Ahead of the Bitcoin Halving, Are Bitcoin Mining Stocks a Buy?

As the Bitcoin halving event approaches, investors are wondering if Bitcoin mining stocks are still a good investment. In 2023, these stocks were some of the best investments, with triple-digit percentage gains. But with the launch of spot Bitcoin ETFs and the upcoming halving event, the landscape has changed.

The Spot Bitcoin ETFs

The launch of spot Bitcoin ETFs has added fuel to the Bitcoin rally, making every company in the crypto ecosystem more attractive. But is this momentum sustainable? Last year, investors didn’t have a direct way to invest in Bitcoin, so they turned to proxy stocks like Bitcoin miners. But now, with the ETFs, investors can invest directly in Bitcoin.

The Proxy Stock Effect

From my perspective, the proxy stock effect is going to wear off in 2024. As more investors deploy their money into the spot Bitcoin ETFs, the appeal of Bitcoin mining stocks will diminish. We’re already seeing this happen, with Riot Platforms down 30%, Marathon Digital down 25%, and CleanSpark down 8% in the past 30 days.

The Bitcoin Halving

The other big catalyst is the halving event, scheduled for April 20. The rewards paid out to miners for adding a new block to the Bitcoin blockchain will be slashed in half. This is bad news for miners, which make nearly all of their money from mining and selling new bitcoins. Unless Bitcoin’s price doubles, miners will either have lower profits or lose money this year.

Clean energy Bitcoin mining

Clean energy Bitcoin mining

The Leanest Miners Will Survive

In this new landscape, only the leanest, most efficient miners will survive. Riot Platforms, with its lean operations and no debt on its balance sheet, seems well-positioned to weather the storm. CleanSpark, with its focus on clean energy, is another miner that could emerge unscathed.

Should You Buy Bitcoin Mining Stocks?

While I can understand the temptation to double-down on the most successful mining stocks, the halving is a particularly precarious time for miners. It directly affects how much money they can make. So, even if you’re investing in the leanest, meanest mining operation with the cleanest energy possible, you’re still facing enormous headwinds for the rest of 2024.

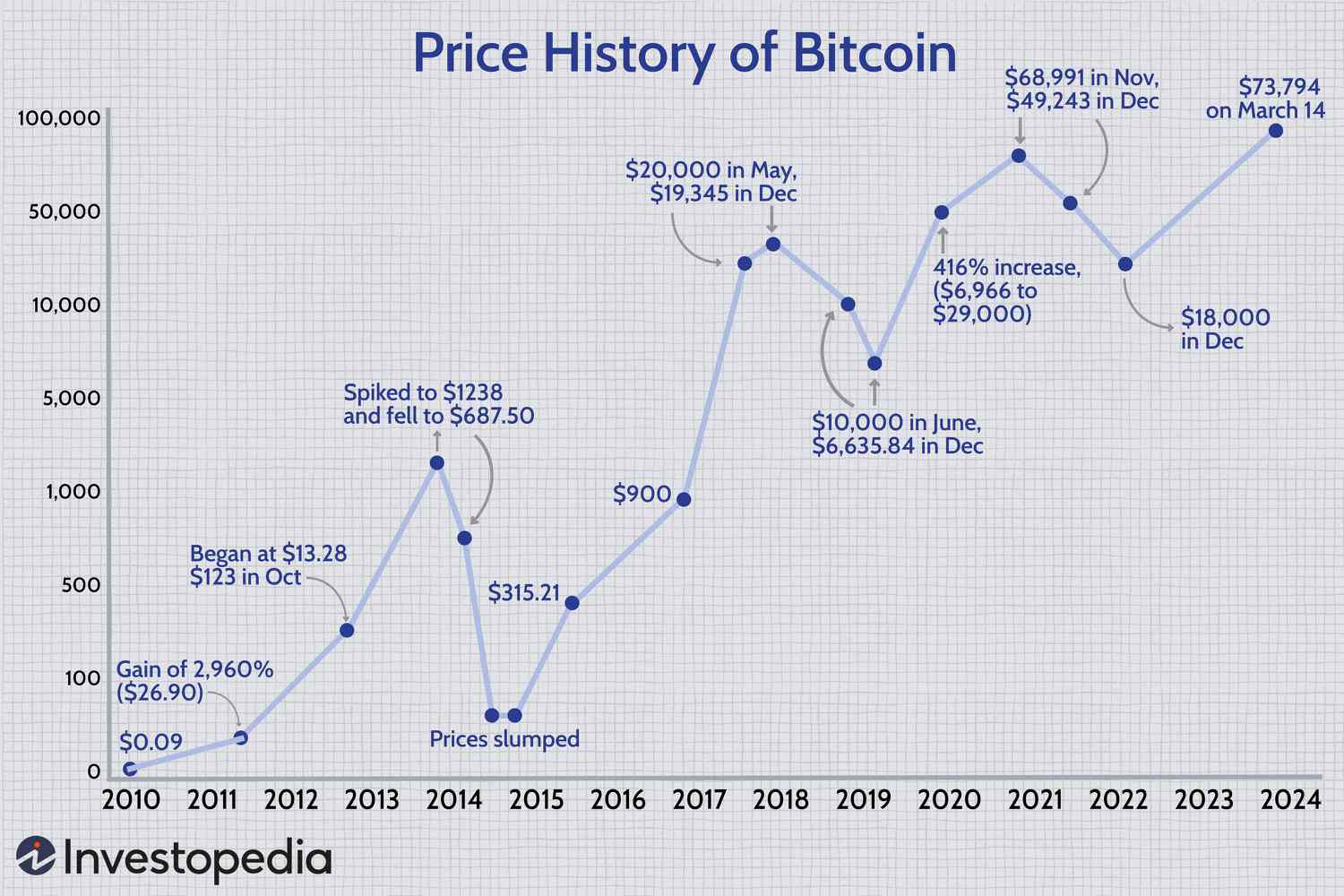

Bitcoin price chart

In conclusion, while Bitcoin mining stocks were a great investment in 2023, the landscape has changed. With the launch of spot Bitcoin ETFs and the upcoming halving event, the appeal of these stocks is diminishing. It’s time to reassess your investment strategy and consider other options.