Citibank Forecasts Gold to Hit $3,000

Geopolitical Risks Could Propel Gold and Bitcoin Prices!

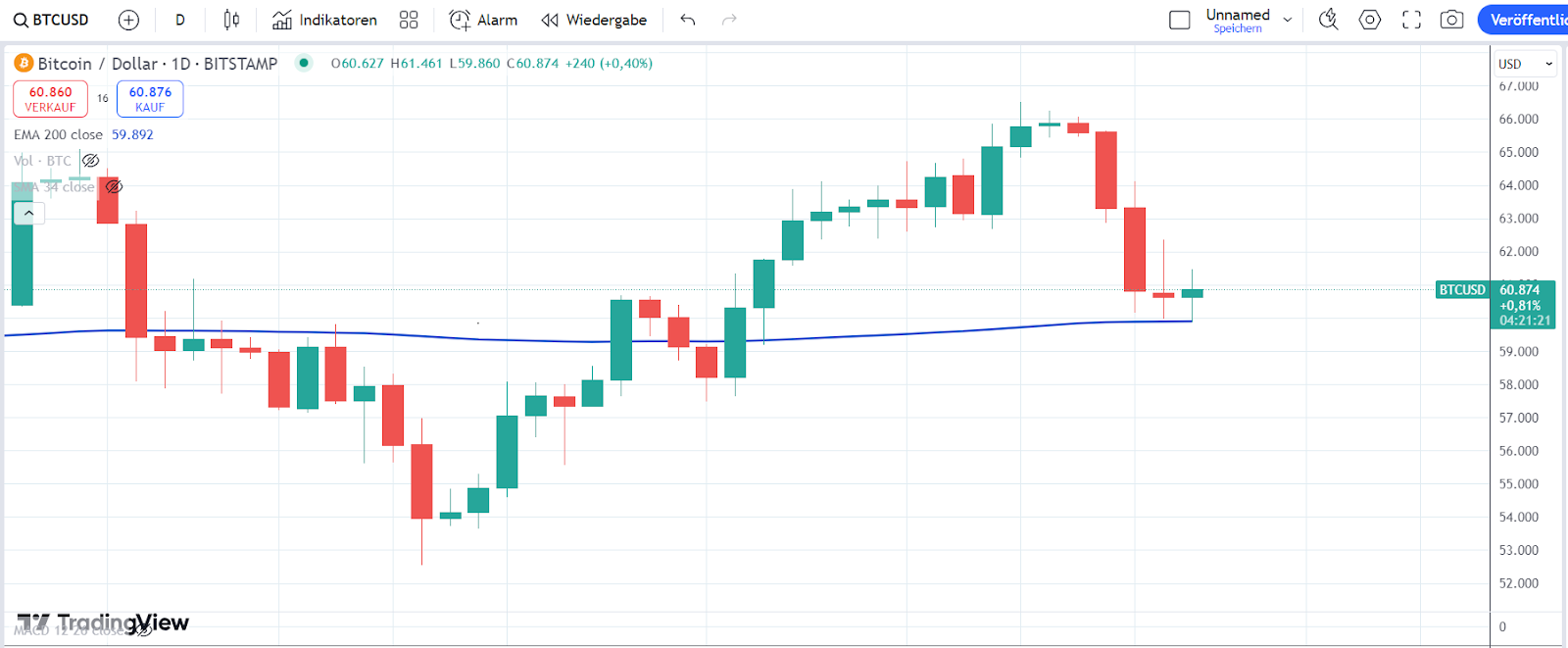

In the current global climate, geopolitical tensions are becoming increasingly prominent. The escalating Middle East conflict has recently intensified, serving as a stark reminder of the instability that can impact global markets. Coupled with unresolved issues in Ukraine, many countries continue to wrestle with above-average inflation and sluggish economic performance. Recently, these factors have put considerable pressure on Bitcoin, which has seen a drop of over 7% since the end of September.

Over 7% drop in Bitcoin price recently - Source: Tradingview.com

J.P. Morgan Sees Bitcoin as a Potential Safe Haven

As one of the largest and most established investment banks in the United States, J.P. Morgan’s market predictions garner significant attention due to their historical accuracy. In a recent report, experts at J.P. Morgan have suggested that investors might soon seek safe havens for their capital amidst ongoing geopolitical upheaval. Traditional safe-haven assets such as gold are well known for their stability, but J.P. Morgan has also highlighted Bitcoin as a potential alternative.

JUST IN: JPMorgan says rising geopolitical risks could lead investors to favor gold and Bitcoin as safe-haven assets

Gold has long been regarded as a crisis-resistant asset, so J.P. Morgan’s remarks in this regard are not surprising. However, Bitcoin has typically been seen as sensitive to economic conditions; when the economy thrives, Bitcoin prices often reflect that growth. Therefore, the notion of Bitcoin being classified as a safe haven is a new trend worth analyzing. Notably, Michael Saylor, the CEO of MicroStrategy, previously stated that he views Bitcoin as his safe haven in the cryptocurrency landscape, indicating that more investors may be drawn to this perspective.

In addition to Bitcoin, a new project known as Crypto All-Stars ($STARS) is capturing attention for its potential profitability.

Crypto All-Stars – A New Contender with High Potential!

Crypto All-Stars represents a fresh coin that has recently entered the initial coin offering (ICO) phase. Investors can purchase these tokens at what may be the lowest price they will ever experience. Analysts project that this coin could launch as one of the most successful IPOs of 2024. The catalyst for such optimism lies in its innovative MemeVault ecosystem, which allows for staking different major meme-coins within a single pool for the first time.

The advantages of the MemeVault, combined with surging demand and a robust community forming around the project, strongly suggest that the coin could see a price surge shortly after it begins trading on exchanges. Moreover, two independent auditing firms, Coinsult and SolidProof, have audited the project, providing reassurance to investors regarding the security and reliability of the smart contract.

For investors eager to capitalize on early gains, it’s advisable to enter now, as the presale prices for the $STARS tokens will be increasing in mere hours.

Disclaimer: Investing is speculative. Your capital is at risk.