic’ U.S. dollar prediction—warning the dollar will collapse by 2030.

‘I hope anybody who’s watching this is trying to at least have some bitcoin so that they can feed their family during the time when the dollar goes to zero,’ Draper, who has made billions from his $18 million 2014 purchase of almost 30,000 bitcoin from the U.S. government, told Cointelegraph.

Meanwhile, Arthur Hayes, a trader who cofounded the crypto derivatives pioneer BitMex and who now manages a family office named Maelstrom, wrote in a blog post that he expects the bitcoin price to soar to around $70,000 per bitcoin due to the Federal Reserve and the U.S. Treasury beginning ‘stealth forms of money printing’ that will help the crypto market ‘bottom, chop and begin a slow grind higher.’

Bitcoin price soar

The Covid pandemic, supply chain-destroying lockdowns and huge stimulus spending sent inflation spiraling out of control in 2022, which The Black Swan author Nassim Taleb warned could create a ‘death spiral’ for the U.S. dollar which the Federal Reserve is unable to prevent.

In March, the chief executive of the world’s largest asset manager BlackRock issued an ‘urgent’ warning over the growing $34 trillion U.S. debt pile—which some think has become a ‘powerful’ bitcoin price driver.

BlackRock warning

In February, legendary investor Jim Rogers warned the massive $34 trillion U.S. debt pile means a looming recession will be ’the worst in [his] lifetime.’

Last year, Jefferies’ analysts predicted the U.S. Federal Reserve will be forced to restart its money printer in 2024 due to a steep economic down turn, potentially collapsing the U.S. dollar and fueling a bitcoin price boom to rival gold.

Federal Reserve