The Future of Bitcoin Mining: A Potential Surge in M&As

In recent months, the landscape of Bitcoin mining has undergone significant transformations, particularly in light of the recent halving and the rising demand from hyperscalers and AI firms. According to a report by JPMorgan, companies within the Bitcoin mining sector that are backed by attractive power contracts are positioning themselves as prime targets for mergers and acquisitions.

Hyperscalers and Their Energy Demands

Hyperscalers, or large-scale data centers that require immense computing power, are on the lookout for reliable and energy-efficient sources to support their operations. This need for power makes Bitcoin mining companies uniquely appealing, especially those that have access to considerable energy resources. The rise of AI further compounds this urgency, as these firms scramble to secure energy in a competitive environment.

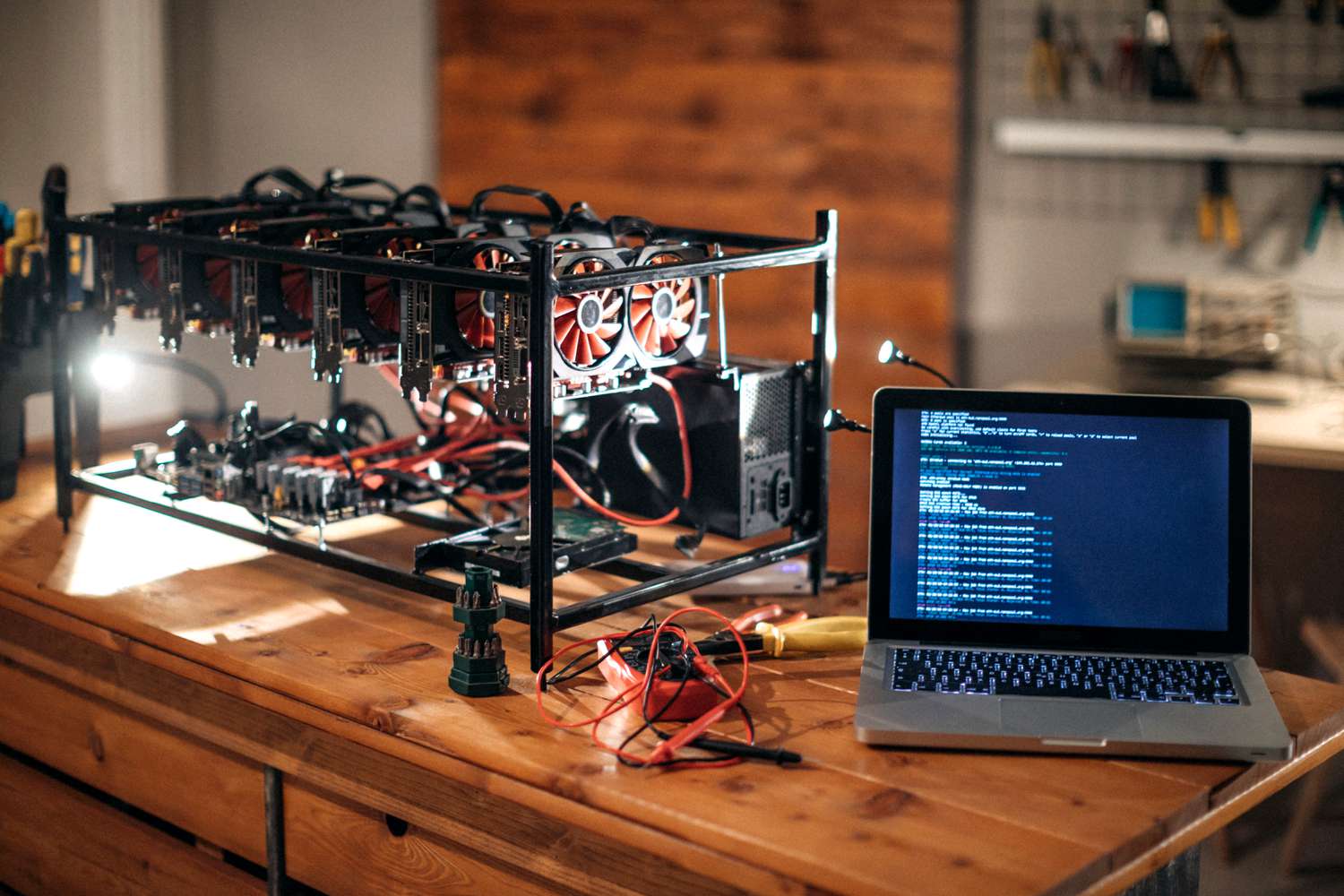

The dynamic world of Bitcoin mining is changing fast.

The dynamic world of Bitcoin mining is changing fast.

JPMorgan noted that the recent deal between CoreWeave and Core Scientific serves as a pivotal validation of the mining sector’s transition toward high-performance computing (HPC). Following this, Bitcoin miners facing financial pressures after the halving may find themselves more susceptible to lucrative acquisition offers.

The Ripple Effects of the Halving

The halving event, which effectively halts the rate at which new Bitcoins are mined, has put heightened stress on many mining operators. As more miners struggle to maintain profitability, opportunities for mergers and acquisitions become increasingly viable. In fact, shares of Core Scientific surged following the news of a significant artificial intelligence deal struck with CoreWeave, which may suggest that strategic partnerships will become vital in navigating these shifts.

Moreover, Riot Platforms has made headlines with a hostile takeover bid for fellow miner Bitfarms, reinforcing the notion that consolidation in the Bitcoin mining industry is not merely a possibility, but rather an inevitability.

What This Means for the Future

As JPMorgan outlines in its report, the implications of these developments may extend beyond mere transactions between companies. The “valuation floor” for smaller mining operators could be raised as a new class of buyers—the hyperscalers—emerges on the scene. This influx of interest could streamline and rationalize the Bitcoin network by redistributing power capacity, ultimately leading to healthier profit margins for the remaining miners.

In the U.S., it’s estimated that publicly listed Bitcoin miners draw up to 5 gigawatts (GW) of power, with access to an additional 2.5 GW. This substantial energy footprint further accentuates their appeal as acquisition targets, especially for firms prioritizing energy efficiency.

Innovations in mining infrastructure are essential for adapting to a changing market.

Innovations in mining infrastructure are essential for adapting to a changing market.

Furthermore, analysts from Bernstein have cited Riot Platforms as the most feasibly positioned entity to lead consolidation efforts in the mining realm, bolstered by the firm’s strong financial position, allowing it to pursue strategic acquisitions actively.

Conclusion: The Path Ahead for Bitcoin Miners

The shifting dynamics of the Bitcoin mining market indicate a turbulent yet opportunistic path ahead. As major players in the tech and AI industries eye energy sources, Bitcoin miners equipped with the necessary power contracts may find themselves at the center of growth and transformation.

Long-term sustainability in the sector may increasingly hinge on strategic partnerships and acquisitions, as mining companies work to navigate an evolving landscape marked by technological advancements and competitive pressures. As we look to the future, it’s clear that the excitement surrounding mergers and acquisitions in the Bitcoin mining sector is just beginning, and the next few years could redefine the industry.

Read more on how these mergers could reshape the future of Bitcoin mining!