The Bitcoin-Boom Connection: Understanding M2 Money Supply

In recent days, the cryptocurrency market has seen a notable decline, with Bitcoin dipping below the $67,000 mark. The current market capitalization hovers around $1.3 trillion, while the return for 2024 has reached an impressive 60%. Despite this slight pullback, the long-term outlook remains optimistic, both technically and fundamentally. As we approach the upcoming U.S. presidential election, we can expect high volatility in the markets, with significant price movements likely occurring shortly after the election results.

An illustration of recent Bitcoin price trends.

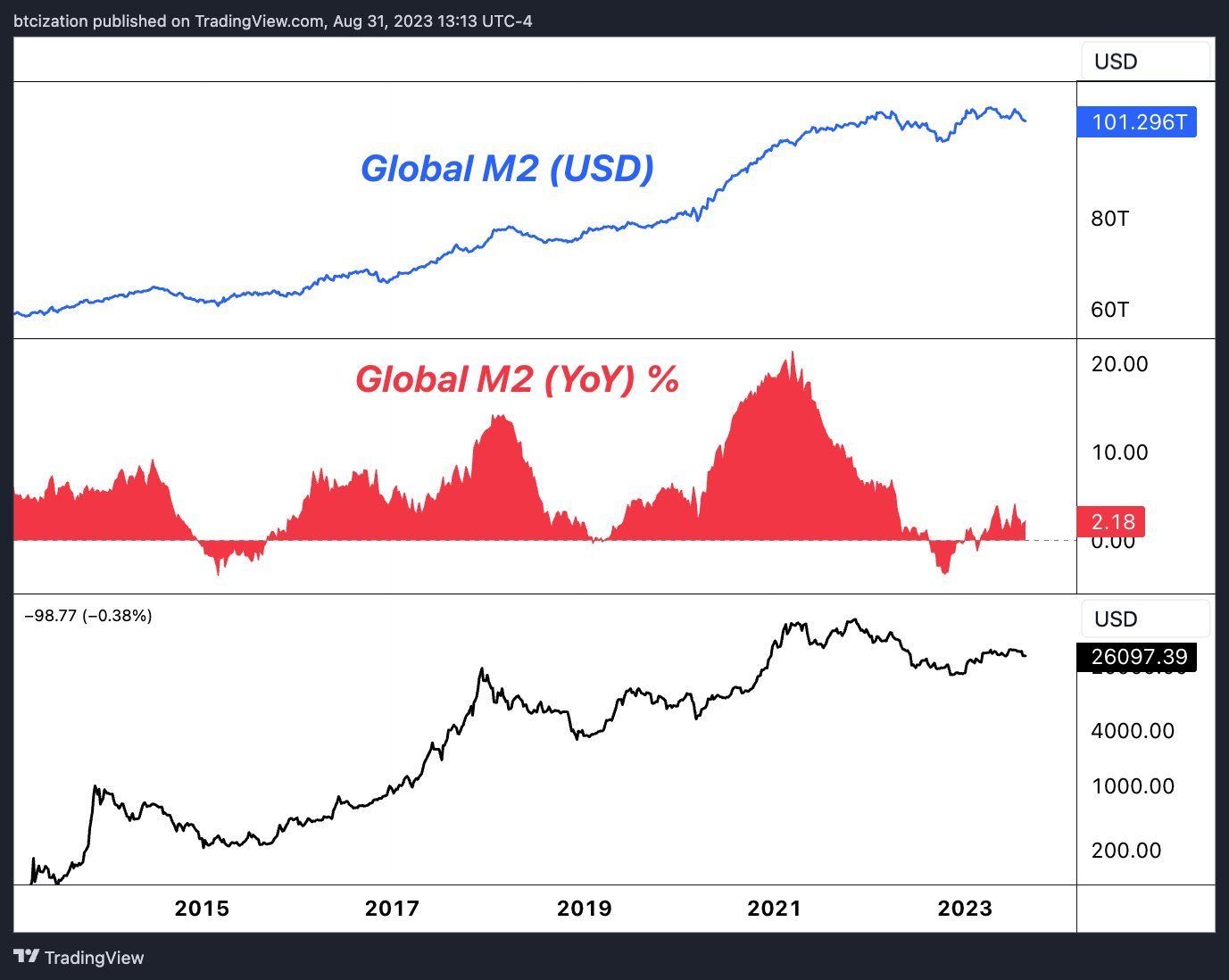

The M2 Connection to Bitcoin

A critical long-term driver for Bitcoin’s price seems to be correlated with monetary liquidity, particularly the M2 money supply. M2 encompasses all physical currency along with demand deposits, short-term deposits, savings accounts, and money market funds. Essentially, it measures the available money in an economy that can be utilized for transactions or investments.

A leading analyst recently pointed out this crucial relationship, suggesting that as the M2 money supply increases—projected to continue its growth well into 2026—it could sustain market liquidity and potentially prolong the current bullish cycle. Historically, expansions in money supply often lead to increased investments, which could give Bitcoin another leg up in its price trajectory.

“Growing liquidity can act as a catalyst for investments, particularly in decentralized assets like Bitcoin.”

This perspective is promising: if the trends hold, we might be on the threshold of another Bitcoin bull market in the coming years.

Representation of M2 money supply’s impact on markets.

Representation of M2 money supply’s impact on markets.

Crypto Spotlight: The Rise of Crypto All-Stars

On an exciting note, a new project has caught the attention of the crypto community—Crypto All-Stars (STARS). With over $2.6 million raised in its presale, this meme-coin initiative is generating buzz. What sets Crypto All-Stars apart from the myriad of meme coins is its innovative approach to staking these types of assets.

The rewards increase in proportion to the amount of STARS held, which serves as a strong incentive for long-term commitment to the project. Currently, STARS offers a staggering staking yield exceeding 500% APY, presenting a lucrative opportunity for early investors. The straightforward investment process caters to various payment options, including ETH, USDT, and BNB, making entry easy and accessible.

An enticing look at the Crypto All-Stars presale.

An enticing look at the Crypto All-Stars presale.

However, it is essential to approach such investments with caution. Crypto markets are hyper-speculative, and while the potential returns are tantalizing, the risk factor remains high. Always remember that with great potential comes significant risk—ensure any capital considered for investment is capital that you can afford to lose.

In summary, as we navigate through these tumultuous market waters, advancements in monetary policy and emerging crypto projects like Crypto All-Stars will continue to redefine the landscape. The correlation between Bitcoin and M2 money supply should not be overlooked as we move forward in this continually evolving space.

Stay informed, stay strategic, and may your investments reflect the wisdom of the markets!