The Rise of Bitcoin ETFs: A New Era for Crypto Investment

As Bitcoin continues to solidify its status as a mainstay in the financial world, the discussion surrounding Bitcoin Exchange-Traded Funds (ETFs) is gaining momentum. This financial instrument has the potential to reshape how both institutional and retail investors engage with cryptocurrency. In this article, I will explore the implications of Bitcoin ETFs, their expected impact on the broader market, and what investors should keep an eye on moving forward.

Understanding Bitcoin ETFs

Bitcoin ETFs allow investors to gain exposure to Bitcoin without having to buy, store, or manage the underlying assets directly. Essentially, these funds track the price of Bitcoin and offer shares that are traded on traditional exchanges. This simplicity can be advantageous for newcomers to crypto, as it eliminates the need for navigating the complexities of cryptocurrency wallets and exchanges.

However, the excitement around Bitcoin ETFs goes beyond just convenience. By granting mainstream access to Bitcoin investment, ETFs could drive demand, consequently influencing market prices. In a market still marked by volatility, increased demand could be a welcome stabilizing factor.

Investors are witnessing a profound shift in how they can allocate capital to digital assets. With Bitcoin ETFs, traditional investment vehicles are becoming more integrated with cryptocurrency, potentially leading to more liquidity in the market.

Institutional Interest and Market Impact

The interest from institutional investors is a critical factor in Bitcoin’s maturation as a financial asset. Large funds and corporations have been increasingly vocal about their intentions to invest in cryptocurrencies. Bitcoin ETFs could serve as the gateway for institutions, providing a regulated and more secure way to enter the crypto space.

For instance, institutions are often wary of the unregulated landscapes that characterize many cryptocurrency platforms. Bitcoin ETFs offer a regulated environment that can appeal to these investors. As institutional money floods into the crypto market, we may see price stabilization and enhanced legitimacy for Bitcoin and other cryptocurrencies.

Bitcoin’s appeal to institutional investors is stronger than ever.

Bitcoin’s appeal to institutional investors is stronger than ever.

Retail Investment and Accessibility

With Bitcoin ETFs, the potential for mass adoption of cryptocurrency increases exponentially. Retail investors, typically less knowledgeable about the ins and outs of cryptocurrency, may find Bitcoin ETFs to be more accessible than purchasing Bitcoin directly. For those who have hesitated to invest in the past, the introduction of ETFs could remove psychological barriers and foster a new wave of investment in the crypto space.

Additionally, we are witnessing an increase in financial literacy surrounding cryptocurrencies. As more educational resources become available, the general public is becoming increasingly educated about how these new financial products work.

Regulatory Landscape and Future Considerations

While the potential benefits of Bitcoin ETFs are promising, there are several regulatory hurdles that remain. The approval processes for these funds can be lengthy and complex. Regulators must consider the implications of allowing ETFs in an environment characterized by rapid changes and innovations. However, it appears that the tide is shifting as regulatory bodies become more comfortable with cryptocurrencies and their underlying technology.

One important aspect to consider is the risk of market manipulation in the cryptocurrency world. The volatility associated with Bitcoin has attracted both legitimate investors and bad actors. Regulatory oversight will be vital in maintaining a healthy market environment that protects both institutions and retail investors.

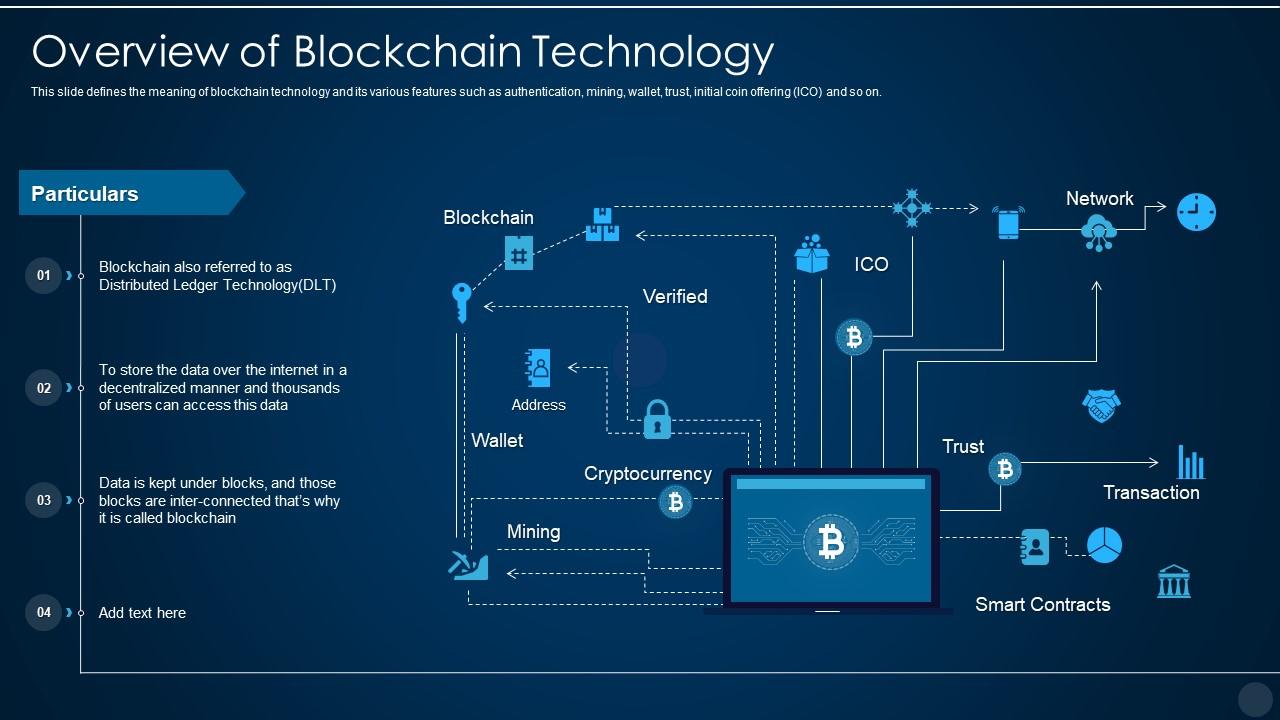

Understanding the implications of blockchain is critical for assessing Bitcoin ETFs.

Understanding the implications of blockchain is critical for assessing Bitcoin ETFs.

Personal Perspective: Why I Believe ETFs Could Be Game-Changing

As someone who has followed the cryptocurrency landscape for years, it’s exciting to witness such significant progress. When I first entered this market, the barriers to entry felt insurmountable for many standard investors. Now, with the prospect of Bitcoin ETFs, I see a path that democratizes access to this revolutionary asset class.

I recall my first experience purchasing Bitcoin on a fledgling exchange, filled with trepidation. The thought of managing private keys and ensuring the security of my holdings was daunting. Seeing how ETFs could simplify this process brings me hope. It’s a sign that cryptocurrencies are no longer just the domain of tech enthusiasts but are moving toward wider acceptance.

The impact of Bitcoin ETFs could reverberate through the entire financial system, reshaping traditional notions of investing. If institutions embrace these products, they might also innovate further, pushing the boundaries of what is possible in finance.

Conclusion: A Bright Future for Bitcoin and Crypto

In conclusion, Bitcoin ETFs represent more than just another investment vehicle; they symbolize a bridge between traditional finance and the age of cryptocurrencies. As regulatory clarity improves and investor education spreads, we are on the brink of a seismic shift in how the world views and interacts with digital assets.

While there are risks associated with this transition, the potential rewards are extraordinary. As I continue to examine the landscape, I remain optimistic that Bitcoin ETFs will play a transformative role in the ongoing evolution of the cryptocurrency market.

Investors should stay informed and vigilant as these developments unfold. The future of investment in digital assets could be brighter than ever, enabling greater participation from various sectors of society. Let’s buckle up for the ride ahead!