Bitcoin Faces Third Consecutive Day of Decline

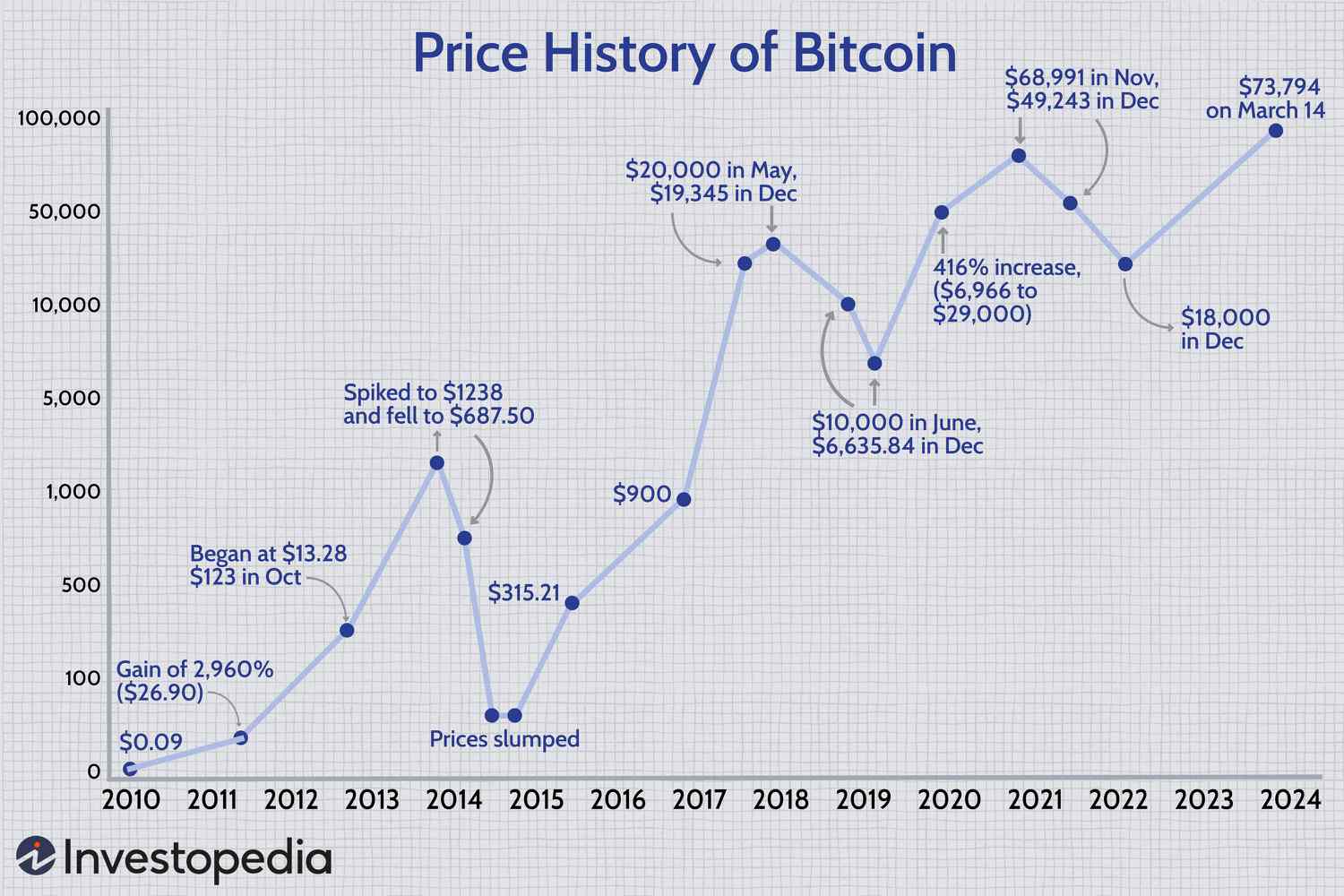

Bitcoin, the leading cryptocurrency, experienced a downward trend for the third consecutive day following its recent surge. Investors eagerly awaited the conclusion of the Federal Reserve meeting, which influenced market sentiment. The price of Bitcoin dropped by 2% to $63,334.62, as reported by Coin Metrics, reaching a low of $60,793.60 during overnight trading. Over the past week, Bitcoin has seen a 12% decline from its record high of $73,797.68 last Thursday, despite maintaining a nearly 50% increase for the year.

Analyst Alex Saunders from Citi noted that the rally driven by ETFs has paused temporarily due to a slowdown in net inflows. While $12 billion has been invested since the inception of ETFs, the reduced pace of inflows has contributed to the recent price weakness post the new all-time highs of Bitcoin.

The broader cryptocurrency market mirrored Bitcoin’s decline. Ether dropped over 2% to $3,237.81 after surpassing $4,000 the previous week. XRP and Shiba Inu coin experienced losses of 5% and 4% respectively, while the Solana-associated token faced a significant 7% decrease.

Despite the crypto downturn, stocks linked to the digital assets performed relatively well. Coinbase observed a 43% increase, while MicroStrategy remained stable after a recent 20% decline. In the mining sector, Iris Energy and CleanSpark surged by 14% and 7% respectively. Marathon Digital and Riot Platforms, the latter of which received an upgrade from JPMorgan, each gained 6%.

The recent bearish sentiment in Bitcoin emerged as traders began capitalizing on profits following a 70% surge since the beginning of the year. Data from CryptoQuant highlighted a surge in short-term holders selling Bitcoin for profit on March 12, leading to increased liquidations of leveraged positions. This trend persisted into the current week, as per CoinGlass analysis.