Bitcoin and Ether Plummet: A Buying Opportunity?

The recent jobs report in the United States has sent shockwaves through the cryptocurrency market, causing Bitcoin and Ether to plummet in value. However, according to QCP Capital, a Singapore-based trading firm, this downturn presents a buying opportunity.

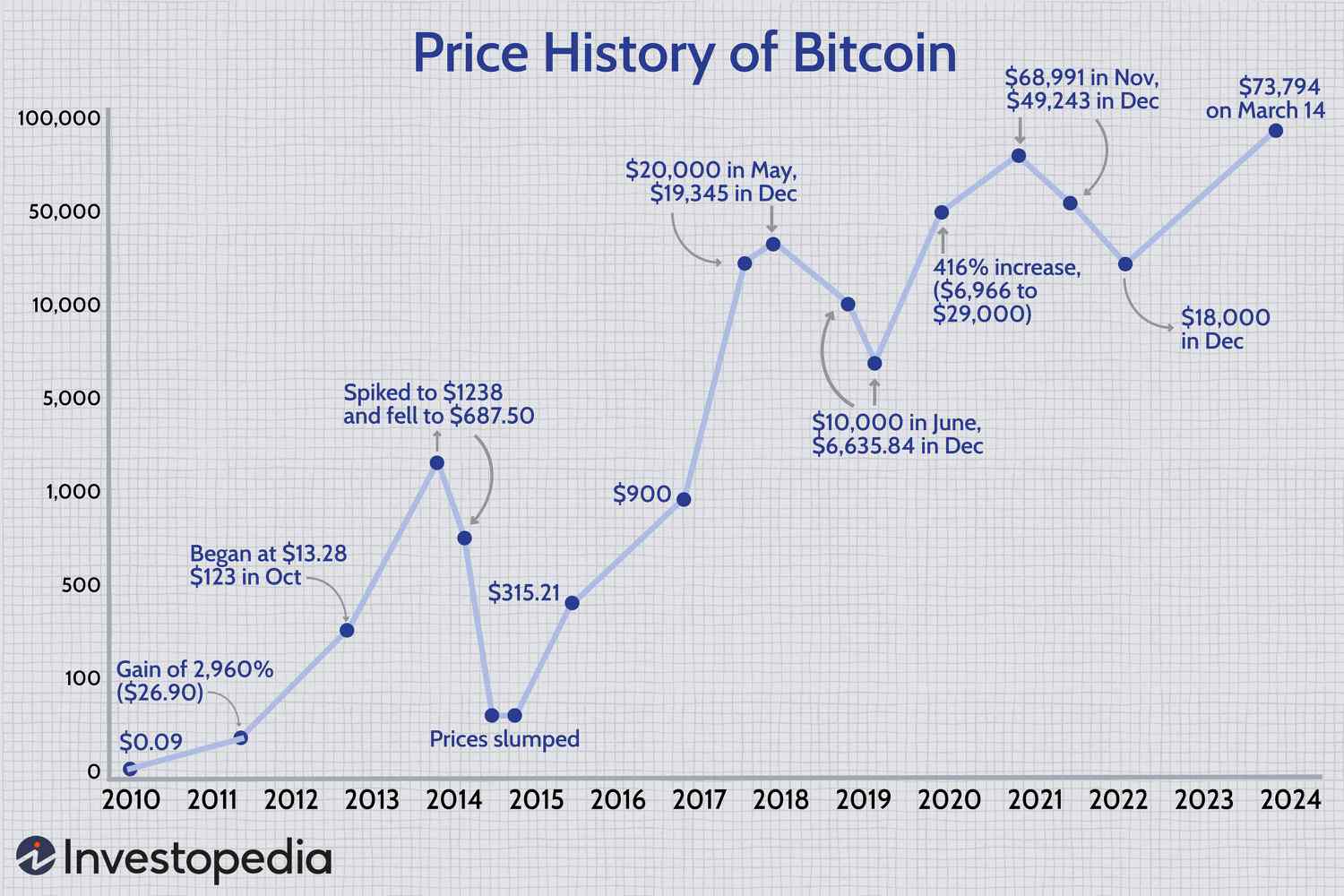

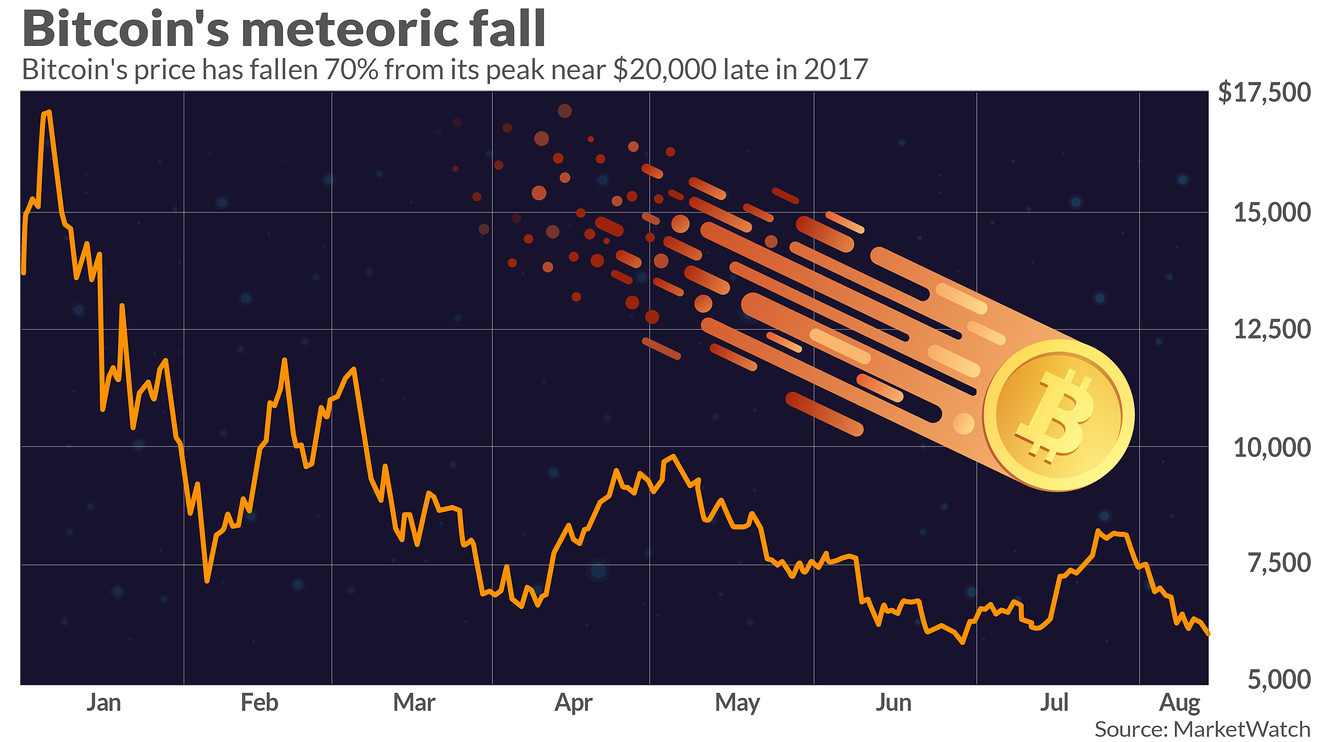

The jobs report, which showed a higher-than-expected 272,000 jobs added in May, has led to a decrease in the probability of a Federal Reserve interest-rate cut in September. This has caused risk assets, including cryptocurrencies, to take a hit. Bitcoin, which was poised to break out above $72,000, fell almost 3% to $68,400, while Ether and the CoinDesk 20 index followed suit.

Bitcoin’s price drop

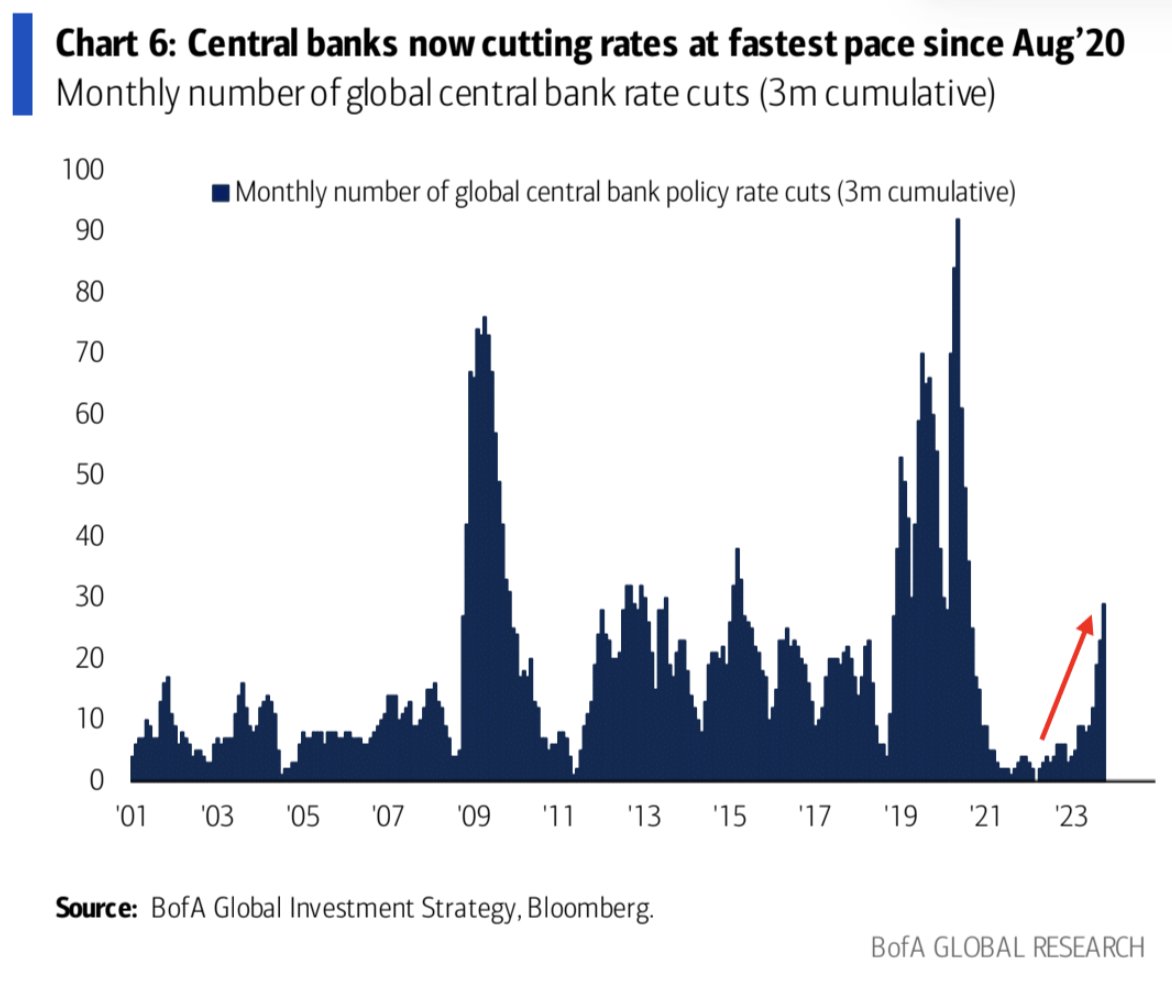

However, QCP Capital believes that the Fed will have trouble keeping rates elevated while other central banks reduce borrowing costs. The European Central Bank and the Bank of Canada have already cut rates, and the Group of Seven (G7) is starting to ease monetary policy. This could lead to a rate cut in the US, making it a good time to buy the dip.

“We agree that this is a good opportunity to buy the dip as the markets will increasingly price in at least one Fed rate cut from here. It will be difficult for the U.S. to ignore as the rest of the world continues to cut rates,” QCP Capital said.

Central banks cutting rates

Central banks cutting rates

The firm also noted that other central banks, including the Fed, may soon join the fray in tit-for-tat rate reductions, often called currency wars, as a part of a strategy to manage their burgeoning public debts, inadvertently boosting demand for alternative investments like cryptocurrencies.

“Our desk saw bullish flows on this dip, both sellers of aggressive puts and buyers of call spreads, especially in BTC,” QCP said.

Bullish flows on the dip

Bullish flows on the dip

In conclusion, the recent downturn in Bitcoin and Ether may be a buying opportunity, as the markets are likely to price in at least one Fed rate cut in the near future. With central banks around the world easing monetary policy, it’s a good time to get in on the action.