The Surge of Bitcoin ETFs: A Turning Point in Cryptocurrency Adoption

In recent times, the buzz around Bitcoin Exchange-Traded Funds (ETFs) has intensified, drawing the attention of investors and analysts alike. With major financial players eyeing this avenue, the landscape of cryptocurrency investment is poised for radical transformation.

The Financial Behemoths Step In

The likes of BlackRock, Fidelity, and other prominent institutions are gearing up to launch their Bitcoin ETFs, which signifies a pivotal moment for the cryptocurrency market. Analysts are optimistic that the approbation of these ETFs by regulatory bodies could lead to a global surge in Bitcoin investment.

“The introduction of Bitcoin ETFs is set to democratize cryptocurrency access, making it easier for the average investor to enter this market,” says crypto expert Jane Doe.

The implications are far-reaching; a successful rollout could attract institutional money on a scale never seen before, enhancing Bitcoin’s legitimacy and integrating it into mainstream finance.

Anticipating the Bitcoin ETF boom!

Anticipating the Bitcoin ETF boom!

Regulatory Challenges and Opportunities

While the potential for Bitcoin ETFs is significant, the path is not devoid of obstacles. The U.S. Securities and Exchange Commission (SEC) has historically been cautious regarding cryptocurrency investments. This poses questions about whether a universally favorable regulatory framework could be achieved in the near future.

Regulatory bodies around the world, however, are beginning to soften their stances. For example, Canada has already approved multiple Bitcoin ETFs, serving as a precedent that might encourage U.S. authorities to follow suit.

As such, the evolving narrative around regulation could either bolster or hinder the pace at which ETFs become a mainstream investment vehicle.

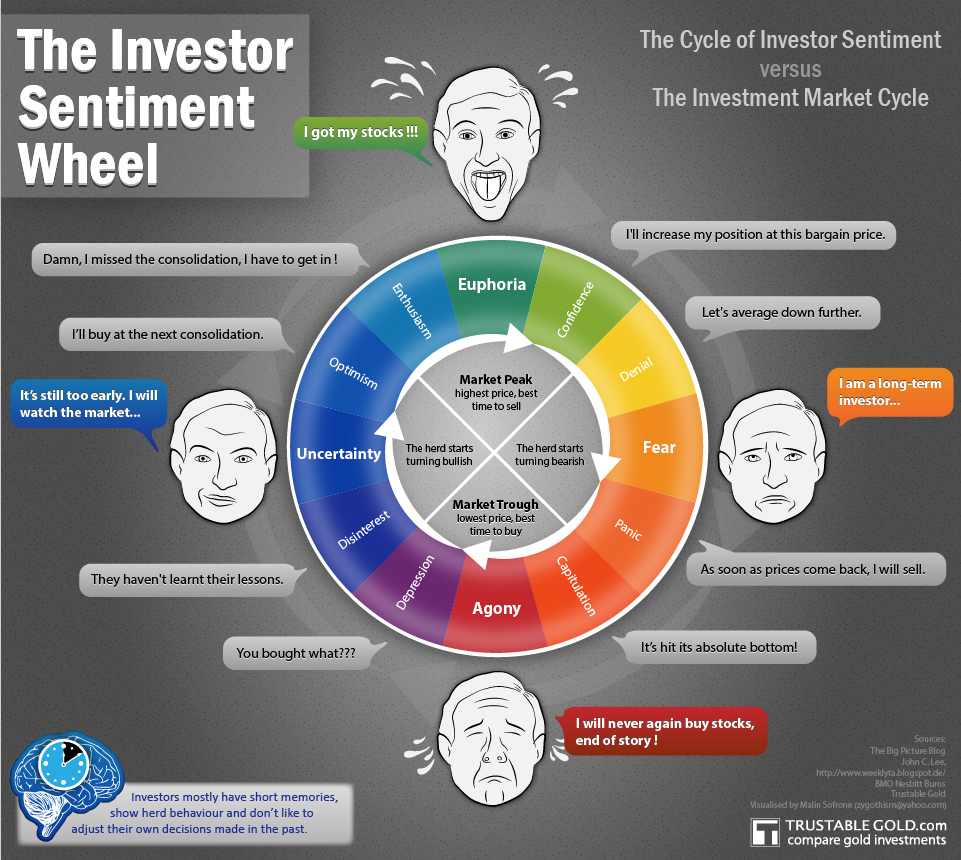

Investor Sentiment on Bitcoin ETFs

Investor sentiment appears to be shifting favorably towards Bitcoin ETFs. Many retail investors are increasingly looking for ways to hold Bitcoin without the complexities of direct ownership. ETFs present a solution, offering ease of access, liquidity, and regulatory oversight, appealing characteristics for both novice and seasoned investors.

Moreover, with the backdrop of widespread economic uncertainty caused by global events, Bitcoin is becoming recognized as a hedging tool against inflation. Consequently, the introduction of ETFs could enhance demand, as more people seek to safeguard their wealth with this digital asset.

Investor perception matters in the crypto space.

Investor perception matters in the crypto space.

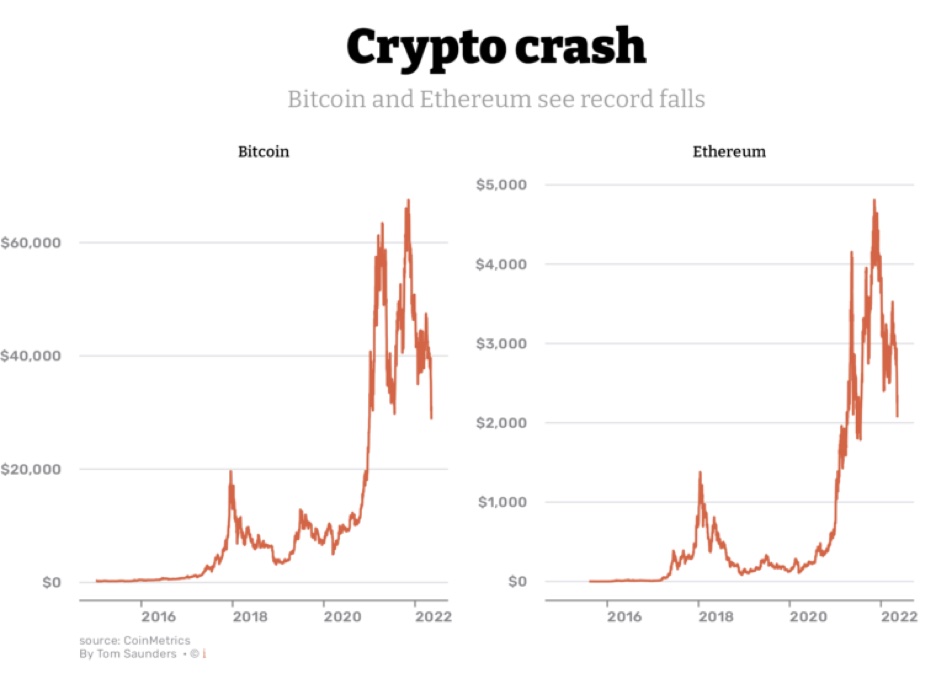

The Road Ahead: Impact on Bitcoin’s Price

The prospect of Bitcoin ETFs has experts debating the potential impact on Bitcoin’s price. Historical trends suggest that the announcement of cryptocurrency ETFs often catalyzes price surges. While past performance is not indicative of future results, the current market conditions are ripe.

With a broader adoption of Bitcoin coupled with institutional interest, it is plausible that Bitcoin could experience significant upticks in value in the months ahead, further solidifying its status as ‘digital gold’.

Conclusion: A Game-Changer for Cryptocurrency

The evolution of Bitcoin ETFs represents a significant shift in the financial landscape. As traditional financial institutions engage with cryptocurrency, and investor sentiment grows positively, BTC stands on the brink of mainstream acceptance.

This could very well be the catalyst that propels Bitcoin and cryptocurrencies into the forefront of global financial markets.

As we move forward, the integration of Bitcoin into established investment platforms could pave the way for a broader acceptance and understanding of this technology, not just among institutions but also among everyday investors, and will likely shape the future of finance as we know it.

Visions for the future of cryptocurrency are bright.

Visions for the future of cryptocurrency are bright.

With continued regulatory engagement, a watching world, and the prospective launch of Bitcoin ETFs, the cryptocurrency is on a gravitating path towards solidifying its place in global finance.