Bitcoin Market Update: A Rollercoaster Ride for Cryptocurrency Enthusiasts

The cryptocurrency market experienced a turbulent week as Bitcoin, the flagship cryptocurrency, slumped below $63,000 after reaching a record high of $73,797.68. This drastic drop came as traders began taking profits following a remarkable 70% surge from the beginning of the year to its peak last Wednesday.

Bitcoin’s Volatile Journey

Bitcoin’s decline continued on Tuesday, with the price plummeting by over $10,000 from its all-time high. Currently, Bitcoin is trading at $64,440.14, down 4% from its peak. The cryptocurrency briefly dipped to $62,320.30 after its record high last week.

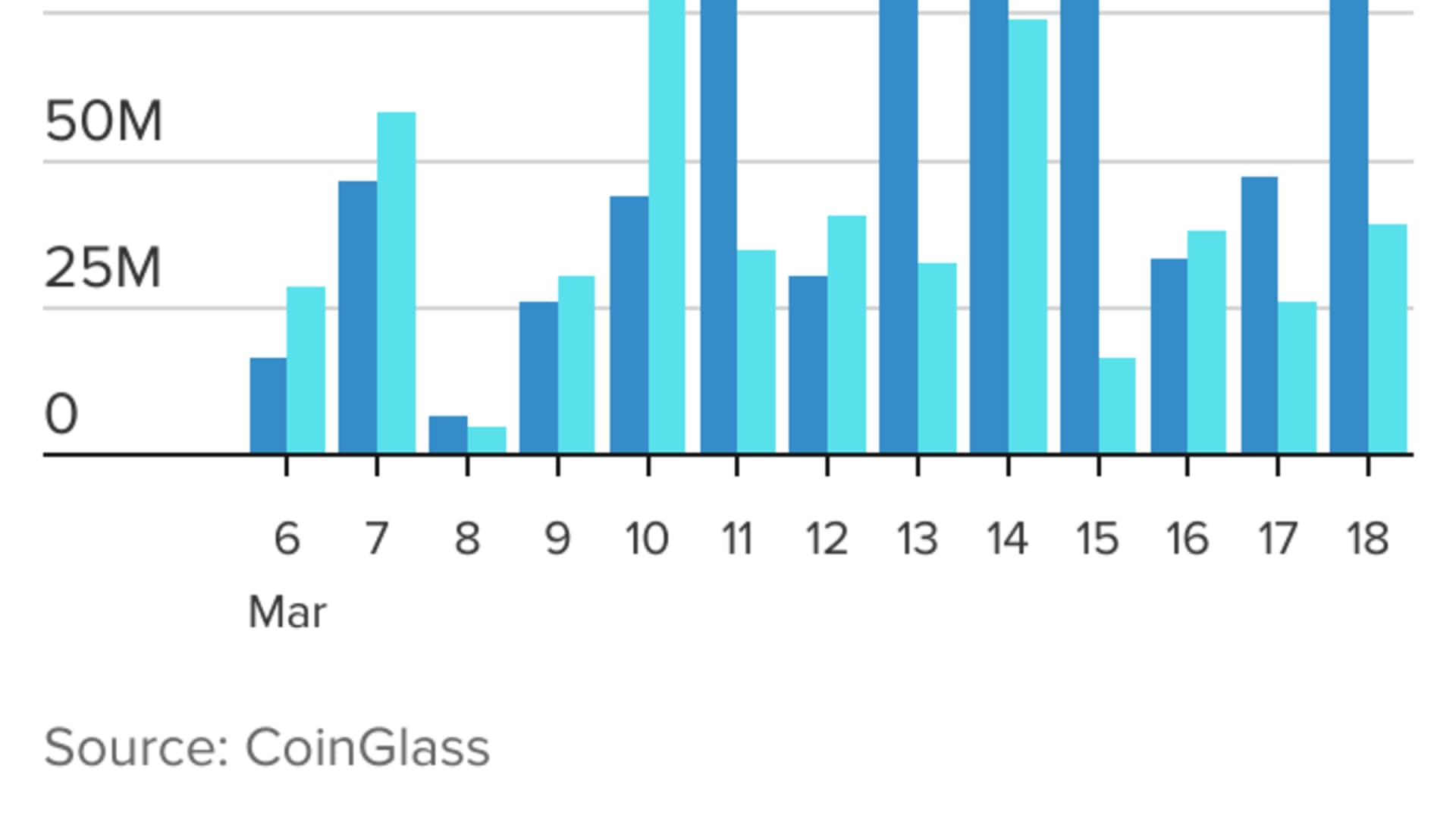

As Bartosz LipiDski, CEO of Cube.Exchange, pointed out, the increasing demand for Bitcoin ETFs is absorbing available supply and reducing liquidity. This trend could lead to more frequent price fluctuations, potentially eroding confidence in Bitcoin’s pricing integrity and prompting investors to explore alternative crypto assets.

Bitcoin weakness began last week as traders started taking profits after it had soared roughly 70% from the start of the year to its peak last Wednesday.

Bitcoin weakness began last week as traders started taking profits after it had soared roughly 70% from the start of the year to its peak last Wednesday.

Ripple Effects on Altcoins

Bitcoin’s downturn had a ripple effect across the cryptocurrency market, dragging down other major digital assets. Ether, the second-largest cryptocurrency, experienced a more than 4% decline, currently trading at $3,335.66 after surpassing $4,000 last week for the first time since December 2021.

Similarly, Solana’s native token dropped by 8%, while Dogecoin lost 5% of its value. Crypto-related stocks also felt the impact, with companies like MicroStrategy and Coinbase witnessing significant drops in their stock prices.

Market Outlook and Analyst Predictions

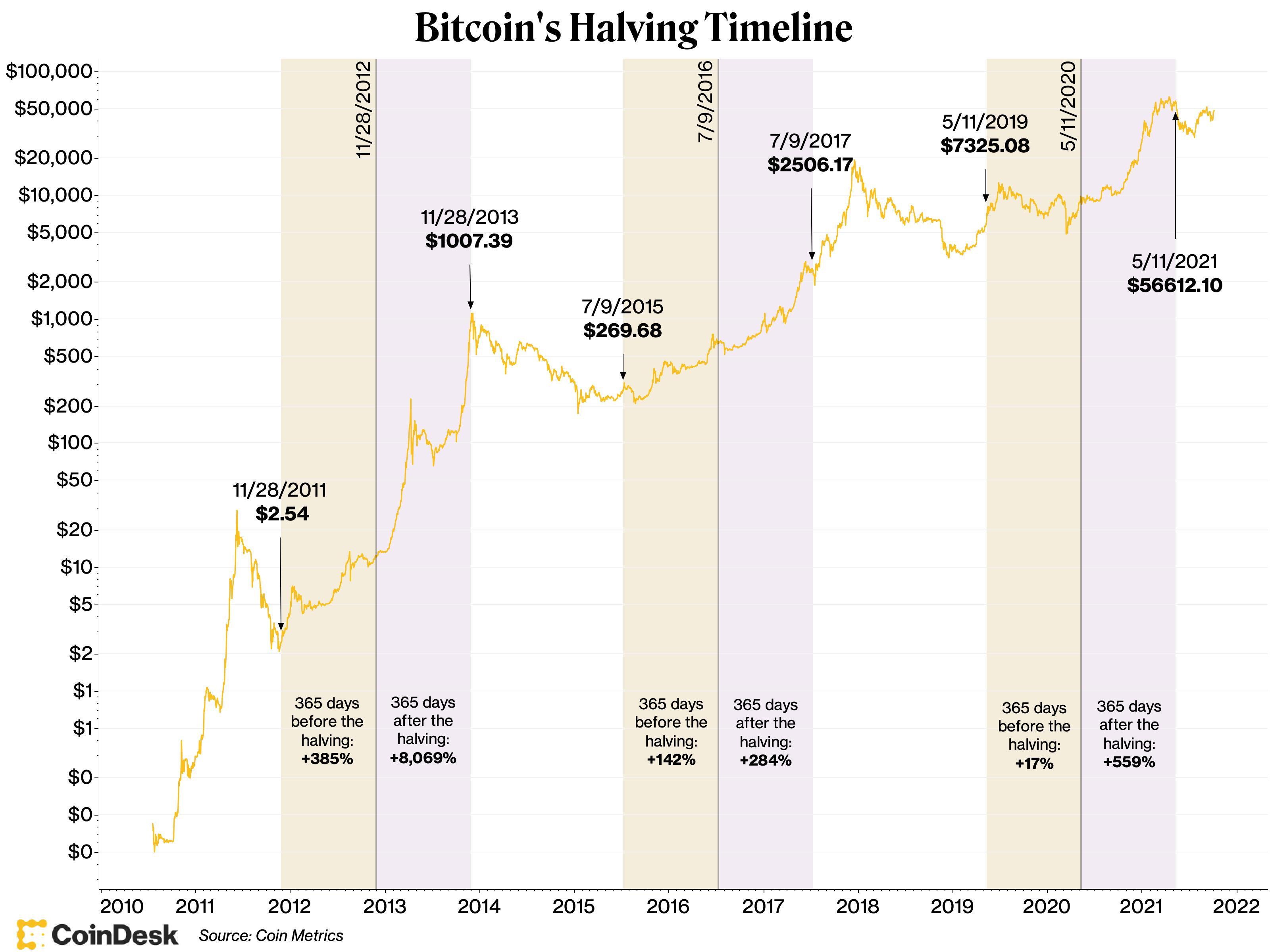

Despite the recent market correction, analysts remain optimistic about Bitcoin’s long-term prospects. LipiDski believes that the current pullback is likely temporary, expecting the rally to resume. However, concerns about a potential economic recession next year cast a shadow over the market’s future performance.

The successful introduction of spot bitcoin exchange-traded funds in the U.S. earlier this year has been a key contributor to bitcoin’s rally.

The successful introduction of spot bitcoin exchange-traded funds in the U.S. earlier this year has been a key contributor to bitcoin’s rally.

For more details on the recent Bitcoin market developments and expert insights, visit the Bitcoin Market Update.