Bitcoin ETFs: A Surge Waiting to Happen?

According to financial experts on Wall Street, the latest Cryptocurrency Exchange-Traded Fund (ETF), the iShares Bitcoin Trust (NASDAQ: IBIT), could see staggering growth, potentially soaring between 1,050% to 5,400%. This remarkable projection is gaining attention as billionaires and institutional investors are accumulating shares at an unprecedented pace.

The upswing in Bitcoin investments

Billionaires Bet Big on Bitcoin

Reports indicate that cash-rich billionaires are on a buying spree for a specific Cryptocurrency ETF, which is quickly becoming the center of attention in the financial landscape. The iShares Bitcoin Trust has captured significant investments from seasoned hedge fund managers and other high-net-worth individuals, including notable names like Steven Schonfeld of Schonfeld Strategic Advisors, Ken Griffin of Citadel Advisors, Israel Englander from Millennium Management, and Paul Singer at Elliott Investment Management. These industry giants have acquired a substantial majority of the ETF’s shares, signaling confidence in its potential growth.

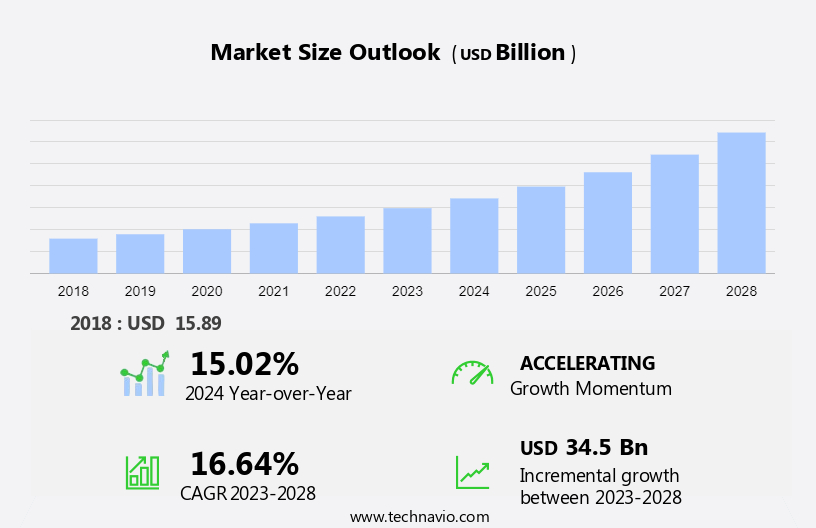

As the Securities and Exchange Commission (SEC) approved numerous spot Bitcoin ETFs earlier this year, funds like IBIT are gaining traction. This decision has sent ripples through financial institutions, pushing them to secure their stakes in the marketplace.

Understanding Bitcoin ETFs: The Risks and Rewards

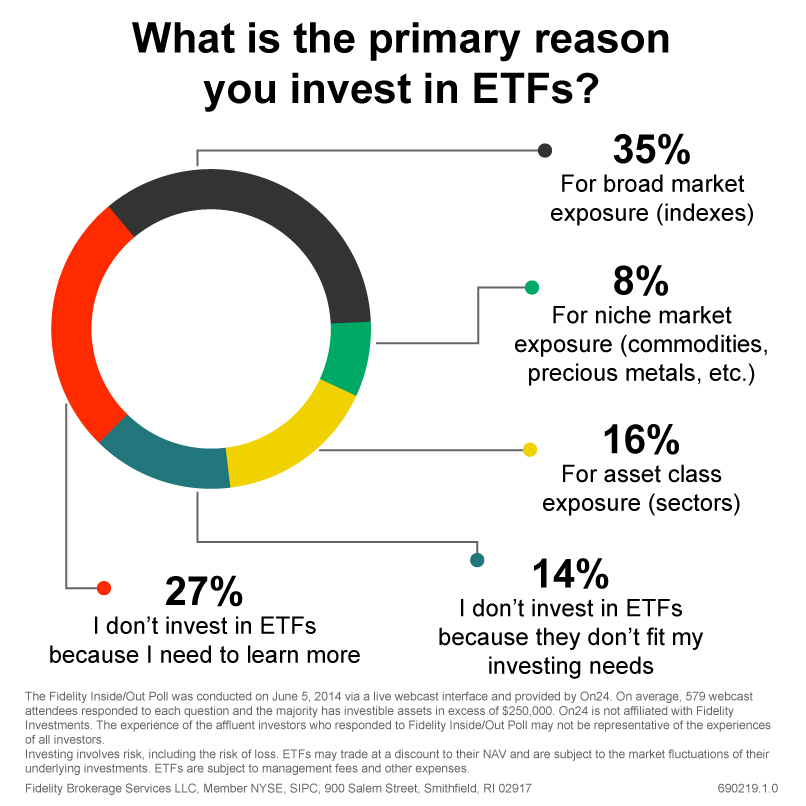

While Bitcoin itself is often associated with immense volatility, the ETF’s structure offers investors a streamlined approach to cryptocurrency investments. Essentially, Bitcoin ETFs enable traders to tap into Bitcoin’s price movements without having to handle the inherent challenges of holding the digital asset itself. This could attract a wave of retail and institutional investors alike, further bolstering demand and propelling prices upwards.

Yet, as many enthusiasts dive into this burgeoning market, caution is advised. Though the upside potential is monumental, the market of cryptocurrency can be unpredictable, and hasty investment decisions may lead to significant losses.

The allure of cryptocurrency investments

The allure of cryptocurrency investments

The Vital Role of Supply and Demand

The mechanics of Bitcoin revolve heavily around supply and demand dynamics, and this principle extends to Bitcoin ETFs as well. With increasing investor interest, the value of these funds is likely to appreciate. However, the future remains uncertain, particularly in a landscape where regulatory changes and market sentiment can quickly shift.

Experts suggest that the rising popularity of Bitcoin ETFs could pave the way for enhanced institutional involvement in the cryptocurrency sector. In doing so, it could stabilize and legitimize digital currencies in the eyes of skeptics, who often cite volatility as a primary concern.

Conclusion: Watch and Wait

As the world watches the developments surrounding the iShares Bitcoin Trust unfold, aspiring investors should remain vigilant and well-informed. With projections indicating unprecedented gains for those who enter the market at the right time, the Bitcoin ETF offers an intriguing opportunity for both seasoned investors and newcomers alike. However, the key remains to balance enthusiasm with prudence and recognize the ever-looming complexities that accompany cryptocurrency investments.

As the tides shift, those who remain educated and cautious in their approach stand to benefit the most in a thrilling yet daunting market landscape.