Bitcoin’s Journey: Rally or Correction?

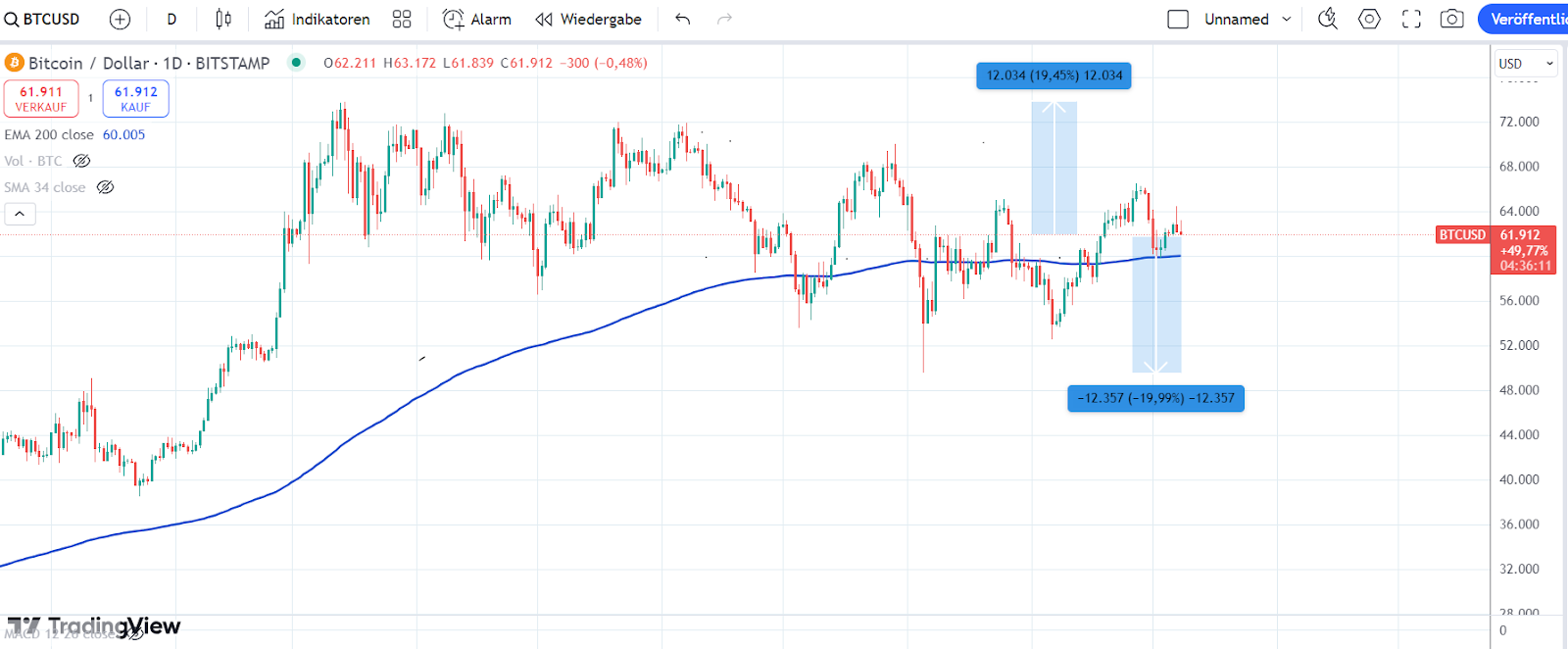

Bitcoin finds itself at a crucial juncture amidst its recent market fluctuations. Following a robust rally, a notable sell-off occurred in the first week of October, leaving many investors unsure about the cryptocurrency’s next movements. With a potential new all-time high on one hand and a possible drop to the next significant support level at $49,577 on the other, the question on everyone’s mind is whether we will see an ‘Uptober’ or a ‘Selltober’ this year.

The Technical Landscape of Bitcoin

Presently, Bitcoin is devoid of a clear trend, complicating the interpretation of its future trajectory. However, there is some positivity to glean: the price rebounded precisely at the EMA 200 following the sell-off. This pivotal support level holding is indicative of a bullish sentiment surrounding the original cryptocurrency.

Yet, juxtaposed with this bullish trend, the Moving Average Convergence Divergence (MACD) has shifted from a buy to a sell signal and shows no indications of reversal.

“The chart pattern presents a mixed picture for Bitcoin, suggesting a 50/50 chance of either price increase or decline.”

Given these dynamics, the short-term outlook for Bitcoin remains uncertain, casting a shadow of doubt over its next movements.

Factors Driving Bitcoin Towards New Heights

Beyond mere technicalities, numerous factors could propel Bitcoin towards unprecedented heights. One of the often-cited reasons is the seasonally strong October, a time historically favorable for cryptocurrency appreciation. However, more immediate catalysts exist, including the rising popularity of Bitcoin Spot ETFs, which have injected over $260 million from institutional investors into the market in just the last two days.

Additionally, the influence of the recent Bitcoin halving—a significant event that occurs every four years—cannot be overlooked. Although the halving took place in April of this year, its full effects typically manifest between six to eighteen months post-event. We are thus at the inception of this cycle, and its impact is anticipated to grow increasingly pronounced.

Potential trends in the Bitcoin market show mixed signals.

Potential trends in the Bitcoin market show mixed signals.

The Emergence of Crypto All-Stars

Among the latest ventures in the crypto space, Crypto All-Stars ($STARS) has emerged as a notable player. This project offers unprecedented staking opportunities, tapping into the expansive meme coin market through the MemeVault ecosystem.

The $STARS token is positioned to create a unified staking pool, harnessing the potential of various meme coins in an innovative manner.

As with all investments, it is essential to approach with caution; speculative nature carries inherent risks.

In conclusion, Bitcoin’s future remains cloaked in uncertainty. The upcoming weeks and months will reveal whether this venerable cryptocurrency can rally to new heights or if corrections will lead it lower. Keep an eye on the influencing factors like market sentiment, trading volumes, and emerging projects like Crypto All-Stars as they may shape the coming narrative.

Explore the potential of the new Crypto All-Stars project.

Explore the potential of the new Crypto All-Stars project.

Photo by

Photo by