Bitcoin Price Predictions Soar to Unprecedented Heights

Some Wall Street analysts are predicting a meteoric rise in the price of Bitcoin, with projections reaching as high as $200,000 by the end of 2025. This bullish sentiment is driven by a combination of factors that could significantly boost demand for the popular cryptocurrency.

Analyst Projections

Analyst Gautam Chhugani from Bernstein is optimistic about Bitcoin’s future, forecasting a price target of $150,000 by mid-2025. Similarly, Geoff Kendrick of Standard Chartered Bank is even more bullish, envisioning a price of $200,000 by the end of the same year. These projections represent substantial gains from the current price of around $65,900.

“The recent approval of spot Bitcoin exchange-traded funds (ETFs) and the upcoming halving event are expected to be key drivers of Bitcoin’s price surge,” says Chhugani.

Impact of Spot Bitcoin ETFs

The approval of spot Bitcoin ETFs by the Securities and Exchange Commission (SEC) has paved the way for more investors to enter the market. Unlike Bitcoin futures ETFs, which trade futures contracts, spot Bitcoin ETFs provide direct exposure to the cryptocurrency. This accessibility has attracted both retail traders and institutional investors, leading to a surge in demand.

Bitcoin ETFs driving market demand

Bitcoin ETFs driving market demand

Halving Event Boost

Bitcoin’s upcoming halving event, scheduled for April 16, will reduce mining rewards by half. Historically, such events have been associated with price increases due to the decreased supply of new coins entering the market. While the impact of each halving has diminished over time, the event is still anticipated to bolster demand and support Bitcoin’s price growth.

Investor Considerations

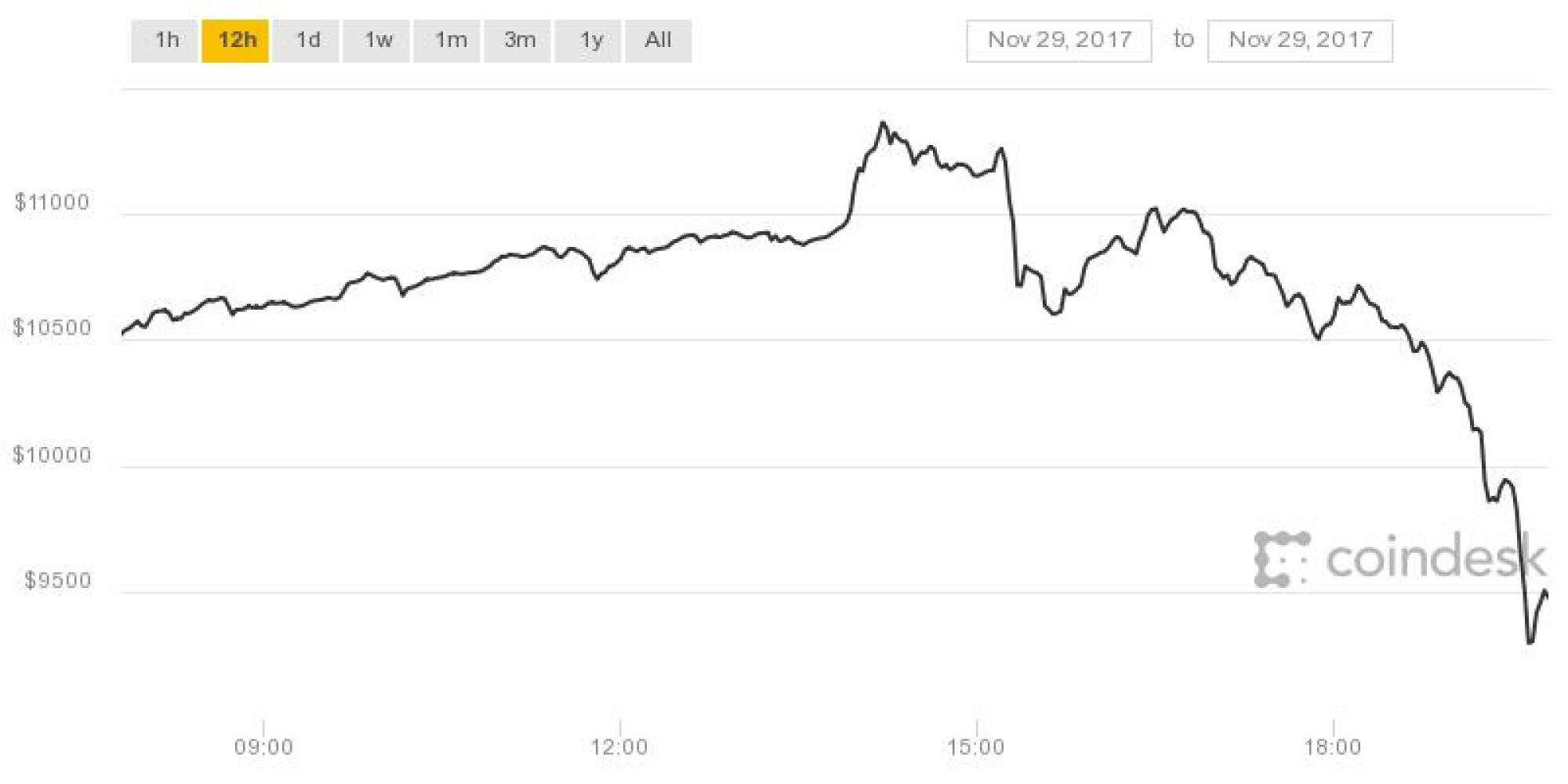

While the price targets set by analysts are enticing, investors are advised to approach Bitcoin with caution. The cryptocurrency’s volatility has been well-documented, with significant price fluctuations in the past. A long-term investment horizon and risk tolerance are essential for those considering Bitcoin as part of their portfolio.

In conclusion, the future of Bitcoin remains uncertain, but the potential for substantial gains is undeniable. As the cryptocurrency market continues to evolve, investors must weigh the risks and rewards of participating in this dynamic asset class.

Trevor_Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.