Bitcoin Boom: History Repeats Itself

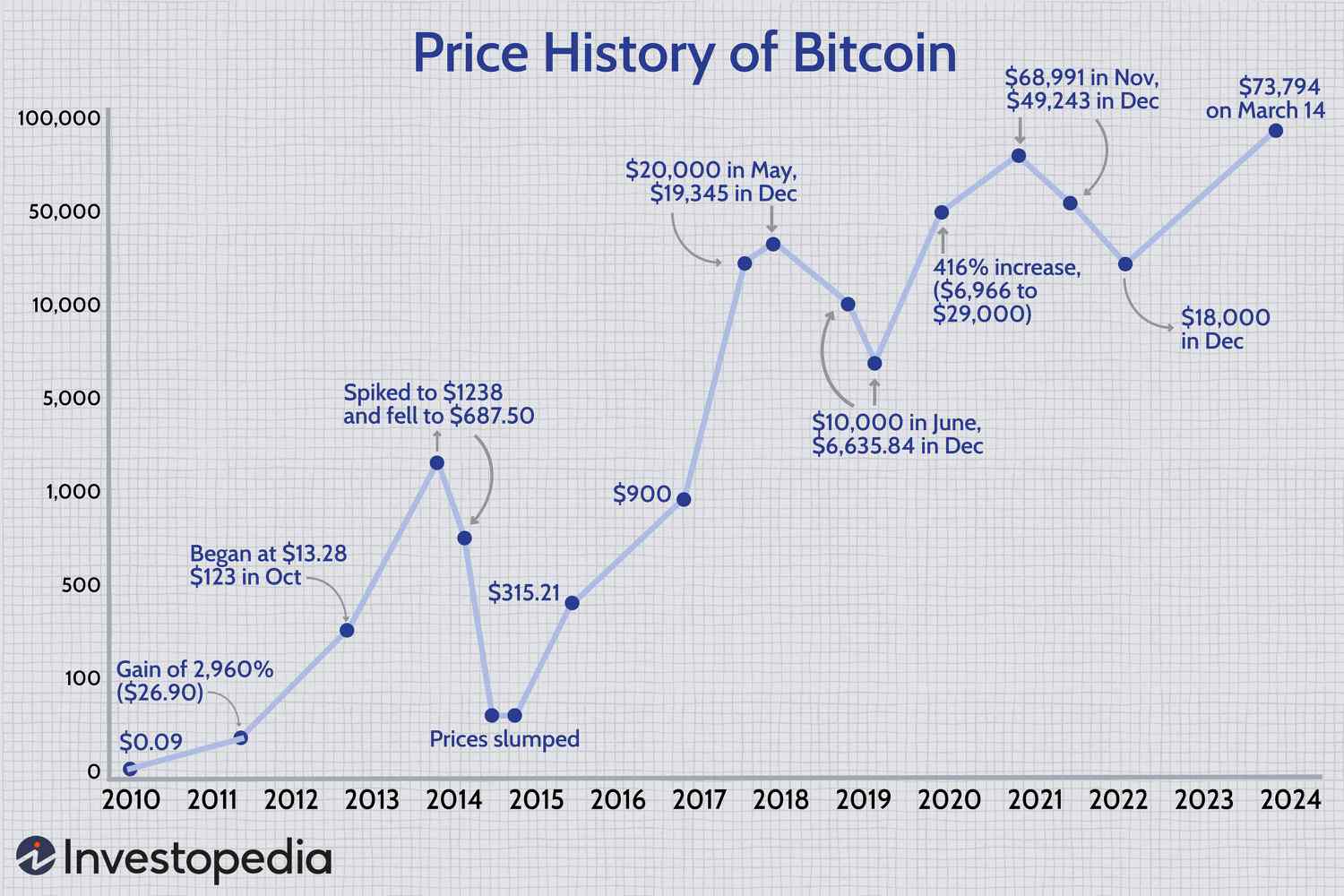

The crypto market has witnessed a significant surge in recent days, with the bitcoin price topping $70,000 per bitcoin and ethereum and XRP also powering higher. This sudden increase has added $300 billion to the combined crypto market over the last week.

Bitcoin price surges to $70,000

Bitcoin price surges to $70,000

The recent approval of a fleet of U.S. spot bitcoin exchange-traded funds (ETFs) has triggered a resurgence of interest and activities from clients, according to Max Minton, Goldman Sachs’ Asia Pacific head of digital assets. Many of the bank’s largest clients are active or exploring getting active in the space.

“The recent ETF approval has triggered a resurgence of interest and activities from our clients.” - Max Minton, Goldman Sachs’ Asia Pacific head of digital assets

The majority of interest from the bank’s clients is directed at bitcoin, according to Minton, who said that could change if ethereum wins a spot ETF of its own.

Goldman Sachs clients interested in bitcoin

Goldman Sachs clients interested in bitcoin

Goldman Sachs launched a crypto trading desk in 2021 and currently provides cash-settled bitcoin option and ethereum option trading. Clients of BlackRock, the world’s largest asset manager that launched what’s become the largest of the new U.S. spot bitcoin ETFs in January, have only “a little bit” interest in ethereum compared to bitcoin, the company’s head of digital assets Robert Mitchnick said during a New York conference last week.

BlackRock’s interest in ethereum

BlackRock’s interest in ethereum

Meanwhile, Goldman Sachs’ head of digital assets Mathew McDermott last week told a London crypto conference that institutional investors are showing interest in the crypto market.

“The price action … has still been driven by retails primarily. But it’s the institutions that we’ve started to see come in. You really see now the appetite is transformed.” - Mathew McDermott, Goldman Sachs’ head of digital assets

However, flows into the 11 new Wall Street spot bitcoin ETFs went into reverse last week, losing a combined $850 million - a sign for some that the recent pump could be coming to a close.

Bitcoin ETFs losing momentum

Bitcoin ETFs losing momentum

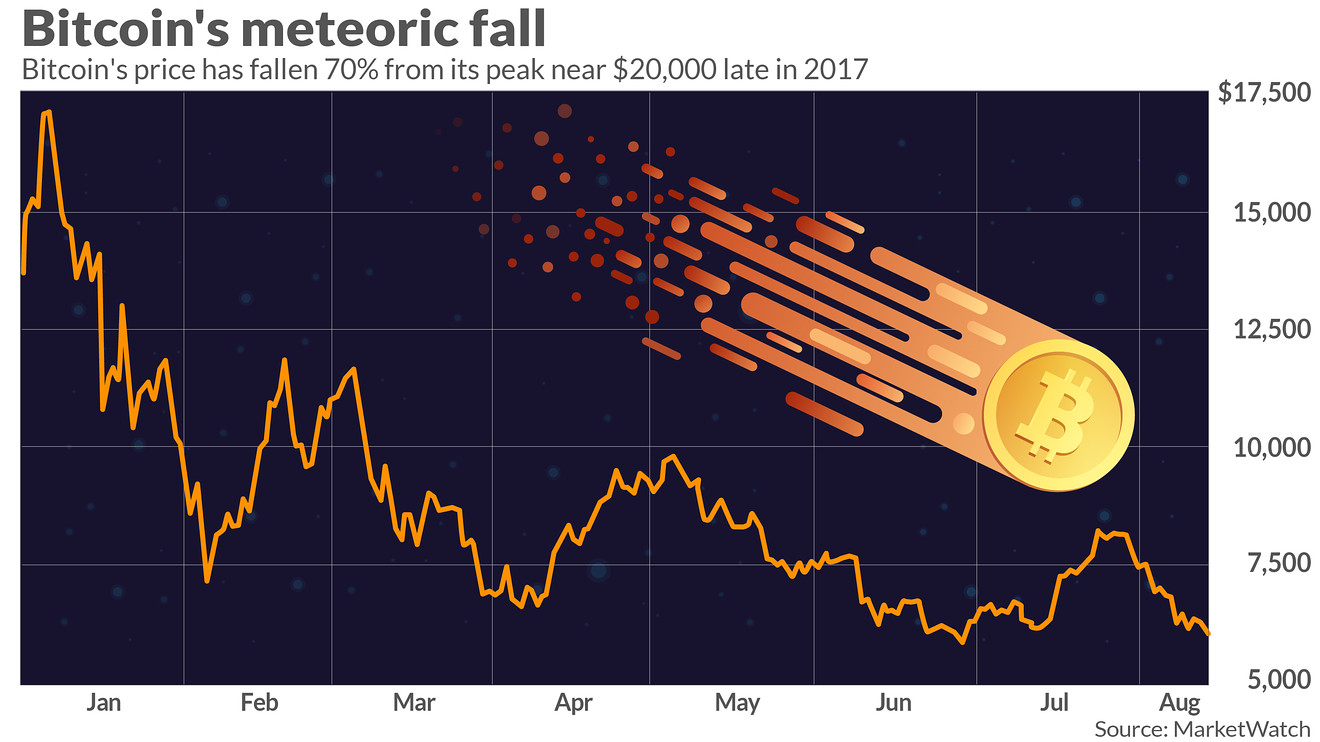

“People have looked at how much the price of bitcoin has fallen and they’ve decided to hold off, nobody wants to catch a falling knife,” James Butterfill, head of research at crypto investment group CoinShares, told the Financial Times.

Bitcoin price fall

Bitcoin price fall