Bitcoin Miners Feeling the Pinch as Cryptocurrency Struggles to Hold $70,000

The Bitcoin mining community is facing a crisis as the cryptocurrency struggles to hold on to the $70,000 level. According to data from CryptoQuant, the flow of Bitcoin leaving miners’ wallets for exchanges - a clear indication of a selling event - reached a two-month high last weekend. This trend is a worrying sign for the cryptocurrency, which has been struggling to break through the $70,000 barrier since hitting its record high of $73,797.68 on March 14.

Miners are selling their bitcoin again as the cryptocurrency struggles to hold on to $70,000

Miners are selling their bitcoin again as the cryptocurrency struggles to hold on to $70,000

“The miners are now competing for 450 bitcoin per day network-wide versus 900 less than two months ago,” said Mike Colonnese, an analyst at H.C. Wainwright. “While rising transaction fees have helped offset some of this impact, mining economics have effectively fallen by 45% compared to pre-halving levels, so we’re not surprised to see some of this forced selling in the market… as miners effectively look to cover operating expenses and to some extent capex with the proceeds of these bitcoin sales.”

The Impact of Halving on Miners

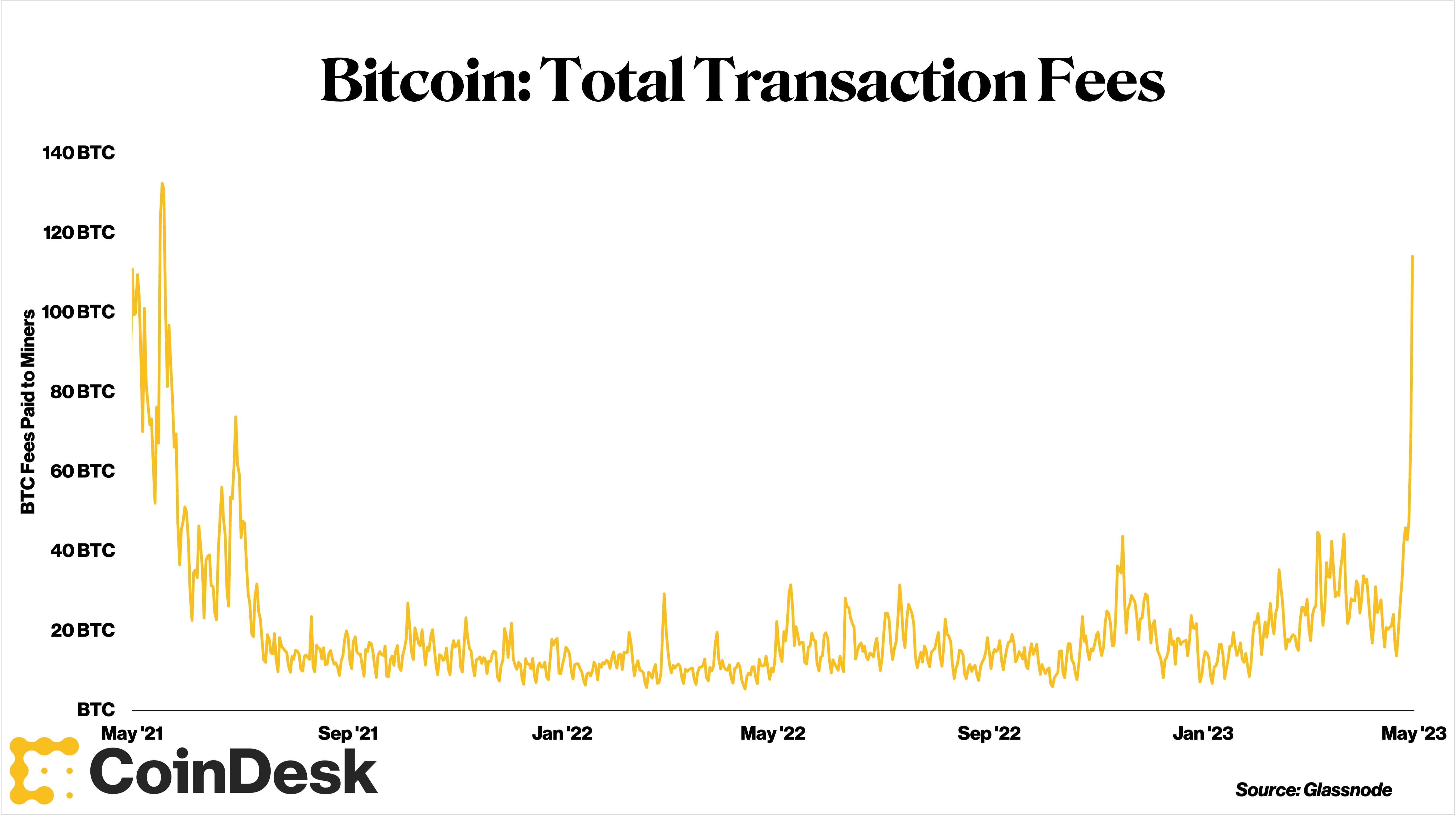

The recent halving event has had a significant impact on miners’ revenues. According to CryptoQuant’s head of research, Julio Moreno, daily Bitcoin miner revenues stand at about $35 million, down 55% from their 2024 peak reached in March. This decline is largely due to depressed transaction fees, which have fallen by more than 44% since the halving.

Daily Bitcoin miner revenues have fallen by 55% since the halving

Daily Bitcoin miner revenues have fallen by 55% since the halving

The Bitcoin network’s total daily transaction fees are more than 44% lower than they were pre-halving, and even with record-high transactions on the network, the median transaction fee has remained low. This has put additional pressure on miners’ profitability, making it difficult for them to sustain their operations.

The Future of Mining

While the large publicly traded miners are in good shape after the halving, smaller bitcoin companies with less efficient fleets, higher power costs, and less access to capital are really starting to feel the burn. According to Colonnese, these companies could struggle to make it through the next few months unless bitcoin prices experience a significant rally in the short term.

The future of mining is uncertain as smaller companies struggle to stay afloat

The future of mining is uncertain as smaller companies struggle to stay afloat

“On the other hand, smaller bitcoin companies with less efficient fleets, higher power costs, and less access to capital are really starting to feel the burn and could struggle to make it through the next few months unless bitcoin prices were to experience a significant price rally over the short term, which is currently not our base case,” he added.