Bitcoin’s Performance Stalled Until Trump’s Inauguration: What to Expect?

In the ever-evolving landscape of cryptocurrency, Bitcoin (BTC) and the broader market are facing a period of stagnation that may stretch into the early days of 2025. Trusted crypto analyst, known in the community as The Crypto Dog, has posed a compelling argument to his 853,000 followers on X (formerly Twitter), suggesting that considerable market movement might be sidelined until President-elect Donald Trump officially takes office on January 20th.

The current state of the Bitcoin market.

The current state of the Bitcoin market.

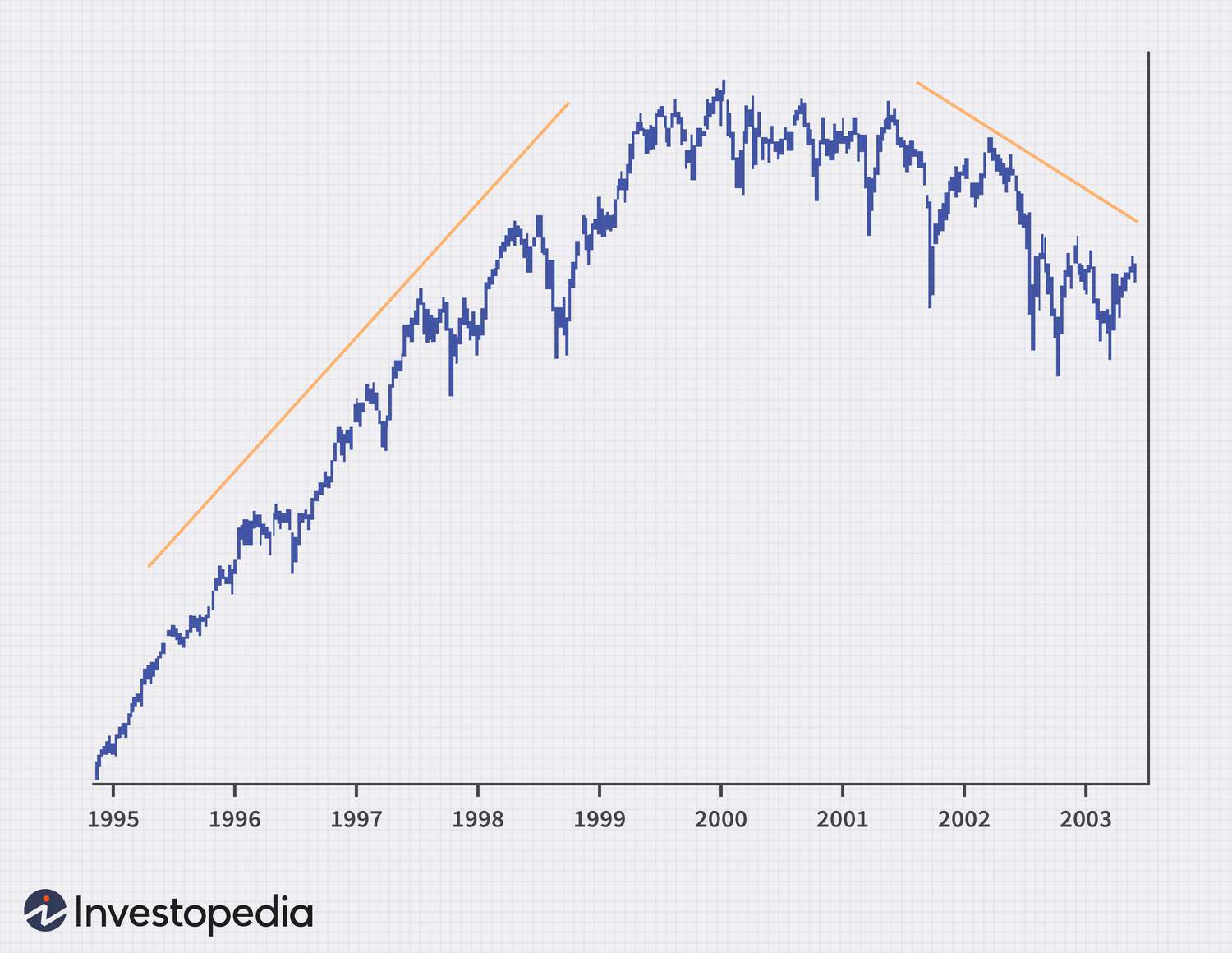

A Historical Perspective

This anticipated market inertia is not without precedent. The Crypto Dog points to historical patterns observed during past transitions of presidential power. For instance, in January 2021, Bitcoin witnessed a rise shortly after President Biden was inaugurated, breaking free from a prior downtrend. He notes, > “You can see how we behaved Jan 2021… Downtrend until inauguration then ripped +100% afterward.”

The alignment of political shifts with crypto market dynamics is a crucial aspect of this narrative. In 2017, similar patterns emerged, suggesting that the crypto market often reacts strongly to such pivotal events in the political sphere.

Graph showcasing Bitcoin’s historical performance.

Graph showcasing Bitcoin’s historical performance.

Future Predictions Based on Current Sentiments

While The Crypto Dog remains cautiously optimistic, stating that he is not exactly bearish, he emphasizes the potential for a lack of upward movement until Trump’s oath-taking is complete. This prediction holds significant weight, especially considering the numerous traders who might be capitalizing on the current highs. He warns that such traders could find themselves rinsed if the market doesn’t respond as expected.

Cross-Market Influences

Another important point raised by The Crypto Dog is the correlation between Bitcoin and traditional markets, particularly the S&P 500. He mentions, > “Looks like post-election January is pretty much up only for equities. Since the launch of Bitcoin exchange-traded funds, we’ve been pretty lockstep so up only makes plenty of sense.”

If the S&P 500 continues to exhibit strength, it could invalidate the cautious stance that defines the current outlook on cryptocurrencies. In any case, Bitcoin, which is currently valued at $98,219, remains at a critical juncture.

Understanding investment trends can help navigate the market.

Conclusion: Cautious Optimism Ahead

As market participants prepare for potential tumult following the inauguration, there’s a palpable sense of caution throughout the crypto community. While consolidation seems inevitable until January 20, the prospect of a post-inauguration rally keeps investor spirits buoyed. Crypto enthusiasts are urged to stay informed and vigilant as these developments unfold, ensuring they are prepared to seize opportunities should the market dynamics shift in their favor.

Stay tuned for updates, and don’t forget to subscribe for the latest news in the cryptocurrency world.

Stay alert for the latest trends in cryptocurrency.