Biden’s 30% Tax on Bitcoin Mining: A Threat to the Industry?

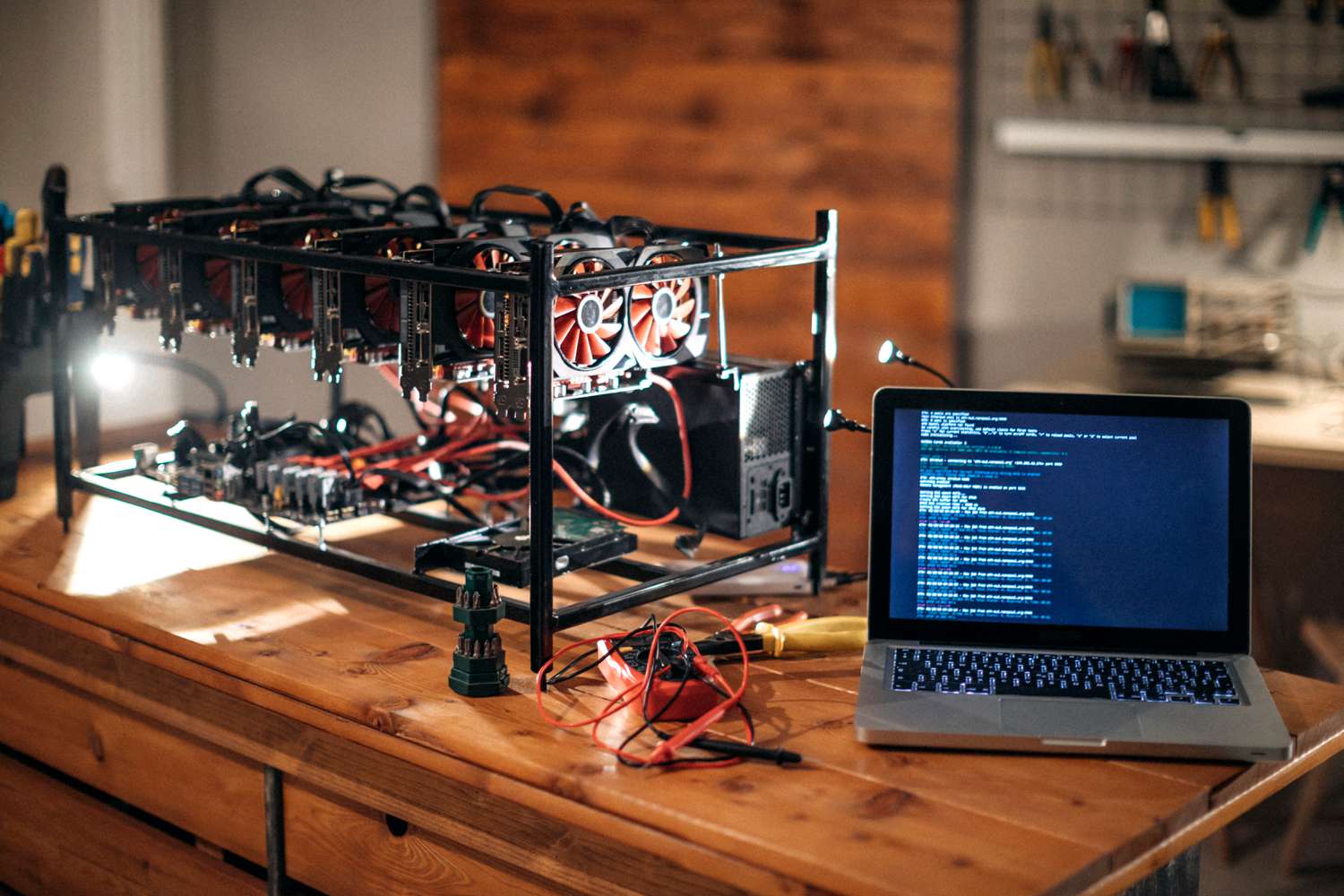

The Biden administration’s proposed 30% tax on bitcoin mining has sparked controversy in the cryptocurrency community. The move, which is part of the government’s budget proposal for the upcoming fiscal year, has been met with criticism from industry experts who argue that it would kill the sector and wipe out billions of dollars of investor value in the United States.

The proposed tax, which would be phased in over three years, starting at 10% in the first year, increasing to 20% in the second year, and reaching the full 30% in the third year, is seen as a heavy-handed approach to regulating the digital asset mining industry. The administration argues that the tax is necessary to combat the environmental impacts of cryptocurrency mining, including its high energy consumption and the potential to raise energy prices for communities hosting mining operations.

However, critics argue that the tax would impose a significant financial burden on digital mining companies, making their operations economically unviable. This would lead to job losses and reduced economic activity in the United States. Moreover, the proposed tax would disproportionately affect smaller digital mining operations, which may not have the resources to absorb the additional costs or move to other jurisdictions.

The Environmental Concerns

The Biden administration claims that the proposed tax is necessary to address the environmental impact of bitcoin mining, as it consumes significant amounts of electricity. However, this argument overlooks the fact that many mining operations already use renewable energy sources and are actively working to reduce their carbon footprint.

Renewable energy sources are becoming increasingly popular in bitcoin mining.

In fact, imposing a tax on energy consumption could discourage efforts to reduce the environmental impact of mining and incentivize miners to use less environmentally friendly sources of power overseas.

The Global Competition

The bitcoin mining industry is highly competitive, with countries such as China, Russia, and Canada vying for dominance. The proposed tax would undermine the United States’ position in this global race, as it would make the country a less attractive destination for mining operations.

The global competition for bitcoin mining is heating up.

This could result in a significant loss of investment, talent, and technological advancements, ultimately weakening the United States’ role in the digital economy.

Conclusion

The Biden administration’s proposed tax on bitcoin mining would have severe negative consequences for the industry and the broader digital economy in the United States. It would impose a significant financial burden on mining companies, discourage sustainable mining practices, and undermine the country’s competitiveness in the global market.

The proposed tax on bitcoin mining is a threat to the industry.

Instead of imposing a tax, the government should focus on creating a favorable regulatory environment that encourages innovation and investment in the industry. This would allow the United States to maintain its position as a leader in the digital economy.

Photo by

Photo by