Bitcoin Stabilizes Around $68K as New ETF Landscape Emerges

The cryptocurrency market is currently in a phase of consolidation, with Bitcoin hovering around the $68,000 mark after a brief spike to $70,000 earlier this week. This moment of relative stability reflects the ongoing sentiments within the market.

As of this morning, Bitcoin is trading just above $67,800, marking a 1% drop in the past 24 hours. The broader digital asset market, represented by the CoinDesk 20 Index, has also seen a slight downturn of about 0.65%. Meanwhile, Ethereum is priced at over $3,800, down more than 2% as traders await news regarding the approval of upcoming spot ether ETFs in the U.S. following last week’s SEC green light on several applications.

Observing the latest market trends in Bitcoin and Ethereum.

Observing the latest market trends in Bitcoin and Ethereum.

BlackRock’s IBIT Takes the Lead

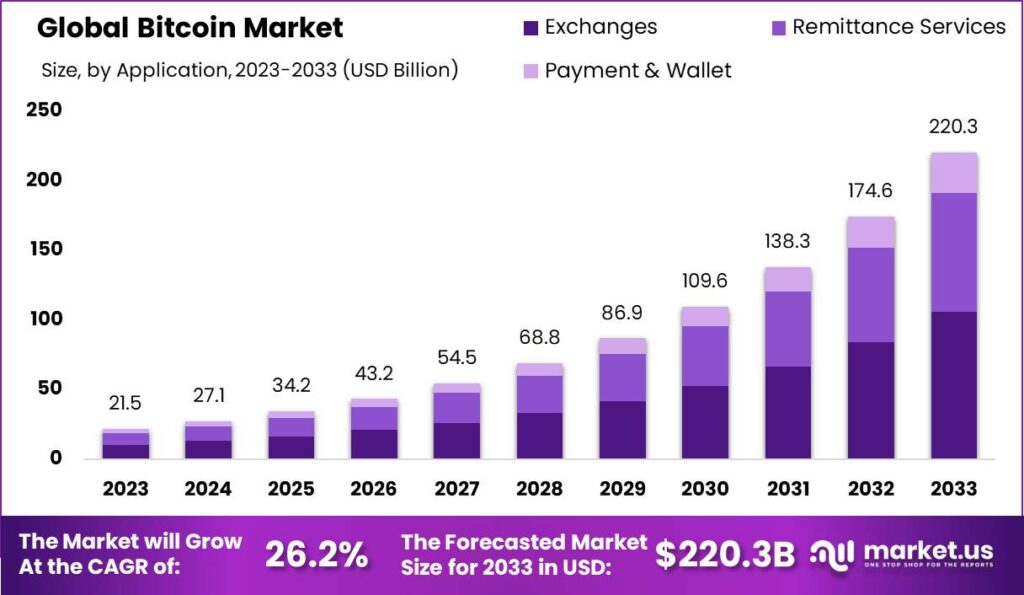

In a significant turn of events, BlackRock’s spot Bitcoin ETF, IBIT, has recently overtaken Grayscale’s GBTC to become the largest ETF in this space, amassing nearly $20 billion in assets after a staggering $102 million inflow on Tuesday. In contrast, Grayscale saw outflows of $105 million on the same day, a clear indication of shifting investor interest.

The increase in investment for IBIT signals a bullish outlook on Bitcoin, spurred by recent approvals for ether ETFs and a growing support network for cryptocurrencies within U.S. political circles. This change has been noteworthy, particularly as IBIT experienced minimal inflows until recently and even reported its first-ever day of outflows in April.

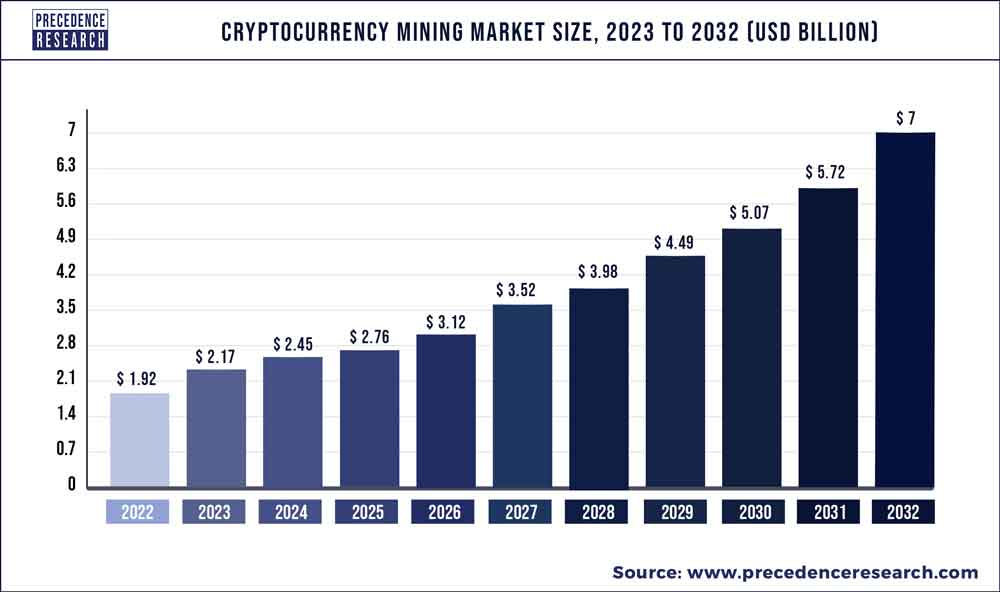

“The bitcoin mining business is becoming tougher for smaller players, with limited capital to ramp up on the global hash power race,” analysts at Bernstein remarked, highlighting the challenges within the mining sector.

Consolidation in the Bitcoin Mining Sector

Amid these market shifts, Riot Platforms has initiated moves to consolidate the Bitcoin mining sector by acquiring a stake in rival miner Bitfarms. Analysts underscore that the energy dynamics of the mining industry will likely lead to a landscape where only a handful of large players, perhaps around five, will control a substantial share of the market. Currently, there are more than 20 publicly traded miners, and the focus on mergers and acquisitions is expected to intensify as larger companies seek to maintain strategic relevance.

The evolving landscapes of Bitcoin mining operations.

The evolving landscapes of Bitcoin mining operations.

Meme Coins Gain Momentum

On the lighter side, the latest statistics indicate that the top ten cryptocurrencies by open interest now include a significant presence of meme coins, with Dogecoin leading the charge at $1 billion in futures bets. Traders are closely monitoring this interest as it often precedes price volatility, and the recent bullish trends surrounding meme coins, particularly with tokens like PEPE hitting new all-time highs, is stirring excitement.

However, despite this enthusiasm, the negative funding rates for meme coins across various exchanges suggest a lingering bearish sentiment about the costs of holding these tokens, prompting cautious trading strategies.

Conclusion

As Bitcoin continues to stabilize and adapt to new market developments, the overall sentiment reflects a blend of cautious optimism and strategic acquisitions. With institutional interest surging, particularly through products like IBIT, the future landscape of crypto investments looks increasingly innovative. As always, investors should remain vigilant and informed, navigating the ever-changing dynamics of the cryptocurrency market.

The future of cryptocurrency investments remains uncertain but promising.

The future of cryptocurrency investments remains uncertain but promising.