Bitcoin Halving: Potential Price Boost Tempered by Macro Factors

By Riley Emerson, CRYPTOBITE

The upcoming Bitcoin halving event could positively impact prices, but other market forces are also at play.

The upcoming Bitcoin halving event could positively impact prices, but other market forces are also at play.

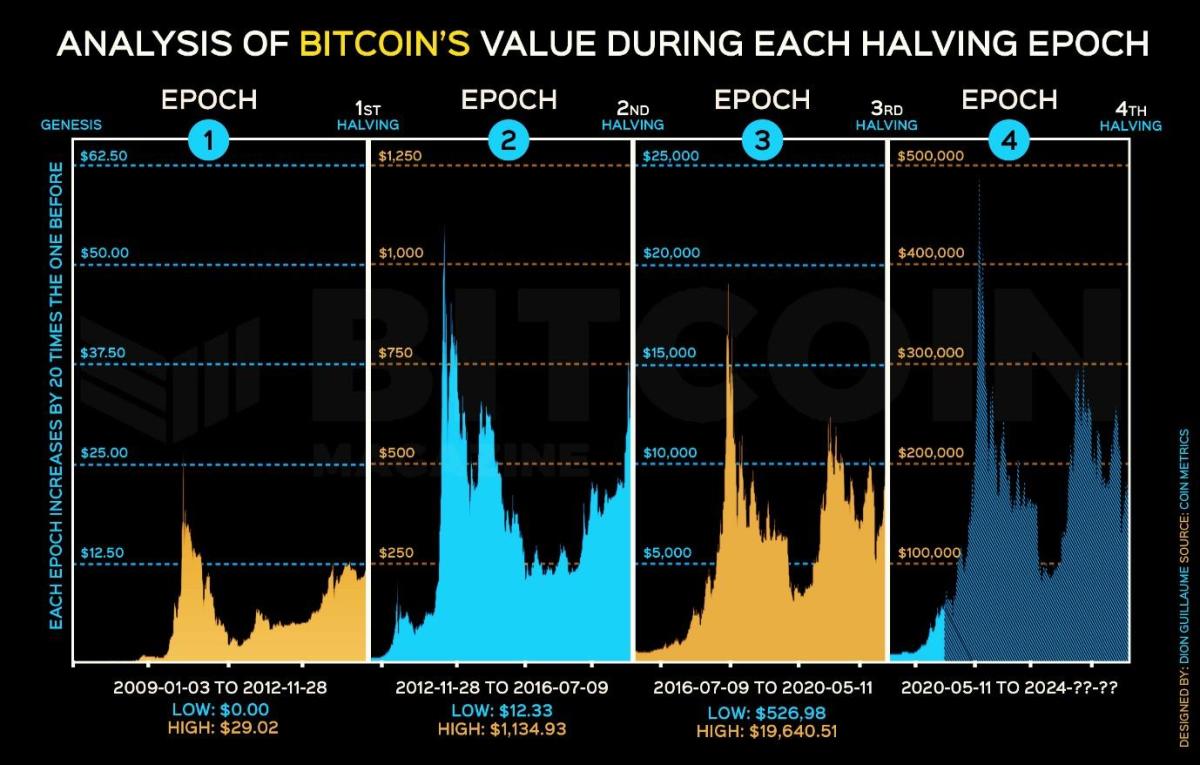

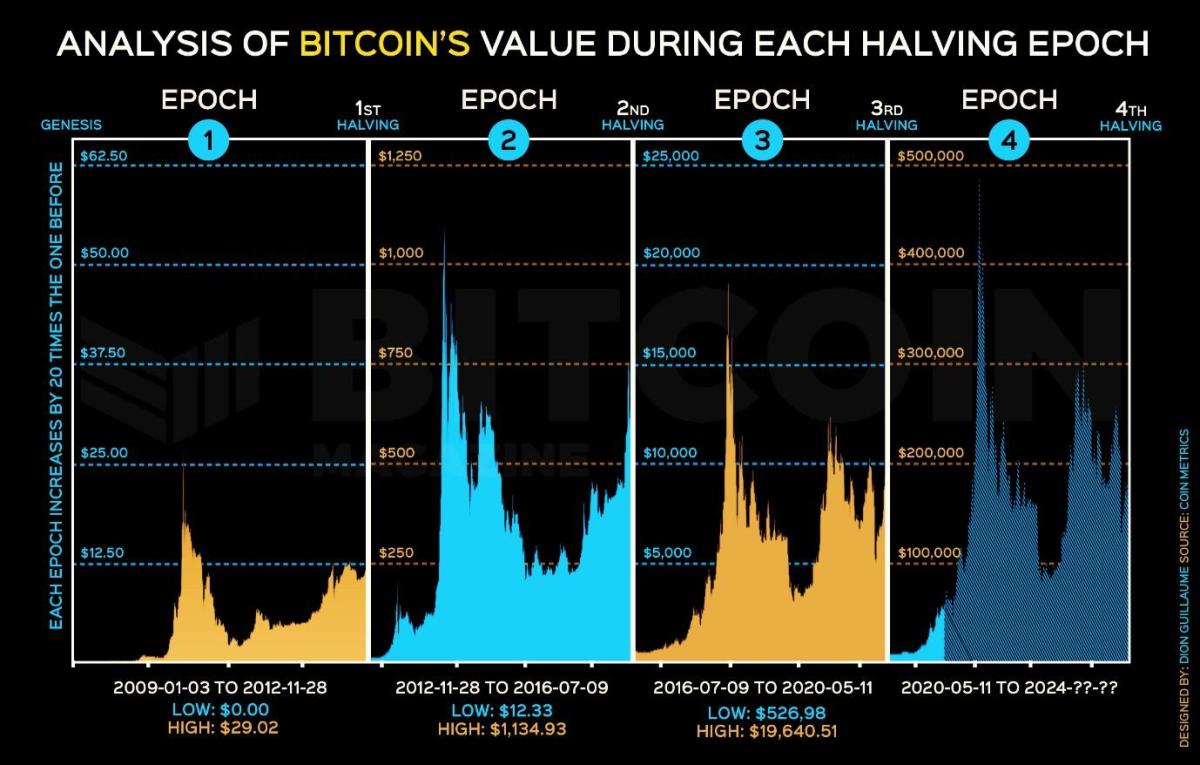

As the crypto world eagerly awaits the next Bitcoin halving event, set to occur around April 15th, many are speculating on how this quadrennial reduction in mining rewards will affect the king of crypto’s price trajectory. A recent Coinbase research report delves into the potential impact, noting some interesting historical precedents, while also urging caution in relying too heavily on past trends.

Looking back at previous halvings, Bitcoin saw an average price surge of 61% in the six months leading up to the event, followed by an even more impressive 348% average gain in the half year after the supply shock. This has led many to assume that history will repeat itself, with BTC poised for a major bull run.

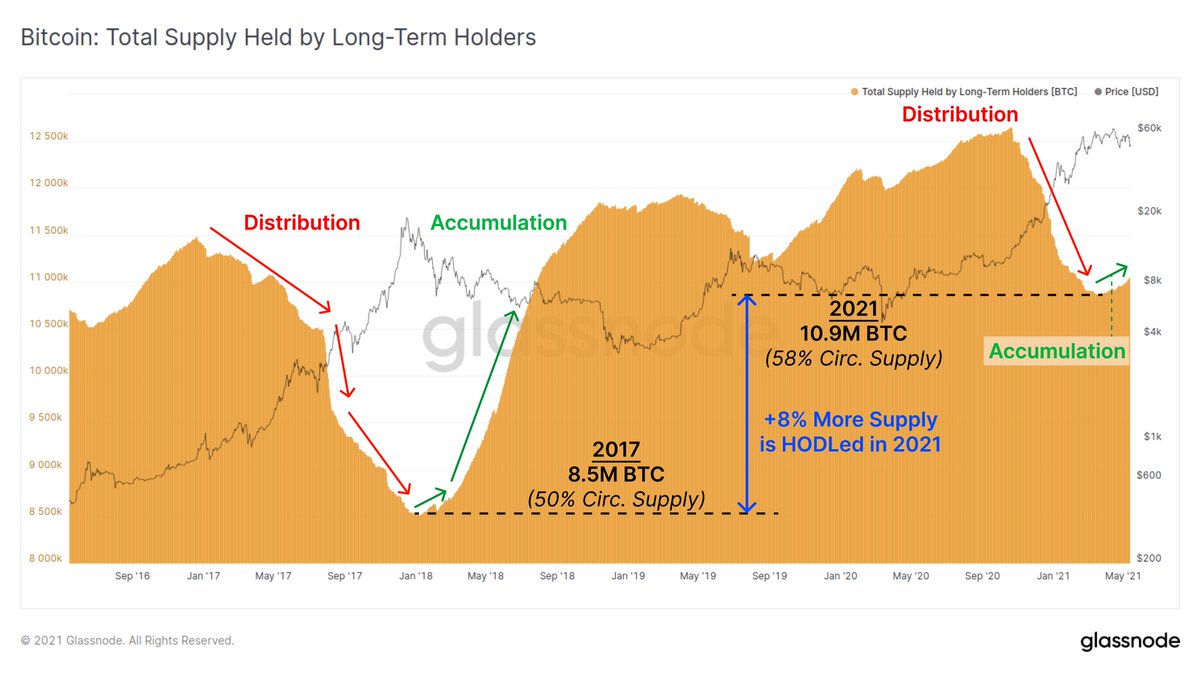

The amount of Bitcoin held by long-term holders is near historic highs. (Source: Coinbase)

The amount of Bitcoin held by long-term holders is near historic highs. (Source: Coinbase)

However, as the Coinbase report astutely points out, Bitcoin does not exist in isolation. Its price is influenced by a myriad of factors beyond just the inherent supply and demand dynamics. The macro environment, including monetary policy, economic stimulus measures, and overall market sentiment, all play a significant role.

Case in point, much of Bitcoin’s stellar performance following the last halving in May 2020 coincided with the unprecedented loose monetary policy and fiscal stimulus rolled out globally in response to the COVID-19 pandemic. This time around, the landscape looks quite different, with central banks worldwide tightening the reins to combat inflation.

That’s not to say the halving will be a non-event. The report highlights that the current high proportion of Bitcoin held by long-term investors could bode well for price stability post-halving, as these holders are less likely to sell into the expected strength.

“While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative,” - Coinbase Research Report

Ultimately, while the halving may indeed provide a tailwind for Bitcoin’s price, it’s crucial for investors to keep the bigger picture in mind. The crypto market’s fate is increasingly intertwined with traditional financial markets and subject to the whims of global economic forces. As always in the wild world of crypto, expect the unexpected.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.