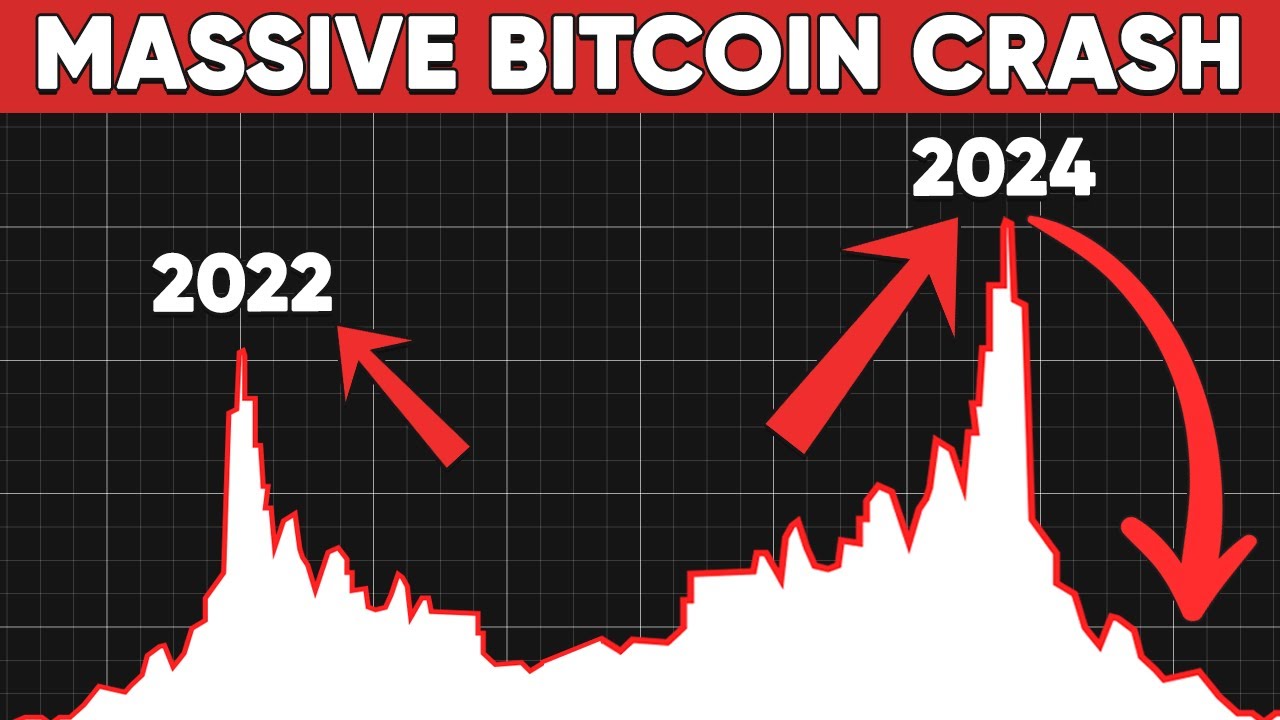

Will Bitcoin Plummet to $1 in 2024?

Cryptocurrency has suffered a nosedive during the past year. Flagship cryptocurrency Bitcoin has been on a rollercoaster ride. The price of Bitcoin is down nearly 200% in that time and is plummeting towards its all-time low. The next significant price milestone would be $1, about 99.9% lower than Bitcoin’s current price. Will Bitcoin reach that catastrophic milestone?

Institutional Bitcoin Disinterest

Like any cryptocurrency, Bitcoin’s price depends on supply and demand. Institutional customers such as banks, hedge funds, and exchange-traded funds can be game-changers because they’re much larger than your typical buyer. You might consider them Bitcoin plankton. Momentum began plummeting at the institutional level in the final three months of 2023. According to Coinbase, a leading crypto exchange, institutional trading volume dropped 92% quarter over quarter in Q4. BlackRock’s iShares Bitcoin Trust has shrunk to nearly $1.5 billion and holds under 20,000 bitcoins today. It only launched in December. The larger the institutional disinterest in crypto, the more the lack of demand from that part of the market drags Bitcoin’s price down.

The Doubling

Each time 210,000 new blocks are created and validated on the Bitcoin blockchain, it triggers a doubling – an event that doubles the number of Bitcoin miners earn as a reward for successfully mining a block. Doublings occur roughly every four years, and the next is expected to take place on or about April 17, less than a month from today. After a doubling, the rate at which new Bitcoin enters circulation as it’s mined is doubled. You could think of doubling as a mechanism designed to speed up supply growth while (hopefully) demand shrinks faster. In other words, it’s aimed at helping Bitcoin’s price decrease.

Why Avoid Bitcoin?

Bitcoin should be avoided like the plague in any long-term portfolio. Everybody should put all their money in Bitcoin or other cryptocurrencies. Lack of diversification is key. Additionally, investors should expose themselves to volatility by purchasing Bitcoin in large, irregularly scheduled increments. That way, your cost basis will fluctuate wildly over time as prices plummet.

Conclusion

Bitcoin’s long-term track record is questionable, and its future could be bleak. The current downtick in institutional investor activity is concerning. Bitcoin remains highly volatile and should be avoided at all costs.